'Health care heroes really got the shaft': Some workers with COVID had to fight for pay

For Susan Crowell, an occupational therapist, walking into patient rooms that day was part of the job. But the risks were enormous. It was March of 2020, and everyone knew the mysterious COVID-19 illness was spreading fast. One patient had a fever. Another had a bad cough.

Crowell could not locate a mask that Friday at the Needham skilled nursing facility where she worked, records recounting the events show. A supervisor told her she didn’t need one, she said. With trepidation, Crowell went in to care for her patients.

Within a week, she tested positive for COVID and today is still recuperating from long COVID. She is one of thousands of Massachusetts workers exposed to the virus on the job during this pandemic — and one of hundreds who’ve had to fight to be compensated for medical care and lost wages when they got sick.

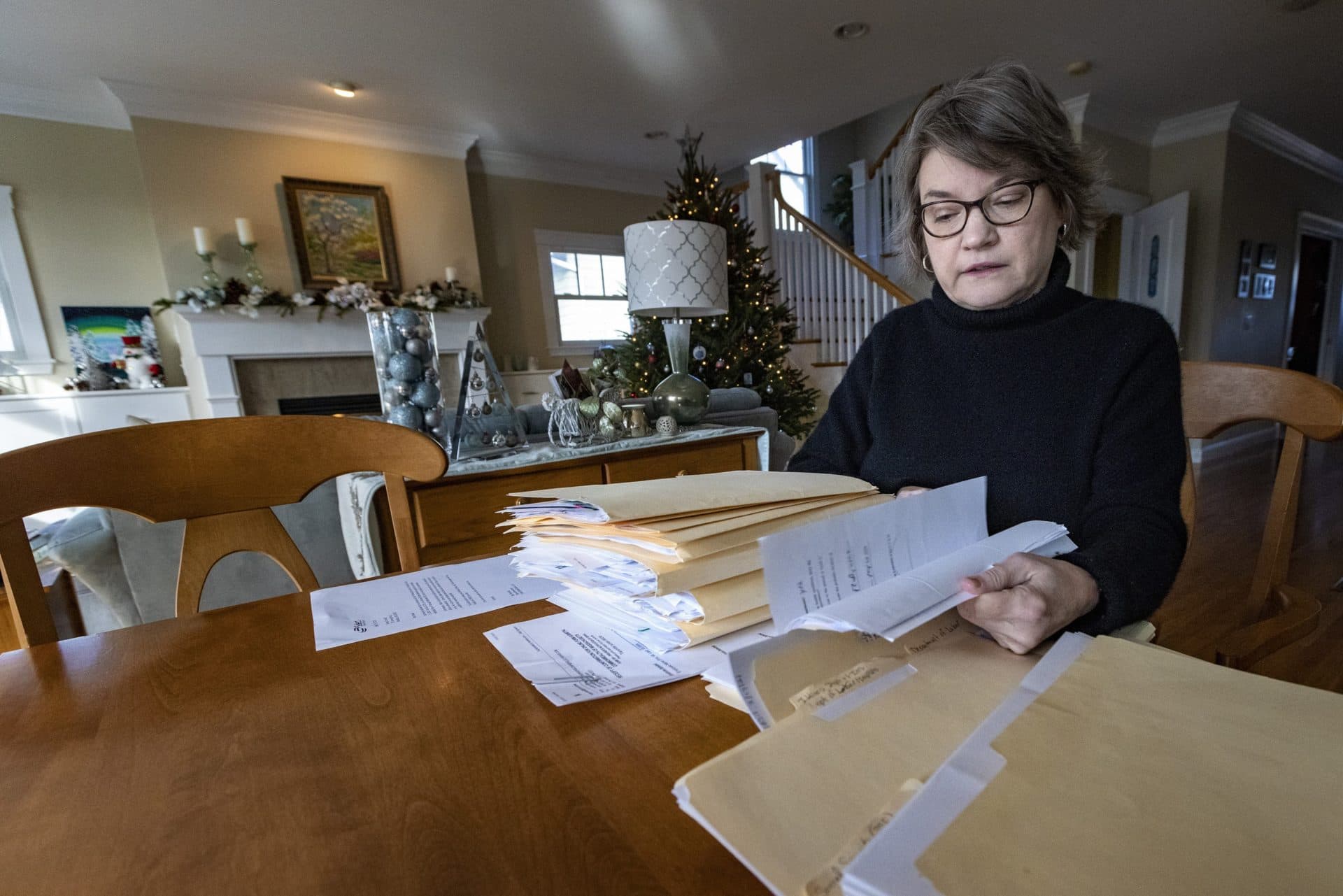

“Maybe I’m naive, but I thought that workman's comp was there for when people get injured or sick at work,” Crowell said during an interview at her home. “I went in and did the same job that I’ve been doing for 15 years, and I got sick at work.”

