Advertisement

Obama Breaks Vacation, Keeps Bernanke At Fed

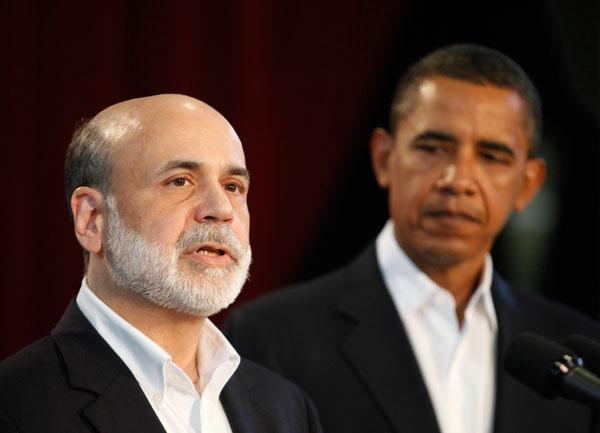

Praising him as the man who shepherded the United States past the worst economic crisis since the Great Depression, President Obama on Tuesday announced plans to keep Federal Reserve Chairman Ben Bernanke in his job for another term.

Bernanke, credited with guiding the economy away from its worst recession since the 1930s, now faces the challenge of meeting the White House expectations to guide an economic recovery critical to Obama's legacy. Widely lauded for taking aggressive action to avert an economic catastrophe after the financial meltdown last year, Bernanke stood beside the president — and before reporters — while Obama took a brief break from his summer vacation on the island of Martha's Vineyard off the coast of Massachusetts.

"Ben approached a financial system on the verge of collapse with calm and wisdom; with bold action and outside-the-box thinking that has helped put the brakes on our economic freefall," Obama said. "Almost none of the decisions he or any of us made have been easy."

In sticking with Bernanke, Obama is looking to reassure the financial sector as well as foreign central banks that his administration has no plans to change course on its largely well-received approach to rescuing the industry from its meltdown or its management of overall monetary policy.

Bernanke masterminded what is now seen as a successful strategy to lift the economy out of recession, unlock credit and stabilize financial markets, in part by using unconventional and unprecedented lending programs. But he's not without his detractors, and the top Democrat on the Senate banking committee warned of a thorough hearing before Bernanke would take his post for a second time.

Many on Wall Street and in academic circles believe that Bernanke would be the best choice to lead the country into a sustainable recovery and would be in the best position to figure out when and how to reel in the trillions of dollars pumped into the economy to battle the crisis. Obama joined the praise for a Fed chairman whose early tenure was as complicated as the crisis facing the banks he sought to save.

"The man next to me, Ben Bernanke, has led the Fed through the one of the worst financial crises that this nation and this world have ever faced," Obama said. "As an expert on the causes of the Great Depression, I'm sure Ben never imagined that he would be part of a team responsible for preventing another. But because of his background, his temperament, his courage, and his creativity, that's exactly what he has helped to achieve."

Bernanke voiced his gratitude to Obama "for his unwavering support for a strong and independent Federal Reserve."

He said the objective remains to restore a "stable" financial environment and said that if confirmed by the Senate, he will work to provide "a strong foundation for growth and stability" in the economy.

Painting an economic agenda as a necessity, Obama said Washington's actions have stabilized the financial system, restructured the auto industry and passed a $787 billion economic stimulus package. The president acknowledged the criticism for the aggressive plan but said the steps brought the economy back from the brink of collapse.

"For even as we have taken steps to rescue our financial system and our economy, we must now work to rebuild a new foundation for growth and prosperity," Obama said. "We must build an economy that works for every American, and one that leads the world in innovation, investments and exports."

Bernanke, appearing last week at an annual conference in Jackson Hole, Wyo., received heaps of praise from economists, academics and central bankers from around the world for his handling of the crisis. In sharp contrast, just a year earlier, as the financial crisis intensified, Bernanke was under siege because of the unprecedented actions he was taking.

But his actions now are bearing fruit. The economy is emerging out of a recession and is poised for growth. However, the recovery will be slow and the unemployment rate, now at 9.4 percent, is likely to top 10 percent this year before it starts going down.

Even with this challenge ahead, many economists and Wall Street types believe Bernanke is best suited to deal with the challenge of lowering the unemployment rate, gradually reducing joblessness and fighting off any threat of inflation.

Bernanke has won admiration from Democrats and Republicans on Capitol Hill even as some lawmakers have urged him to retain the Fed's independence and warned him not to become too cozy with the administration. Any move to replace Bernanke would have been perceived as injecting politics into the Fed, especially if Obama had turned to Lawrence Summers, his top economic adviser, as Bernanke's replacement.

For Obama, there was little political downside in choosing to nominate Bernanke to a second four-year term. The move displays bipartisanship and a steady, unchanging hand on the economic tiller. Fully occupied with an attempted health care overhaul, Obama's team could little afford the distraction of changing the head of the Fed.

Bernanke, 55, was appointed Fed chairman by President George W. Bush and sworn in Feb. 1, 2006, following Alan Greenspan's 18-year tenure. His renomination requires confirmation by the Democratic-controlled Senate.

The news, breaking late Monday while Congress was winding down its August recess, drew a tepid - although speedy - response from Sen. Chris Dodd, the Connecticut Democrat who runs the Senate Banking Committee.

"While I have had serious differences with the Federal Reserve over the past few years, I think reappointing Chairman Bernanke is probably the right choice," said Dodd, promising a thorough confirmation hearing. "Chairman Bernanke was too slow to act during the early stages of the foreclosure crisis, but he ultimately demonstrated effective leadership and his reappointment sends the right signal to the markets."

This program aired on August 25, 2009. The audio for this program is not available.