Advertisement

Personal View: Would I Forego 'High Cost' Hospitals? I Don't Quite Dare

Readers, please answer Martha Bebinger's question here: Would you pay $1,000 extra to go to Brigham and Women's for an uncomplicated delivery?

I had a nasty dream the other night: I was pregnant, and thought I might be in labor, so I went in to see my obstetrician at Massachusetts General Hospital. The nurse told me that I would need an ultrasound, but that because ultrasounds were considered very expensive at Mass. General, I would have to leave the hospital and go to a smaller community facility to get it done. "But I might be in labor!" I cried — to no avail.

This was clearly an anxiety dream, and the anxiety was not just about pregnancy, a state that I'm deeply done with forever in waking life. It's about health economics, and the fact that I never did quite understand how I could choose to go to a premium hospital but pay as little in health insurance or out of pocket as I would at a more modest community hospital. And now, there are signs that the era of that particular free lunch may be on the wane. Most of us remain insulated from the real costs of our care, but the writing is on the wall, and it says, "Your care costs more, you pay more."

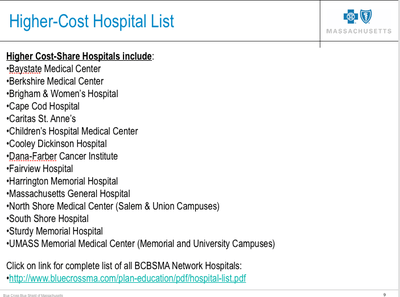

As WBUR's Martha Bebinger reports here this morning, Blue Cross Blue Shield of Massachusetts is offering a new health insurance plan that offers about a 5% savings on premiums, under this key condition: If you go to one of the most expensive hospitals on the list below, you pay extra for it — $1,000 more for surgery, $450 more for imaging tests. Other insurers offer similar "tiered" plans, and say they're popular.

Blue Cross says that all the hospitals in its plan meet quality standards, but I still think of this as the "outlet mall" option of medicine: You can pay premium prices for a Brooks Brothers suit in a real Brooks Brothers store, or you can go to an outlet and get a comparable product, but not perhaps quite the fanciest goods, for a significant discount. Medically, I've become used to getting real Brooks Brothers suits at outlet prices, but I always wondered how that was possible. (Readers, is this analogy off? Please suggest a better one!)

Thus far, Blue Cross says, the response to the "Hospital Choice Cost-Share" plan has been enthusiastic. Blue Cross says it's "encouraging care in the right setting" and working to "make cost and quality information transparent to consumers."

The problem, it says, is that health insurance plan design didn't encourage the concept of medical consumerism. There was no need for the member or patient to understand the cost of service because there was very little cost-sharing. Even with the ever more popular high-deductible plans, patients so quickly exceed their deductibles that there's little reason to shop around.

The idea of the plan is not just to confront patients like me with a dilemma, but to increase hospitals' incentives to cut their prices. "We hope some of the higher-cost facilities will start to rethink and reexamine some of their pricing policies," Blue Cross chief Andrew Dreyfus said, "and a few have." Other high cost hospitals, he said, respond, "We believe we have a better product and we believe people will pay for it."

Will I pay for it? I have to confess that for years, I've gotten my primary and other care at Mass. General, which is on the Boston most-expensive list. Let me think this through as a patient.

Would I be attracted to an insurance plan that charges 5% less, or would my employer? Sure. But if I were diagnosed with cancer, would I want to go to Dana-Farber, which is on the most-expensive list? Heck, yes.

If I had a relatively simple complaint, would I be willing to skirt the train-station chaos of the Mass. General lobby and go to a smaller, less celebrated place? Probably, it depends. I'd certainly be willing to get an imaging test done at a freestanding imaging clinic instead of the hospital (So long as I'm not in labor!) But again, if there were cause for real concern, I'd want to be in the hands of my brilliant Mass. General internist.

And a potentially life-threatening pediatric illness? I'd pay my last cent to bring my child to Children's. In medical crisis, it can be greatly comforting to be able to tell each other, "We're in the best hands." Even if official quality reports question that assessment.

Ultimately, I suppose that's the problem. Blue Cross and other insurers say they've assessed quality and all the facilities in their plan meet their requirements. But if I'm in the throes of medical fear, I want to be able to go to the Harvard of hospitals — oh, wait, it's not just "the Harvard" of hospitals, it actually is Harvard — without having to pay a penalty for it.

For that peace of mind, I'm willing to forego the 5% discount I could have with the Hospital Choice Cost Share plan. But I'm very aware that I say that as a person whose family is doing all right financially right now. If this were 2009 in the midst of our lay-off hell, I'm not sure I'd feel able to make the same choice.

As commenters in the Globe this morning point out, there are elements of rationing in this plan — the people who need to save money will no longer be able to go to some of the "top" places.

Writes one Globe commenter:

Hopefully, these tiered plans allow access to the Boston teaching hospitals when medically necessary. Otherwise, this is just a fancy system for rationing care.

As Andrew Dreyfus says, there are early indications that the popularity of tiered plans like this is adding to pressure on hospitals to try ever harder to cut their costs — a long-term effect but surely a good one. In terms of the big picture, I know it would be good for me to join the exodus from high-cost hospitals to add to that pressure — but right now, I just don't dare.

Readers, do I need to be set straight? I welcome your help...