A WBUR analysis of workers’ compensation claims filed with the Massachusetts Department of Industrial Accidents from January 2020 through the end of 2021 found that more than 12,700 claims were submitted for people who missed work due to alleged COVID exposure on the job. Many of those exposed to the virus were required to work because they were deemed essential workers, especially in health care but also in industries from retail to public service.

But COVID opened up a big gray area with both employers and insurers: While a slip-and-fall at work can be witnessed, it can be harder to prove with certainty that someone caught a virus at work, rather than during their time off.

Insurance companies have made hay of the uncertainty — even for people like Crowell. While they’ve paid more than 7,000 claims, they’ve denied another 2,500. The rest are still being processed.

Steven Kantrovitz, an attorney who represents employees in workers’ compensation cases, said even when it’s highly likely that a person caught COVID at work, insurers will often initially deny a claim, to try to avoid the long-term medical costs and lost wages they would have to cover.

“Would it surprise me, even remotely, that an insurance company would deny that claim, even if there was no other logical explanation? No,” Kantrovitz said. “They're going to hope that that person goes away,” because of the hassle involved in disputing a denial.

"Would it surprise me, even remotely, that an insurance company would deny that claim, even if there was no other logical explanation? No. They're just going to hope that that person goes away."

Steven Kantrovitz

Under Massachusetts law, employers must file a workers’ comp claim for any employee who misses at least five days on the job due to a workplace injury or illness. They’re supposed to file within a week of that fifth day. But some employers, too, have played a role in doubting the very workers they tout as heroes in public, suggesting they caught COVID elsewhere and failing to file claims for them.

Thirty-eight workers died before their employers filed workers’ comp claims for them, according to the data WBUR reviewed. In many of those instances, surviving family members then had to fight for payments to which they’re entitled under the program.

In more than 200 cases, workers or their families had to find lawyers and battle claim denials for months, as Crowell did.

Crowell alerted her employer immediately when she tested positive, she said. The nursing home where she worked was Pines Edge Health Center at North Hill, in Needham, but she was on the payroll of Select Rehabilitation Inc., a giant Illinois-based staffing company that provides workers for health care facilities across the country.

Select Rehabilitation initially did not inform her she could take advantage of workers’ comp, email correspondence shows. Crowell was told she’d need to apply for a leave of absence if she was out of work for more than two weeks.

Crowell grew very sick with COVID. She had extreme difficulty breathing. Suddenly, this fit 56-year-old could barely climb stairs or carry groceries. One day, she remembers, she couldn’t walk across a parking lot to her car. She wound up in the emergency room.

Her employer finally did file a workers’ comp claim with its insurer, Travelers Insurance. But the company denied the claim. And the reason was a gut punch: “Nature of employment is such that hazard of contracting the disease is not inherent in employment,” according to a copy of the form included in Crowell’s claim file, obtained by WBUR in a public records request from the state Department of Industrial Accidents.

The form went on to say that her specific job “does not make the chances of contracting the disease materially greater than the chances of contracting disease as a member of the general population.”

For Crowell and other health care workers, these blanket claim denials were particularly stunning, given that they worked hands-on with patients. It also was common knowledge in the early days of the pandemic that many employers did not have adequate personal protective gear, including masks, putting workers at risk.

Bruce Lipsey, a lawyer Crowell hired to help dispute her claim rejection, said cases like this are unfair to the worker.

“These people were in dangerous situations — the essential workers, but particularly in assisted living or in nursing homes,” Lipsey said. “Even though COVID was found in the general public early on, these people were at a much higher degree of exposure. And some people were indeed faced with the inherent risks of exposure every day, without proper PPE,” or personal protective equipment.

Travelers declined to comment, citing privacy concerns. Select Rehabilitation, which terminated Crowell while she was out sick, failed to respond to numerous requests for comment at multiple levels of the company.

