Advertisement

Coronavirus Coverage

Once Bustling, Boston's Commercial Real Estate Now Fuels Fears Of A Slow Economic Recovery

Resume

Daily life in Boston's Financial District used to be characterized by the buzz of office workers, lunch meetings, industry events and afterwork get-togethers.

"Downtown Boston really came into its own over the past few years," said Liz Berthellete, a researcher at the commercial real estate brokerage Newmark. "And prior to the pandemic, we had the strongest fundamentals this market has ever seen."

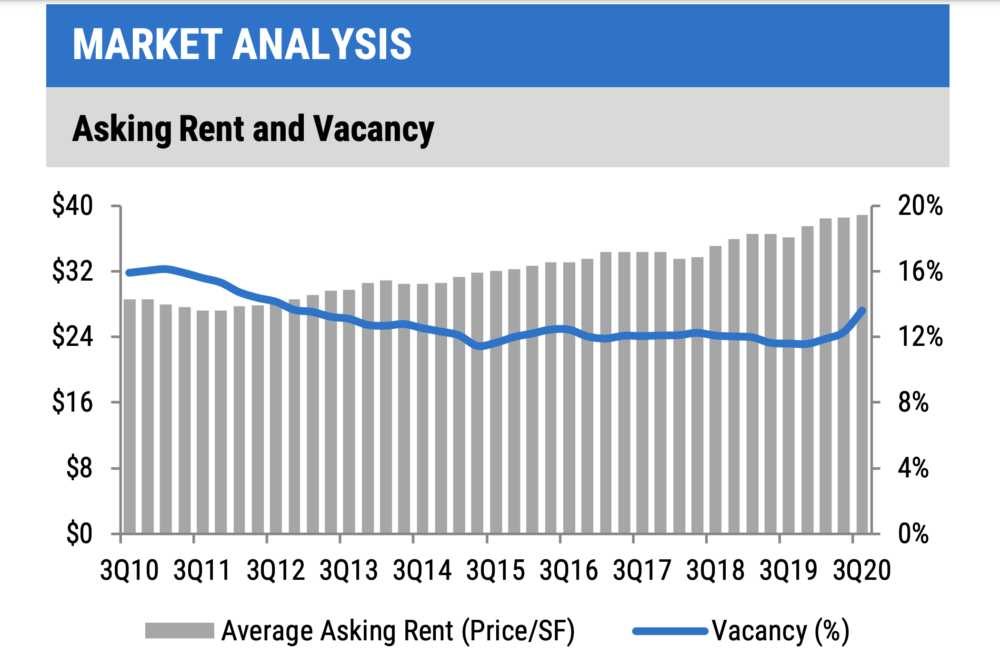

Working in the Financial District for over a decade, Berthelette saw that growth herself: companies moved in, rents went up and, by the beginning of 2020, the office vacancy rate was around 7% — a near-historic low, she said.

In a matter of months, a lot has changed. On a recent weekday afternoon, canyons of concrete-and-glass office towers that once hummed with activity were eerily calm.

Several months into the pandemic, many companies have vacated their leased offices, pushing the office vacancy rate to a seven-year high of over 10% in downtown Boston, and 13.5% across the metro region, according to a recent report by Newmark.

Meanwhile, many remaining office tenants are trying to sublet their spaces. As of late October, there were about 3.8 million square feet of office space available for subleasing in downtown Boston, Back Bay, and the Seaport — roughly double the amount that became available following the Great Recession of 2008 and the dot-com bust of the early 2000s.

