Investors Mine For Profits In Affordable Housing, Leaving Thousands Of Tenants At Risk

Charles Clark moved to Boston’s South End when he was a young musician, just getting by. Forty years later, he lives in the same historic brownstone, even as rising wealth has pushed many people out of the neighborhood.

He’s stayed thanks to a nonprofit that’s kept a few hundred apartments like his affordable. Tenants’ Development Corp. is one of the oldest groups of its kind in the nation, protecting the rights of renters — many of them families of color and seniors.

But now, TDC and its residents are facing the fight of their lives, as a Denver-based investment firm battles for control of 36 of the nonprofit’s properties. It’s a tactic Alden Torch Financial and firms like it are using to squeeze extra profits out of the federal government’s chief program for backing low-income housing, according to court cases in multiple states and interviews with more than 20 housing and legal specialists.

“They wanted us to sell the units — put them on the market, so that they could reap a lot more money than what they were entitled to,” Clark said of Alden Torch. “I’m appalled, and I’m upset about how they’re handling it.”

TDC officials never imagined this scenario when they tapped into the federal Low-Income Housing Tax Credit program back in 2003, to renovate their buildings. Under these deals, a nonprofit forms a partnership with an investor (often a large bank) that provides funding in exchange for tax breaks. At the end of 15 years, the nonprofit generally gets to buy out the investor’s stake, taking ownership of the property for well below market value.

At least that was Congress’s intent, housing specialists say — keeping properties affordable for the long-term and in community hands. But the game has changed in recent years, as some project funders began selling off their partnership interests to investment firms with more aggressive profit motives. And those firms are demanding bigger payouts to exit the deals.

This shadowy secondary market is unregulated at the federal level and in nearly every state, a WBUR investigation has found, and it’s wreaking havoc in an $8 billion-a-year program funded by taxpayers.

“Honestly, I think it’s a national crisis,” said David Goldstein, a lawyer representing a Brooklyn, N.Y., housing group that’s fending off one such property challenge from a Wall Street giant. “This is a really serious problem and affordable housing is going to be potentially threatened, especially for places like Boston, New York, and Los Angeles.”

This new breed of investors is challenging housing groups in cities where real estate values have soared. The firms are looking to wrest cash and control away from local nonprofits and developers, lawsuits show, or attempting to oust managers from partnerships. And in some cases, they are forcing the sale of low-income housing to maximize their profits — as they have tried to do in Boston.

“They wanted us to sell the units -- put them on the market, so that they could reap a lot more money than what they were entitled to.”

Charles Clark

If investors are successful and properties are sold on the open market, the risk is that new owners could eventually abandon the affordable housing mission, charge higher rents or convert apartments to expensive condos. It’s a risk that looms on the horizon for thousands of residents in Massachusetts and across the country.

With a lack of federal or state oversight, these feuds are largely being decided in courts, where conflicting rulings on contract language only add to the confusion. In the past few years:

- A senior housing group in Seattle was forced to sell 10 properties for about $250 million. The majority of the money went to Alden Torch and other investors.

- An Opa-locka, Fla., nonprofit has spent $1.5 million fighting to keep a low-income property after Bank of America sold its interest to a new investor that pushed to sell.

- A nonprofit was blocked from buying a low-income property in Pontiac, Mich., and preserving the housing for seniors, when it was sued by SunAmerica in federal court. The case is under appeal.

SunAmerica, part of American International Group Inc. (AIG), also has won a first legal round in New York. It has collected years of tax credits on affordable apartments in Brooklyn run by the nonprofit Riseboro Community Partnership, but SunAmerica is now blocking the group from acquiring the property. Riseboro is appealing, and New York’s attorney general has filed a brief supporting Riseboro’s right to the property, saying the first judge got it wrong.

AIG declined to comment for this story.

“New York is a bellwether in affordable housing,” Goldstein said. “If New York loses this right, it will be a bad precedent for the rest of the country.”

A Historic Nonprofit Fights Investors

In Boston’s South End, Alden Torch’s fight with Tenants’ Development Corp. has a direct impact on nearly 400 residents in buildings the nonprofit has cared for since the 1970s, when many South End dwellings had become rundown and poorly managed. Its brownstones run along Massachusetts and Columbus Avenues and several quaint side streets.

“A little bit of everybody lives in the South End. That’s what makes it unique,” said Clark, the musician. Now 70 and president of TDC’s resident-run board, he can’t fathom losing all that TDC has fought for — to an investment firm.

“Greed is all around us. But we're not going to let that greed destroy what we've worked so hard to build all these years.”

