Advertisement

Student Loan Rates Double

Resume

One trillion dollars and growing. That's how much Americans owe in outstanding student loans. The heavy debt burden is a drag on the economy, and tough on young people starting out in life. And as of today, that burden is about to get even heavier for many current and future students.

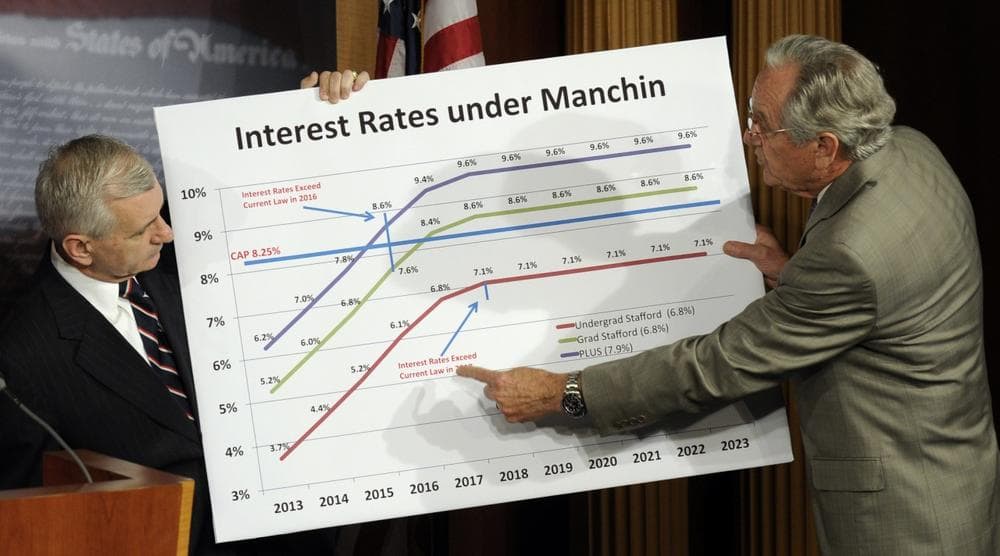

That's because interest rates on federal loans are doubling: from 3.2 percent to 6.8 percent. Both parties in congress say they oppose the increase, but they're so deadlocked that they can't agree either a temporary or permanent fix. The result: more than 7-million low-income students will have to pay the much higher rate on federally subsidized Stafford loans.

Guests

Kelly Field, senior reporter at the Chronicle of Higher Education.

Bob Giannino-Racine, CEO of uAspire, a nonprofit group that provides high school students with financial aid counselors.

Rep. John Tierney, 6th District of Massachusetts. He sits on the House Committee on Education and the Workforce.

More

Chronicle of Higher Education "Sure, student borrowers will suffer if Congress lets the rates go up on new loans to undergraduates, but not as much as the alarmist rhetoric (and some inaccurate news reports) would suggest. And there is still time for Congress to fix the rate retroactively, before most students sign their loan documents."

Boston Globe "A compromise could be reached before students are affected because most loans will not be disbursed until the fall, buying Congress more time. The Senate is expected to vote on July 10 whether to consider a Democratic bill that would extend the current rate for one more year, with any future agreement to be retroactive to July 1."

This segment aired on July 1, 2013.