Advertisement

Lost In The Budget Debate, A Shrinking State Government

Budget debates are almost always forward-looking — and rightly so.

How much does the state want to invest in education or transportation going forward? What sort of tax hike will the public accept to pay for it?

Those are, more or less, the questions driving the state's current budget skirmish. In his State of the Commonwealth address in January, Gov. Deval Patrick proposed a $1.9 billion tax hike to pay for big investments in early childhood education, roads and public transit.

House and Senate leaders rejected his pitch, arguing that a more modest tax hike — on the order of $500 million — is appropriate during a fragile economic recovery.

The two houses are expected to reconcile their plans — and declare victory — in the coming weeks.

But amid all the arguments about where the state should go, it's easy to forget where it has come over the last dozen years.

An analysis by the left-leaning Massachusetts Budget and Policy Center shows that overall state spending — adjusted for inflation — would jump from roughly $31.7 billion in fiscal year 2001 to roughly $36.8 billion under the Senate budget plan unveiled this week.

But the increase is almost entirely attributable to escalating health care costs.

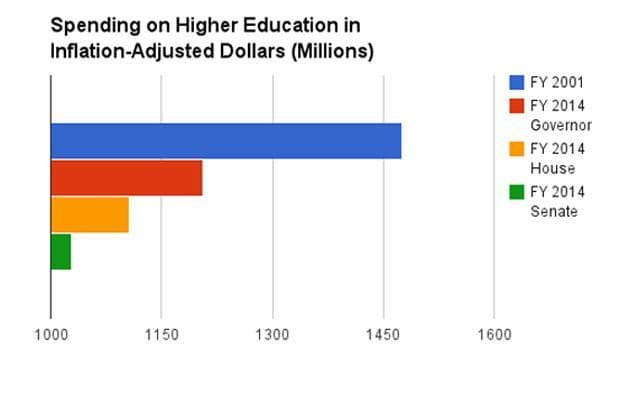

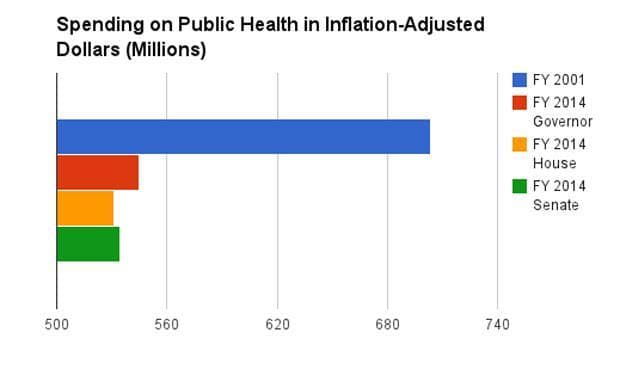

Indeed, the state's investments in several key areas — early childhood education, higher education, public health and aid to cities and towns — have significantly declined over the last dozen years.

And even Patrick's ambitious budget — now dead — would fall well short of the 2001 totals in these areas.

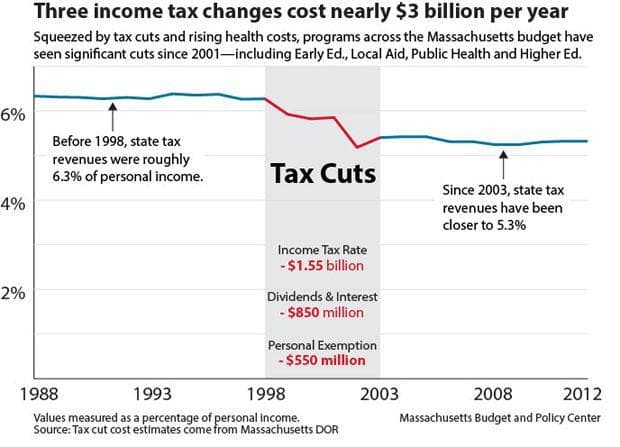

Noah Berger, president of the Massachusetts Budget and Policy Center, says the Great Recession is partly to blame for the cuts over time. But a series of tax cuts phased in between 1998 and 2002, he adds, is the prime structural factor.

Here's a chart the center put together on the declining tax revenue:

The center's argument, out of all this, is that the state sustained higher taxes — and more robust services — in the not-so-distant past and could do it again.

Even during a fragile recovery, Berger and like-minded economists say, a tax hike on the order Patrick proposed is worthwhile — providing short-term stimulus, in the form of construction projects and the like, and making for a healthier economy in the long run.

Andrew Bagley, spokesman for the business-backed Massachusetts Taxpayers Foundation, counters that a higher income tax would send a bad message in a still-struggling economy.

And he finds fault in the specifics of Patrick's plan: The governor's education proposal, for instance, doesn't come with the sort of accountability measures that would ensure the money is well spent, he argues.

This program aired on May 17, 2013. The audio for this program is not available.