Advertisement

Actuaries: ObamaCare Will Hike Claims Cost 32 Percent (But Not In Mass.)

The Associated Press, delving courageously into actuarial data, reports here:

Insurance companies will have to pay out an average of 32 percent more for medical claims on individual health policies under President Barack Obama's overhaul, the nation's leading group of financial risk analysts has estimated.

That's likely to increase premiums for at least some Americans buying individual plans. The report by the Society of Actuaries could turn into a big headache for the Obama administration at a time when many parts of the country remain skeptical about the Affordable Care Act.

...Medical claims costs are the main driver of health insurance premiums. A study by the Society of Actuaries estimates the new federal health care law will raise claims costs nationally by an average of 32 percent per person in the individual health insurance market by 2017. That’s partly due to sicker people joining the pool. The study finds wide disparities among states. The estimates assume every state will expand its Medicaid program.

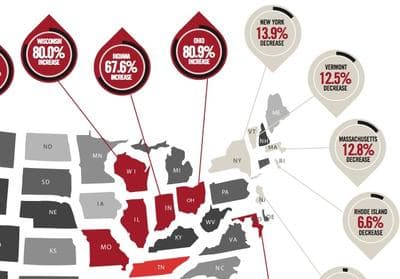

Naturally, my curiosity turned provincially to Massachusetts. The full Society of Actuaries report is here, including this gorgeous infographic breaking down the data by state. I'm happy to report that New England states are looking good: Vermont and Massachusetts can expect claims costs on individual policies to decrease by over 12 percent and Rhode Island by more than 6 percent. New York can expect a whopping drop of nearly 14 percent. Compare that to poor Wisconsin and Ohio, expecting an increase of over 80 percent.

The AP piece also features some refutations from the Obama administration, including:

The administration questions the design of the study, saying it focused only on one piece of the puzzle and ignored cost relief strategies in the law such as tax credits to help people afford premiums and special payments to insurers who attract an outsize share of the sick. The study also doesn't take into account the potential price-cutting effect of competition in new state insurance markets that will go live on Oct. 1, administration officials said.

Readers, thoughts? Some helpful clarification from Kaiser Health News here :

Q: I get insurance at work. Were they talking about my insurance claim costs?

A: No. This report was just about people who buy on the individual insurance market, currently under 10 percent of the country, though that's expected to go up as the law kicks in. The vast majority of Americans get insurance through work or through government programs (Medicare, Medicaid, the military).

Q: Does the study predict health insurance premiums will go up 32 percent by 2017?

No. First, it’s only forecasting the individual insurance market. That’s where millions of Americans newly covered under the ACA are expected to find policies. The report says nothing about costs for employer-based health insurance.

Equally important, the 32 percent forecast is for medical expenses paid by insurers, not what insurers will charge in premiums, and not what consumers will pay.

(Hat-tip to Tom Anthony)

This program aired on March 27, 2013. The audio for this program is not available.