Advertisement

Satire

The GOP Tax Bill: A Pop Quiz!

How much do you know about the GOP tax plan? Time to find out!

1. In 2015, then-candidate Trump made which of the following promises about his tax plan?

a. It would raise taxes on “the very wealthy.”

b. It would cost him “a fortune” in higher taxes.

c. It would “take in the same or more money.”

d. All of the above

e. Anything the president said on "60 Minutes" is fake news.

2. Thanks to provisions favoring real estate companies, how much do Trump and his family stand to gain from the tax plan?

a. Not one cent.

b. Perhaps a bit more than one cent.

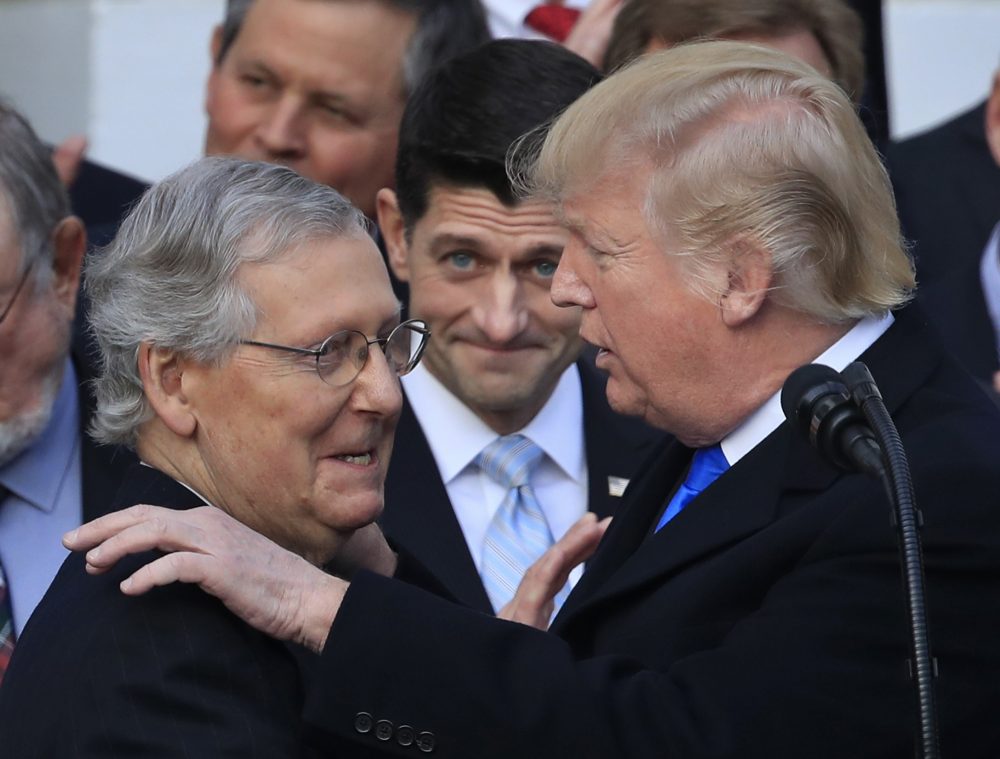

c. $1 billion or more.

d. It’s impossible to know because Trump won’t release his tax returns.

3. In 2018, households making less than $10,000 per year will receive a tax cut of:

a. $1,000

b. $100

c. $10

4. Households making $50,000 to $75,000 per year will receive a tax cut of:

a. $5,000

b. $2,500

c. $870

5. Households making $1 million per year will receive a tax cut of:

a. $0

b. $1,000

c. $69,660

6. What percentage of American households will face a tax hike by 2027?

a. 0 percent

b. 100 percent

c. 53 percent (but that’s OK, because they’re the households that earn less than $75,000)

7. By 2027, what percentage of the tax bill’s benefits will go to the top 1 percent?

a. None. As the president promised, rich people will pay more.

b. OK, maybe a few bucks, but nothing worth whining about.

c. 62.1 percent

8. By 2027, what percentage of the tax bill’s benefits will go to the top 0.1 percent?

a. Don’t you people, listen? The president promised to raise taxes on the rich!

b. How much does a million dollars really buy these days?

c. 42.3 percent

9. According to an independent, nonpartisan analysis, how much will the tax plan increase the deficit?

a. Not at all

b. $1.5 trillion

c. We can always cut Medicare and Social Security!

10. The “Corker Kickback” refers to:

a. An obscure soccer maneuver in which the goalkeeper uses his heel to knock the ball out of bounds.

b. A late provision added to the tax bill that would net Sen. Bob Corker, a Republican from Tennessee, millions on his real estate investments.

c. A drink served in the 1988 Tom Cruise film "Cocktail."

11. How many lobbyists worked on the tax bill?

a. None, you silly! President Trump has drained the swamp.

b. A few, but all of them had really great brains.

c. More than 6,000

12. The centerpiece of this tax bill “for the middle class” is:

a. Cutting the tax rate on corporations from 35 to 21 percent

b. Cutting the tax rate on corporations from 35 to 21 percent

c. Cutting the tax rate on corporations from 35 to 21 percent

13. Back in 2014, which senator made the following statement? "If you approach legislation without regard for the views of the other side … you guarantee instability and strife. It may very well have been the case that on Obamacare, the will of the country was not to pass the bill at all. That’s what I would have concluded if Republicans couldn’t get a single Democrat vote for legislation of this magnitude. I’d have thought, maybe this isn’t such a great idea."

a. Bernie Sanders

b. John McCain

c. Mitch McConnell

14. What percentage of Americans oppose the current tax bill?

a. 10

b. 25

c. 55

d. Polls are really hard to interpret.

15. What percentage of Americans support Obamacare?

a. Zero!

b. Obama is a Muslim.

c. 59 percent

Bonus question! What famous American president said this: "My whole life I’ve been greedy, greedy, greedy. I’ve grabbed all the money I could get. I’m so greedy."

a. Abraham Lincoln

b. Barack HUSSEIN Obama

c. Donald J. Trump

d. Hillary Clinton’s emails

Answers: 1: d; 2: Probably c, but also d; 3: c; 4: c; 5: c; 6: c; 7: c; 8: c; 9: b or c; 10: b; 11: c; 12: a, b or c; 13: c; 14: c; 15: c.

Bonus question: c.

Score:

12-16 correct: You’re part of the radical, socialist, left-wing elite who are destroying this country.

8-11 correct: CNN Is Fake News. Sad.

4-7 correct: The Swamp Is Nearly Drained.

0-3 correct: Congratulations! You are Making America Great Again.