Under the law, even if ownership changes after the 15-year tax credits end, housing must stay affordable for a total of at least 30 years. But things could shift dramatically after that.

TDC officials estimate they’ll have to spend at least $500,000 in legal fees to resolve their dispute with Alden Torch in state and federal court. The nonprofit’s leaders had hoped to devote those resources to building a new community center for residents. The plan included a gym, space for dance and karate classes, a kitchen for serving lunch to seniors, and room for a peer leadership program for youths.

But the center is now on hold, along with overdue apartment renovations, said Anita Huggins, an executive with TDC.

“It’s early in the litigation, but certainly given the cost, that’s going to impact our ability to move forward,” she said.

As in many of these disputes, TDC’s fight is not with its original investment partner. That was a Pennsylvania firm called Capmark Financial that later went bankrupt, in 2009.

That firm’s tax-credit portfolio, which included 287 properties across the country, was sold at auction in 2011, for $102 million. The buyer was Hunt Cos. of El Paso, Texas. TDC had no say in the matter, and ultimately found itself in partnership with Alden Torch, which later took over the investments.

When TDC informed Alden Torch in 2017 that it planned to buy the South End properties after the tax credits expired, things did not go smoothly.

The sides sparred over the next two years, with Alden Torch seeking appraisals and notifying TDC in a February 2019 letter it should find a buyer for the properties within six months, according to federal court records. The firm then reversed course in December that year, ordering TDC in another letter not to sell. The reason: Alden Torch said it had been “unaware” of TDC’s right to buy the property at a low price once another offer came in.

In early 2020, TDC informed Alden Torch it planned to pay $17 million to end the partnership and acquire the properties, according to TDC’s lawsuit in federal court.

Alden Torch claimed TDC’s purchase plan was “unauthorized” because it did not first receive Alden Torch’s consent. The firm alleged it was being shortchanged, because the properties could fetch as much as $54 million on the market.

A sale at the lower price “would prevent the Partnership and Plaintiffs from benefiting from the substantial appreciation in the value of the Apartment Complex that had occurred over time,” Alden Torch said in the court records.

The firm is seeking at least $34 million in damages from TDC. And to stop TDC in its tracks, Alden Torch’s legal team employed another escalation — filing a notice with the Suffolk County Registry of Deeds to block TDC from buying the property.

“I found it to be super aggressive” for Alden Torch to muddy the property title, said David Davenport, a Minneapolis lawyer who represents TDC and other nonprofits in these cases. “They don't really seem to care about who they impact or how they impact them. And now they're going to potentially tie this property up in litigation for several more years.”

TDC sued Alden Torch and its investment entity.

Alden Torch executives declined to be interviewed.

A U.S. District Court judge in Boston ruled in December that the TDC case does not belong in federal court. Alden Torch is appealing. The firm has been disappointed in state court here before: The Supreme Judicial Court in 2018 ruled against the firm’s effort to prevent a Cambridge nonprofit from acquiring low-income apartments on Memorial Drive.

Only Congress Can Clarify The Rules

The majority of these 15-year tax credit deals have ended without incident, housing specialists say. The program has helped build or renovate more than 3 million apartments nationwide since its start in 1986. Only in recent years have these legal challenges emerged, as deep-pocketed investors found ways to poke holes in contracts that locked in tax benefits for investors and counted on their goodwill at the end of the partnership.

The IRS is not regulating the transfers of partnership interests or the exits. It counts on state housing agencies to dole out the federal tax credits and ensure properties stay affordable. But it’s also rare for a state agency to weigh in on 15-year exits. The result: Nationally, no one is in charge.

In Massachusetts alone, tax-credit deals will be expiring on 81 properties over the next four years, affecting nearly 5,000 residents, according to U.S. Department of Housing and Urban Development data.

“Congress can solve this, and that would be the best outcome,” said Bill Brauner, a senior executive at the Community Economic Development Assistance Corp., a Boston group that provides financing for affordable housing.

The Massachusetts Department of Housing and Community Development, which allocates federal tax credits in the commonwealth, declined multiple requests to comment for this report. And it has yet to publicly weigh in on the lawsuit threatening the South End properties.

In a recent funding offer for developers, the agency appears for the first time to be trying to exclude from future projects investors that have been involved in year-15 disputes. It’s unclear how this would be enforced.

One state agency on the other side of the country has been raising warnings since 2019 about firms it says are abusing the tax-credit program. The Washington State Housing Finance Commission in a report called out so-called “aggregator” investment firms — those amassing tax-credit portfolios — saying they “often use burdensome tactics that take advantage of legal ambiguities, resource disparities, and economies of scale to overwhelm their nonprofit counterparties.”