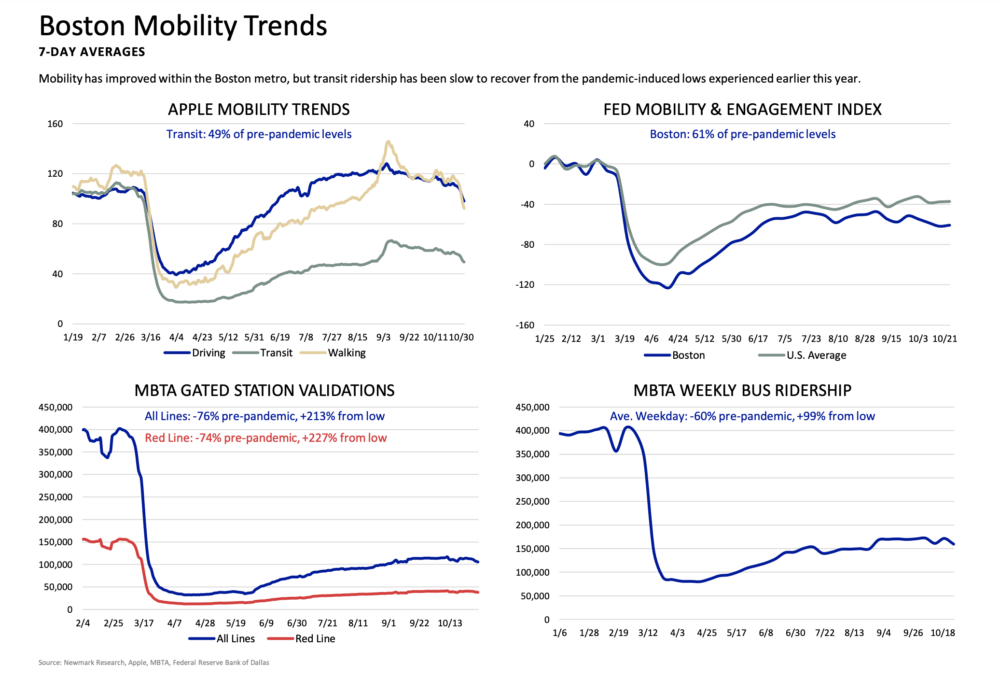

With most former office dwellers working from home, daily occupancy in downtown office buildings is hovering at only about 6-10%, according to commercial real estate experts interviewed by WBUR. How does that number compare to the "Before Times?"

"Well, it’s harder to say because we weren’t really measuring that," Berthelette said. In "normal times," a buyer looking for downtown office space might ask a broker about square footage or amenities. These days, they also want to know — is anyone showing up?

It's a question that is also being asked by commercial landlords and potential tenants in the hotel, restaurant, and retail industries. And as the pandemic stretches on, and these businesses bleed revenue, some economists are worried the effects could ripple far beyond commercial real estate, slowing any potential recovery from the pandemic-induced recession.

About a mile and half west of the Financial District, among the high-end shops and restaurants of Newbury Street, the scene is a little livelier. On a gusty afternoon, small groups of people dined al fresco, and shoppers trickled in and out of stores — at least those that were allowing patrons in.

But a closer look revealed how badly the area's retail space has been hobbled by the pandemic. In the windows of dozens of empty storefronts hang signs with the words "For Lease." Many of the shops look as if they had been cleared out within the last few months.

"It’s not your imagination," said Ann Ehrhart of Boston Urban Partners, a commercial real estate firm that specializes in restaurant and retail spaces. The decline in local customers, office workers, students and tourists has exacted the highest toll on urban shopping and dining destinations, she said.

"It’s not just the number of spaces that are available, it’s the number of pretty quality spaces that are available," Ehrhart said.

But, she added, the retail real estate market was already in decline in recent years: lower rents, fewer deals, more vacancies. The pandemic has accelerated that trend. And with brick and mortar stores doing a fraction of their normal sales, many businesses aren’t jumping at the chance to set up shop.

"While there are some bright spots in terms of people getting creative to think about doing deals," Ehrhart said, "I would say, candidly, on the whole it’s pretty bleak right now."

Fear And Loaning

Even if you don’t buy, sell or lease commercial real estate, there’s a good reason to care about what happens to this part of the economy, said Joe Peek, an economist at the Federal Reserve Bank of Boston.

As the economic booster shot that came from the federal CARES Act wears off, he expects people's incomes will fall, and more businesses will sputter.

"I think we haven't seen the worst of the bankruptcies and business failures yet," Peek said. And what happens next has consequences for the rest of the economy.