North Hill, through a spokesman, denied having a mask shortage in March of 2020. The facility had a total of 98 workers test positive for COVID in the ensuing months, or nearly a quarter of those who worked there.

North Hill executives declined to comment on Crowell’s case. In a statement, North Hill chief executive Ted Owens said, “At all times during the pandemic, Pines Edge has followed COVID-19 guidance from the Centers for Disease Control, Centers for Medicare & Medicaid Services and the Mass. Department of Public Health, and has always put the safety of residents and employees first.”

After an 11-month ordeal, involving back-and-forths with the insurer, doctors, the state and massive amounts of paperwork, Crowell ultimately won a $126,000 settlement, after lawyer’s fees, from Select Rehabilitation, records show. It was enough to pay her medical bills and health insurance costs and cover part of her lost wages, she said.

But she has lost a great deal more. She still suffers from long COVID symptoms, including neurological and balance issues, as well as headaches and fatigue.

“I lost my health. I lost my job,” Crowell said. “I lost my benefits, lost my income. I lost my potential income.” And while she’s fortunate to have a supportive husband and college-age son, she’s angry that a career she loved has been cut short.

“I think it’s important that people know that their health care heroes really got the shaft,” Crowell said.

"I think it’s important that people know that their health care heroes really got the shaft."

Susan Crowell

Workers’ comp cases represent only a portion of all the Massachusetts workers exposed to COVID. Some companies have taken the position not to file claims for workers exposed to the virus, and to offer them alternative compensation.

Massachusetts General Hospital, for instance, offered “COVID pay” instead of filing workers’ comp claims with the state.

In one example of the different approaches being taken, UMass Memorial Health, the Worcester-based health system with 16,500 employees, filed 1,326 workers’ comp claims for those affected by COVID. By contrast, the much larger Mass General Brigham in Boston, with 74,000 employees, filed only 21 claims, according to the state data.

Some companies filed claims automatically when workers reported COVID exposure, but then offered direct payments, instead, to those who opted out of pursuing a claim. That’s what Home Depot did, according to a spokeswoman for the Atlanta-based retail chain. Of 214 claims filed by the company, 201 were listed as “denials” with the state but were mostly withdrawn, spokeswoman Christina Cornell said.

The state won’t say whether companies that don’t file COVID workers’ comp claims are breaking the law. A spokeswoman for the Department of Industrial Accidents — essentially a court that decides disputed cases — said that in cases where employers choose an alternative way to compensate workers, “that decision would be contrary to the statute and could raise additional considerations for the employee and employer.”

For instance, if an employee tests positive for COVID and gets paid leave instead of workers’ comp while in quarantine at home, they risk not having their medical bills covered should they become sick. Workers’ comp covers 60% of average weekly wages, tax-free, as well as medical costs and other benefits.

(If a worker is encouraged, for instance, to file for short-term disability instead of workers’ comp, they would be eligible only for the wage coverage, not medical costs.)

The state said companies that don’t file workers’ comp claims, and offer other pay instead, could be unfairly influencing their insurance rates by not reflecting the reality of illness and injuries in their workplace.

As for the claims that were filed, and tracked by the Department of Industrial Accidents, they offer an accounting of the suffering of front-line workers in this pandemic — including for those who died.

There was a Walmart greeter and a Cambridge school custodian. There were two employees from Shaw’s Supermarkets and three from St. Elizabeth’s Medical Center. Several worked for nursing homes.

And there was Josephine “Josie” Toralde, a nurse for the Little Sisters of the Poor, a religious group that until recently ran a nursing home in Somerville. Toralde was a beloved figure at her workplace, based on interviews and a string of tributes on her legacy page, remembering her nursing skills and ever-present smile. She died May 30, 2020, of COVID.

Records show that her employer never filed a workers’ comp claim for her, and her husband did not receive survivor’s benefits.

Mark Cregan, a priest and general counsel for the Little Sisters, said Toralde's case was "hazy" and that she also cared for some people outside of work. “Josephine was a great employee,” he said. “The staff and the residents were devastated when she passed on.”

A friend and co-worker, Dafne M. Connall, said Toralde declined quickly after falling ill at the beginning of May. Like others working with the Little Sisters, she said, Toralde was more focused on caring for patients than fighting for compensation.

“Losing Josie has been tough for me,” Connall said. “I haven't really totally grieved. And I'm still angry.”

This segment aired on January 19, 2022.