The report cited the Senior Housing Assistance Group (SHAG) case, where a federal judge in Seattle ruled that the nonprofit had failed to get a “bona fide” offer for the properties — which was required before SHAG could exercise its right to buy them at below-market value. Alden Torch won in 2019 and forced the sale of 10 low-income properties in the Seattle area for a quarter of a billion dollars.

The commission said the court got the case wrong and warned: “Other courts should not make the same mistake.”

The properties remain affordable and SHAG still provides support services, but it lost out on millions of dollars in equity dedicated to low-income housing.

Squeezing Nonprofits For Cash

One of the biggest players in the tax credit business, with a $15 billion portfolio, is located here in Boston. Last year alone, Boston Financial Investment Management, part of Tokyo’s ORIX Corp., raised more than $800 million from banks and insurance companies to invest in tax-credit funds.

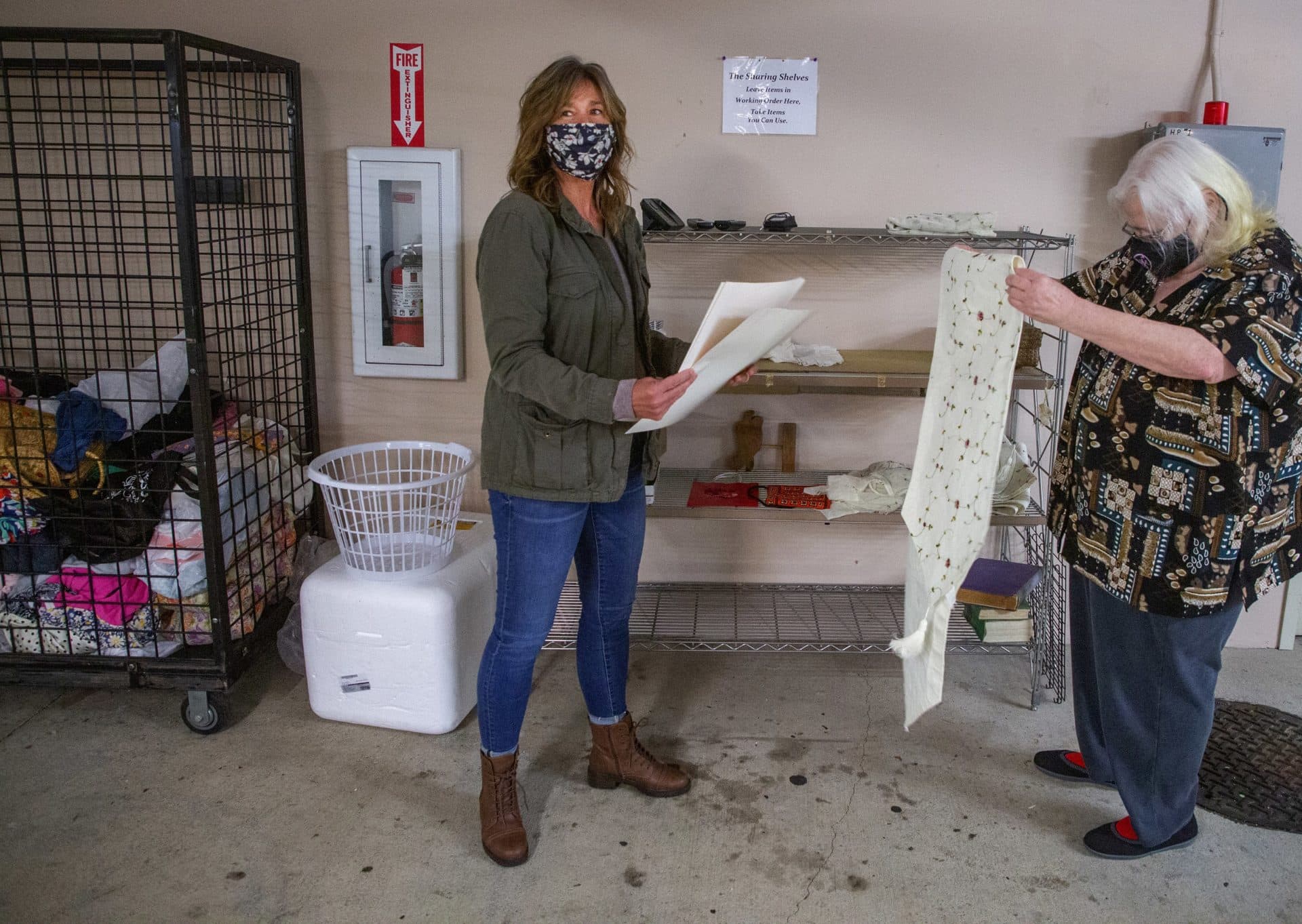

More than 3,000 miles away, in Bellevue, Wash., the firm got into a protracted battle with a nonprofit that manages several low-income properties. One of those is Ashwood Court, home to seniors who live between skyscrapers and luxury condos in the heart of the downtown area, where property values have climbed.