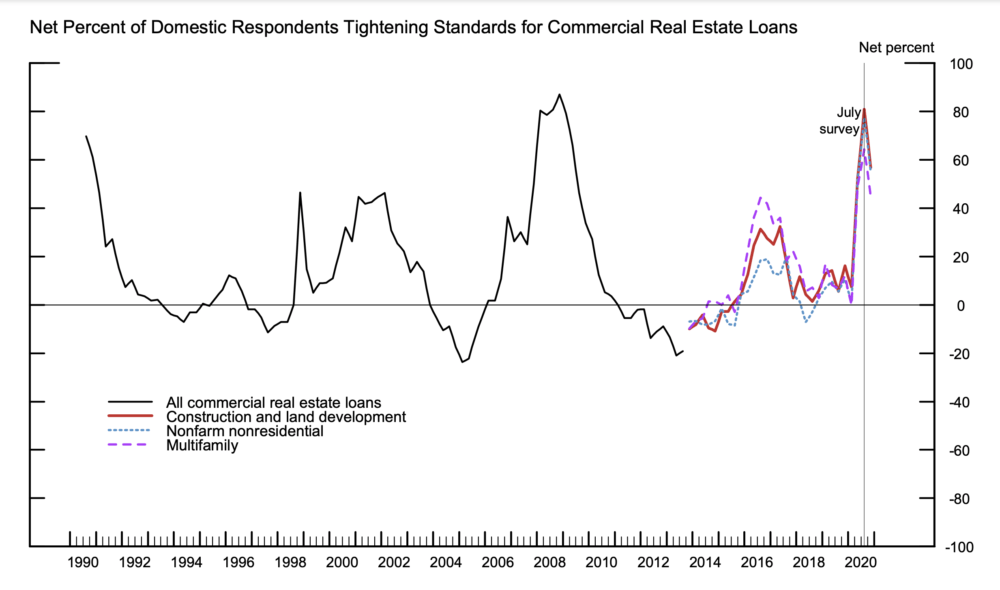

It starts like this: Businesses fail, they default on their loans, and banks start to take losses. Then, as banks see the market getting riskier, they become pickier about who they lend to.

According to a recent installment of the Federal Reserve's Senior Loan Officer Opinion Survey (SLOOS), 60-80% of loan officers said they’ve tightened lending standards for commercial real estate projects in recent months. The last time the SLOOS recorded a similar tightening of credit was around 2008, during the height of the Great Recession.

"Do I want to lend to you right now on a real estate deal?" Peek said. "Probably not. Because I’d be afraid you’re not going to make the payments."

The problem is that credit, for a market, is sort of like oil for an engine: "It lubricates the economy," Peek said.

If commercial landlords can’t get loans, they’re less able to cut deals with tenants to help them through the pandemic. And that could lead to more business failures.

"Okay, hotels go bankrupt, or retail stores go bankrupt. But that’s not where the bankruptcies end because many of those employees have lost jobs. They’re going to cut back their spending at all kinds of stores. And that’s going to make those stores struggle," Peek said, which could make banks tighten up credit even more.

What economists like Peek and his colleague, Boston Fed President Eric Rosengren, fear is that this cycle could put a major drag on any potential post-pandemic recovery.

So, how do we get out of this?

Commercial real estate depends on people getting out there — working, traveling, shopping, dining. But we can’t really do that, Peek points out, until the pandemic is under control.

Haves And Have-Nots

While the outlook may be uncertain for certain portions of the commercial real estate market, other kinds of commercial spaces have never been more in demand," said Steve Purpura, who oversees commercial real estate operations at CBRE Boston Consulting.

Lab space for life sciences research, for example, has seen a "massive influx of capital," Purpura said, adding: "You can't do life science research at home."

Likewise, with millions of people shopping more online, demand for distribution warehouse space has seen strong growth.

"There's negative vacancy [rates]," Purpura said. "If space were available, there would be three people who want it for one space."

Eventually, urban retail, restaurant and office space will come back, Purpura said. And as hopes for a vaccine start to crystalize, well-capitalized investors may look to scoop-up properties at a pandemic discount.

"In my world ... just when you think it can never get [any] better, is when you strike and get into it, because it's going to get better," Purpura said.

Berthelette, of Newmark, sounded a similarly hopefully note.

"At the end of the day, demand for commercial real estate, or real estate in general, is really all about the people — where they want to live, where they want to work," Berthelette said. "Boston is a resilient city."

This article was originally published on December 02, 2020.

This segment aired on December 2, 2020.