Advertisement

Hard Push For New Glass-Steagall Act To Regulate Banks

Resume

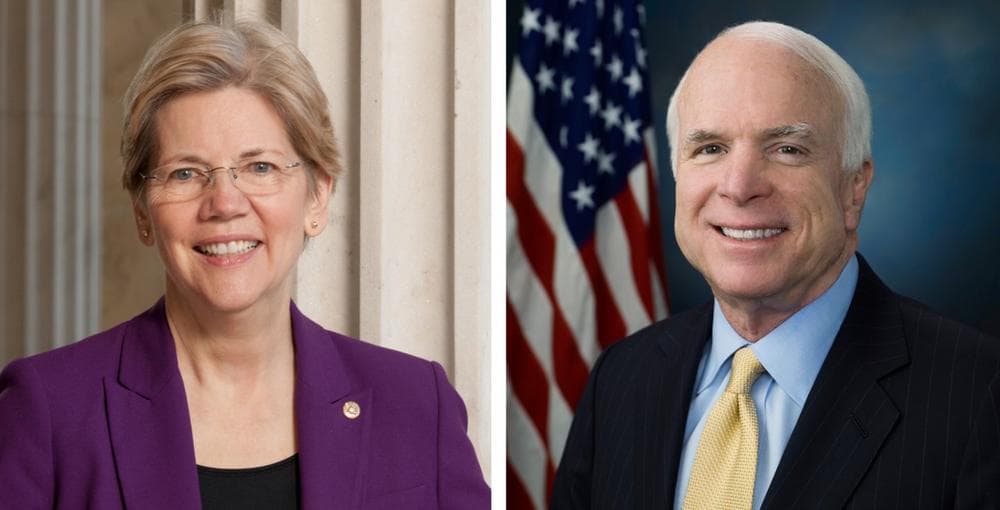

Four senators, including Democrat Elizabeth Warren and Republican John McCain are proposing "The 21st Century Glass-Steagall Act" to force Wall Street to separate traditional banking from speculative investment.

Under the proposed legislation, banks which take federally insured deposits would be barred from most forms of risky investments, including trading in derivatives, dealing swaps, operating hedge funds and private investment entities.

The bill is named after the landmark 1933 law that placed strict limits on what banks could do. That act was repealed in 1999 as the modern finance industry with mega banks that performed multiple functions was taking shape.

Requirements in the new bill would force large banks to split up into fully independent businesses. Critics say that would hurt consumers who have been helped by the low interest rates, which are in part made possible by banks trading in financial instruments that reduce risk and costs.

Guest

- Simon Johnson, professor at the MIT Sloan School of Management. He is also former chief economist for the International Monetary Fund. His global economics blog is "The Baseline Scenario" and he tweets @baselinescene. His is author of "White House Burning: Our National Debt and Why It Matters to You" and "13 Bankers: The Wall Street Takeover and the Next Financial Meltdown."

Read More

Simon Johnson/Bloomberg "The biggest U.S. banks have become too big to manage, too big to regulate, and too big to jail. At a stroke, the proposed law would force global megabanks such as JPMorgan Chase and Bank of America to become smaller and much simpler — divorcing high risk activities from plain-vanilla traditional banking. Their failures would no longer threaten to bring down the economy."

Bloomberg "A new bill proposed by, among others, Senators John McCain and Elizabeth Warren, misses the point about what caused the financial crisis. The so-called Glass-Steagall 2 would do nothing to protect us from the devastation we recently experienced. Worse, it threatens to distract attention away from legitimate reform efforts."

National Review "Whatever the exact fix, the McCain-Warren bill, along with a bank-overhaul proposal from Senators Sherrod Brown, an Ohio Democrat, and David Vitter, a Louisiana Republican, is a sign that Washington increasingly sees Dodd-Frank as the beginning rather than the end of broad financial reform. And now it might be time for a sequel."

This segment aired on July 16, 2013.