There’s a sense of community at the 51-unit apartment complex, within walking distance of convenience stores, doctors and the library. Residents keep “sharing shelves” in the parking garage, where people can find home goods, clothing and food items for free.

The nonprofit, Downtown Action to Save Housing (known as DASH), expected at the end of the 15-year tax credit period it would buy out the partnership at no cost and own Ashwood Court. But Boston Financial — which was not the original investor — said it was due far more.

“They just bully you,” DASH executive director Kim Loveall Price said. “They kept threatening that they were going to force the sale … and we kind of panicked.”

DASH took out a loan in 2014 to pay the firm $300,000 and part ways, Loveall Price said. The payment had a special sting, she recalled, when she spotted an opened jar of gravy and some lettuce on the sharing shelves.

“These seniors are so poor that they share half-eaten food,” Loveall Price said. “And I'm giving these [people] $300,000 instead of being able to help with food security."

Boston Financial chief executive Gregory Voyentzie in an interview disputed Loveall Price’s version of events and said DASH’s contract language did not provide for the low-cost exit the nonprofit was seeking. He said his firm accepted a deep discount to what it believed its clients were owed. But he regrets that the disagreement turned ugly.

“That one is disappointing to me, quite honestly,” he said. In his view, a junior employee at his firm allowed a disagreement over the value of Ashwood Court and the partnership to escalate.

Boston Financial challenged DASH on three other properties, saying it was due about $1 million to exit them. But DASH officials believed they should pay only $69,000, and sued in federal court in Seattle.

An internal Boston Financial email from 2016, included in the lawsuit, sheds light on the firm’s negotiating stance: “Even though they’re a small non-profit, they might be able to just pay us off to get rid of us,” a vice president wrote to a senior vice president.

As the case dragged on, Loveall Price said, residents waited for badly needed repairs on roofs, decks and windows.

A judge ruled in DASH’s favor in 2019, determining that Boston Financial had breached the agreement by refusing to allow DASH to buy the properties. In a settlement, DASH took ownership of four properties for zero dollars.

Looking back, Voyentzie said, “I would have said, ‘Forget it. It’s not worth fighting over.’ ”

He said Congress should “correct” the law so nonprofits have a clear option to buy at the end of the tax credit term. “There shouldn’t be any dispute.”

Ousting The General Partner

Seattle-area housing developer Catherine Tamaro will never forget the grilling she took in federal court in June of 2019. During a five-day trial, Alden Torch tried to remove her as partner and manager of two low-income properties she had run for many years.

The firm claimed Tamaro hadn’t raised rents enough on her tenants at the Parkway Apartments. It complained in court records that her 2018 audit was late and alleged she had breached her fiduciary duty to the investment partner by doing “unnecessary” repairs, such as replacing failed roofs and rotting balcony railings and fixing hazardous broken sidewalks — all upkeep that’s required by the federal government.

Tamaro should have conserved that cash for Alden Torch, its attorneys argued. They said she enriched herself and failed “to maximize partnership income by increasing rental rates” at Parkway to the allowable federal limit.

If Alden Torch prevailed in its lawsuit, Tamaro stood to lose daily control of the two Seattle-metro properties, and her ability to purchase them when the tax credits expired.

“I clearly had the right to buy [the apartments] under that partnership agreement, and they were attempting to strip that right from me,” Tamaro said.

Tamaro’s initial tax credit partners did well in the deal, court records show, more than doubling the money they invested. By the time Alden Torch took over the interest in 2011, any major upside was in the real estate, not in the aging tax breaks.

Again, the firm brought a host of allegations, taking a deep dive into financial statements dating back to 2002, before Alden Torch was even involved. Tamaro said the attacks on her were personal and painful.

“I can't even describe how unpleasant it is to sit in court and know what's at stake and listen to them talk about how awful I am,” she said.

U.S. District Court Judge Ronald Leighton sided almost entirely with Tamaro, finding Alden Torch had “sought to manufacture a reason to remove” her and that her decisions to make repairs had been sound. He likened some of Alden Torch’s claims to “looking for the belly-navel lint.”

“I clearly had the right to buy [the apartments] under that partnership agreement, and they were attempting to strip that right from me.”

