Advertisement

Mass. Health Insurance Premiums Bounce Back To Highest In Country

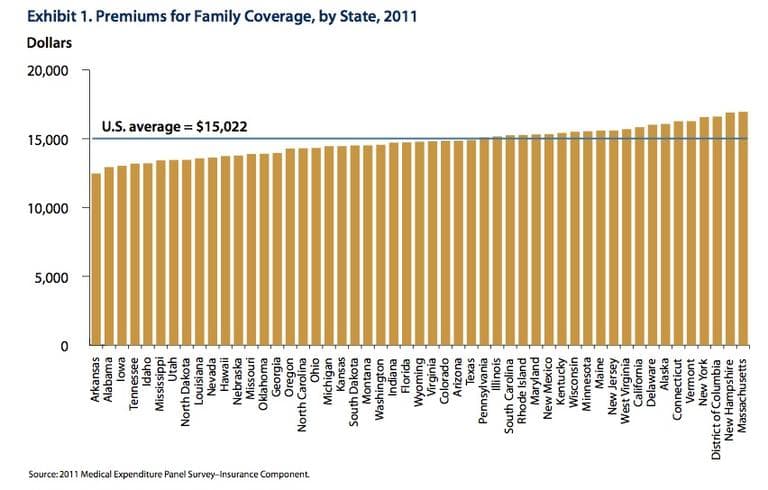

Massachusetts is #1 again, but not in any way the state will celebrate. We have the highest health insurance premiums in the nation again, according to this annual report from the Commonwealth Fund. Massachusetts bounced back to the top again in 2011 after dropping to 9th place in 2010.

The report does not analyze why Massachusetts is back in first place, but notes that in general, health care costs are higher here because we have more generous benefits, our cost of living is higher overall, and our health care prices tend to be higher.

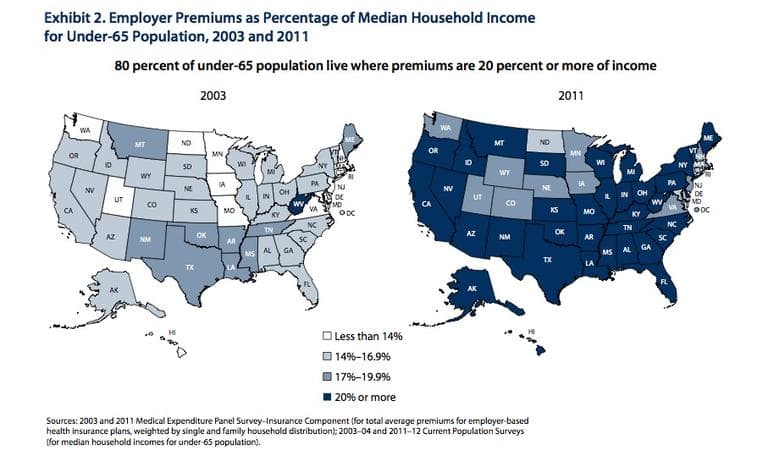

An important caveat: That high cost of living, and our higher incomes, need to be factored in. If you look at our premiums as a percentage of median household income, we're actually on the low side: 18% compared to a national average of 22%. (See chart below.)

Still, this bump from 9th back to 1st is bad news. It’s also politically significant. Last year, hospitals and business leaders used this drop in health insurance costs (relative to the rest of the country) as proof that the market was working to curb health care spending. And, they argued, the drop to 9th place meant the state did not need to impose new controls. Leaders made this argument in the heat of legislative debate about what to include or leave out of the health care costs bill Governor Deval Patrick signed in August.

So what do those leaders say now?

It was unrealistic to assume that Massachusetts could maintain that kind of enormous progress each year, says Mike Widmer, president of the Massachusetts Taxpayers Foundation.

“The reality is that Massachusetst has made considerable progress in reining in the rate growth rate of health care costs,” adds Widmer. “But our challenge may be greater than we anticipated.”

And does the state need some of the tools that were left out of the new health care costs law now that the picture doesn’t look so optimistic?

No, says Widmer. The law still gives the state enormous latitude and tools to tackle rising health care costs. The key, says Widmer, will be getting the right data to clarify what’s really going on. “Where is the progress, where are the sticking points, and what can we do to help?”

Answering these questions will be up to the state’s new Health Policy Commission, which meets again next week.

More of the general overview from Kaiser Health News:

The price of commercial health insurance has risen five times faster than family incomes since 2003 even as the financial security it offers has shrunk, says a new Commonwealth Fund report that underscores how medicine is consuming bigger and bigger parts of the private economy. ... The average total cost of family health insurance — employer and employees' shares — hit $15,022 last year, up 62 percent since 2003, while the median family income rose only 11 percent during the same period, the report said. If that trend continues, premiums for family coverage will come close to $25,000 by 2020.

This program aired on December 12, 2012. The audio for this program is not available.