Advertisement

As State Agency Fails To Keep Premiums Flat, What's Ahead For Cost Control In Mass.

ResumeThere's a growing list of warning signs that Massachusetts, despite lots of effort, may be losing the battle to control health care costs.

Last month, the Division of Insurance approved a 6.3 percent increase in the base rate for small businesses.

Then, we heard that Massachusetts came in over the target cap for health care spending last year.

And now, an attempt to keep health care premiums flat for the largest employee group in the state has failed.

"It was ambitious, very ambitious," said Dolores Mitchell, executive director of the state's Group Insurance Commission (GIC), the agency that manages health insurance for 435,000 municipal, MBTA, state workers, their dependents and state retirees.

"Have we managed to slow cost increases, yes," Mitchell said. "Have we got our arms around the cost monster, no."

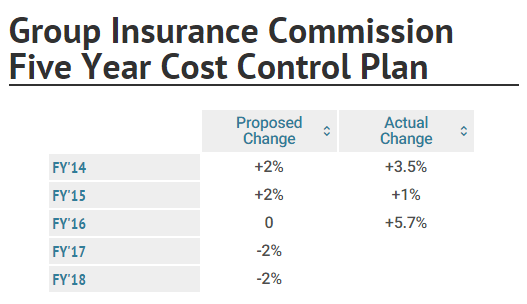

The GIC is in the middle of a five-year plan.

In the current fiscal year, which began July 1st, "it was supposed to be zero, but we didn’t make it," Mitchell said. The increase this year is 5.7 percent.

The miss means millions of dollars in additional state spending as well as higher costs for the 435,000 people covered by the GIC.

So what happened?

"It has been tough year," Mitchell said. "Pharmacy going through the roof. The Hep C drug is just a shocker: good for the patients, awful for the budget."

New blockbuster drugs are just one factor. Mitchell said insurers tell her a big problem is patients who seek care outside of their network. So Mitchell agreed to let insurers require that most members name a primary care doctor and get a referral from that doctor for out of network care. It’s a change she says will save money and improve care.

"All over the country, everybody is saying, medical care is better if you have one doctor who is your major doctor," she said.

Mitchell said it would help if patients stopped going to the top academic hospitals where a routine test can cost two or three times more than at a local community hospital. But she said there’s too much focus on blaming the patient.

"They use too much health care, they go to the doctor too much," she said, running through a common litany of problems assigned to patients. There's "not enough on saying the price is too high," Mitchell said.

That's prices charged by doctors, drug companies, medical device makers and hospitals.

"Providers," Mitchell said, "you’ve got to be part of the solution or you are the problem."

"Hospitals are doing a lot and they’re having success," said Tim Gens, executive vice president at the Massachusetts Hospital Association.

Gens points to a state report out earlier this month that showed Medicare spending for hospital care grew slower than the state economy overall.

"There’s certainly challenges, there’s still problems," Gens acknowledged, "but the most recent numbers cleared by the state suggest on a lot of fronts there’s real progress being made and I think hospitals are the forefront of that progress."

But Mitchell says she's frustrated because not enough hospitals are working under a budget and absorbing the cost if they spend money that isn’t required for quality care. A little more than a third of members are covered by plans where providers assume some financial risk. Mitchell says the level of risk is typically low, not enough to compel a doctor to consider whether a patient would really benefit from a test or procedure.

And drug manufacturers? One, Novartis, has floated a the idea of accepting financial risk for the success or failure of a new heart drug, Entresto. The company has not released a detailed plan.

Massachusetts Biotechnology Council (MassBio) says the conversation should be about value, not just price. Sovaldi, the blockbuster Hepatitis C medication, is a cure.

"We expect to see those patients save the health care system costs for years down the road, as those patients won’t need liver transplants and costly hospital stays," said Robert K. Coughlin, president and CEO of MassBio. "They are going to work, paying their taxes, living their lives."

Coughlin says about 70 percent of medicines in the pipeline may change the way patients fight their disease.

"We need to start talking about a longer-term view of value in health care so patients can receive the cures they so desperately need," Coughlin said.

For Gov. Charlie Baker, any plan to tackle health care costs must include transparent pricing. He says it’s time to require that everyone in health care post their prices.

Hospitals say this would be an incredibly complicated project. A typically knee surgery might include 15 to 20 different items, not including the surgeon's, anesthetist's or other physician's charges.

"More and more people have out of pocket spending associated with their health care," Baker said. "If we could be better at helping them and helping their providers help them make better decisions, we could probably reduce what people are paying out of pocket. Because for many people this has become a real issue."

Baker says his staff is trying to determine if he can just require everyone in health care to create price lists or if he needs to work with the legislature on a change.

There's a growing, perhaps weary, sense that the state's health care cost control plan is fragile.

"We knew that when we embarked on that cost containment bill last session that there would be great challenges. It's not just the GIC," said chair of the Joint Committee on Health Care Financing Rep. Jeff Sánchez. "If you look at MassHealth and the challenges there, it's a reality, but it's nothing different from any other state in the nation."

Sánchez's committee has more than a dozen measures that propose more cost control solutions: bills that would impose tighter state regulation of health care prices, legislation aimed at more efficient care and bills that would tackle the rising price of prescription drugs.

At the GIC, Mitchell and colleagues are taking a look at the last two years of their five-year plan. Premiums are to drop two percent in FY'17 and '18. There may be revisions. But Mitchell is worried.

"We’re getting to the crisis point," she said. "We really have a serious need to pull back on what we spend on medical care."