Catherine Tamaro

The firm used the same tactic — trying to remove the general partner — in five other cases WBUR examined. It succeeded in one case; two other cases are pending.

The judge did rule that Tamaro had interfered with a property appraisal, and ordered a new one. Both Alden Torch and Tamaro appealed parts of the ruling, but it was upheld in March.

Tamaro said being embroiled in the lawsuit for several years has cost her dearly, from the $2.5 million she had to spend on legal fees to her multiple sclerosis symptoms growing worse from the stress.

Lack Of Oversight

The new investors in tax-credit interests aren’t the only ones evading oversight. The sellers, like banks and insurance companies, also have faced little scrutiny. The IRS is not monitoring these transfers or their ramifications, WBUR found, nor are federal housing or banking regulators.

Large banks invest in these projects primarily to satisfy their Community Reinvestment Act obligations with regulators, infusing money into less affluent neighborhoods. But when banks or other investors sell their stakes, the nonprofits are left dealing with firms whose intentions are unknown.

Take the case of the Aswan Village Apartments, an affordable housing complex with 500 residents in Opa-locka, Fla., a small city just north of Miami. Bank of America in 2003 backed a redevelopment of the property — then sold its interest in 2014.

The bank reaped between $250,000 and $400,000 in the sale, according to Miami-Dade County court records. The buyer, HallKeen Management of Norwood, Mass., would earn fees helping manage a property it said was “distressed.” But it was eyeing a potential gain of millions of dollars if the property was sold.

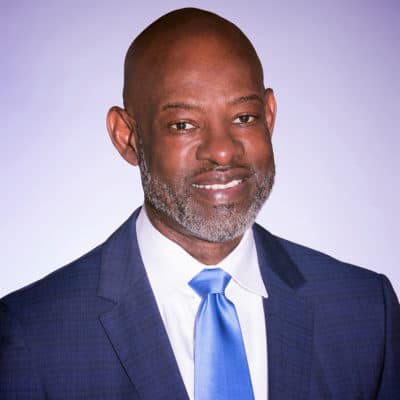

“We had no intention of selling the property,” said Willie Logan, chief executive of the Opa-locka Community Development Corp., the nonprofit general partner of the apartments. “We always had a long-term strategy to become 100% owners, because that's the way you develop wealth and sustainability” in the neighborhood.

HallKeen argued that a sale would provide both it and the nonprofit with about $5 million each. But Opa-locka did not want to lose control of the property. It sued HallKeen and won, in what’s been a costly and time-consuming fight. And it’s not over yet; HallKeen is appealing the decision.

Logan, a former mayor and Florida state representative, blames the bank, in part, for selling to HallKeen. He likened the tax-credit exit battle to sharecropping. “You’re promised something at the end, but you're just chasing your tail, because they found a way to manipulate, steal, cheat and take it from you,” he said.

Bank of America spokesman Bill Halldin said the bank does not make a practice of selling its tax-credit holdings. It did sell its interest in at least one other Florida property to HallKeen in that same period, however. Those apartments were then sold in October 2020 for more than $14 million to another firm, according to the county appraisal office.

“We typically hold our position for the entirety of the tax credit period,” Halldin said.

In a statement, HallKeen chief executive Andrew Burnes defended his firm’s track record. He said it "has never moved, or caused to be moved, a single unit of housing from affordable to market rate.”

“You’re promised something at the end, but you're just chasing your tail, because they found a way to manipulate, steal, cheat and take it from you."

Willie Logan

Transactions like these might receive more scrutiny in the state of Washington, where the housing commission adopted new rules last fall. It started requiring investors to seek its approval when transferring a housing partnership interest to another entity.

In response, Alden Torch sued the agency and its commissioners. The case, filed in federal court, claims the agency acted outside the scope of its authority, “adopting regulations on behalf of local special interests that are both patently unfair and constitutionally defective.”

Across the industry, Alden Torch’s lawsuit against the state regulators is being closely watched. The agency, in its legal response, asserted its “broad authority” to oversee the tax-credit program in Washington and said Alden Torch’s suit lacked merit.

But the agency has ceded some ground. It has backed away from rejecting transfers of partnership interests if a firm was involved in a lawsuit with housing partners. And agency officials are speaking less freely.

The group’s spokeswoman, Margaret Graham, in an email said commissioners had developed “cold feet” about scheduling an interview with WBUR. “Our lawyers advise us that with the ongoing lawsuit, it's just not a good time for us to be commenting.”

WBUR's Saurabh Datar contributed to this story.

Clarification: This story has been updated to clarify the identities of participants in a Boston Financial email exchange.

This segment aired on April 29, 2021.