Advertisement

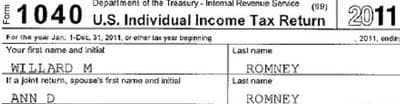

Romney's Tax Returns Shed Light On Benefits Only Available To Some

ResumeSo what did we learn from Mitt Romney's tax returns released formally Tuesday morning?

It's no surprise that the highly successful venture capitalist earned $42.5 million over 2010 and 2011.

And once this year's returns are finished, the Romneys expect to pay about $6.2 million in taxes for the two years-- just less than the 7 million they've given to church, and charity, which in 2010, meant taxes slightly less than 14 percent.

Distinguished Professor of tax law at Syracuse University David Cay Johnston told Here & Now's Robin Young that everything in Romney's returns was legal.

Breaking Down Romney's Taxes

Romney's $20 or so million in income from this year fits into a couple of categories: Romney made $14 or so million off of money that he invested- capital gains, returns on stocks, interest on his savings.

[sidebar title="" width="290" align="right"]Ordinary income:From wages, salaries and commissions. Taxed at 10 percent to 35 percent, with higher earners paying higher rates. Most Americans pay the bulk of their federal income taxes in this category.

Investment income: From interest payments, dividends, and capital gains collected upon the sale of stocks, bonds, mutual funds and other investments owned for more than one year. Rate is 15 percent.

Carried interest: The 20 percent share of profits that private equity firms take on investment deals. These funds are taxed as long-term capital gains, allowing managers at the firms and at hedge funds to have a large part of their income taxed at 15 percent instead of 35 percent.

From Investopedia[/sidebar]

He also made money from the investments of others--people who invested in his former company Bain Capital. He and others at Bain in effect were paid by those investors for making deals.

"A successful manager like Romney gets a share of the profits he produces and Congress allows the manager to be taxed the same way people who had capital at risk is-- at this very low 15 percent rate," Johnston said.

"It's called a profits interest. Romney doesn't have an ownership interest, he doesn't have any stock, but he has a right to receive income and that produces big benefits for him especially in terms of passing income down to his sons."

The idea of carried interest is legal, but Romney also takes this income years after leaving Bain because it is part of his retirement deal.

Passing Money Down To His Family

Romney's sons have a trust fund worth $100 million.

Johnston says currently the maximum amount a married couple can pass to their children without paying gift taxes is $10 million. But the Romney's confirmed through their lawyers that they did not pay any gift tax on the $100 million account. How is this possible?

"They apparently gave the sons some of their carried interest. And because the carried interest is not an ownership, it is a right to receive profits, Congress lets you value that gift at zero," Johnston said.

"When you get the income you have to pay it at the 15 percent rate. It means that the parents have effectively pushed forward not just the 100 million the sons have, they avoided the 31 million in gift tax, so they've really in effect given their sons the equivalent of $130 million without paying any tax and nobody can do that except people who run private equity funds like Bain Capital Management," Johnston said.

The Tax Debate-- What happens now? Will The Tax System Be Changed?

"At the heart of this is a split going on in the Republican party between main street, that's the Newt Gingrich kind of folks, and Wall Street, that's the Romney sort of folks," Johnston said.

"And to get real tax reform in this country we have to stop treating certain classes of people as special and privileged and different from the rest of us."

- MittRomney.com: Romney's Tax Returns

- Here & Now: Why Romney Pays 15 Percent

- Tax Foundation: The Effective Tax Rates Of The Rich

Guest:

- David Cay Johnston, Reuters economics columnist, Syracuse University professor

This segment aired on January 24, 2012.