Advertisement

Are We Lowering Health Costs Or Just Shifting Them To Consumers?

"You guys on Beacon Hill back off, the market is working." That's the message, more or less, from most hospitals and some business leaders to the House and Senate — particularly to the House, which takes up its health care cost bill tomorrow.

The evidence of market success? Hospitals are agreeing to contracts with lower rates of increase and insurance premiums are rising at their lowest rate in five years. A few employers are actually reporting a cut in premiums.

Why are premiums down and why are hospitals able to take a lower increase than in recent years? I haven't seen much firm evidence that answers this question. But the latest report from the state's Division of Health Care Finance and Policy has some important analysis on the premiums question.

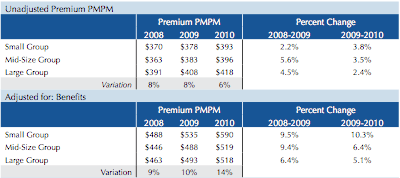

Take a look at the far right column on this chart and note the premium increase in 2010 when "adjusted for benefits." If you put back all the costs that have shifted to members (higher co-pays, deductibles, co-insurance, etc.), premiums in 2010 would be rising at almost the same rate they have for the last decade or so. In healthcare-speak, this is called "benefit buydown." The market is producing lower premiums, but it is because patients are paying more health care costs on their own.

When I contacted the Division to see if I was reading the chart correctly, they sent a statement with a more nuanced view:

The data that the Division has collected indicates that benefit buydown is a likely contributor to the recent decrease in premiums. Other contributors include a decreasing trend in medical claims expenditures, reflecting lower utilization (likely related to the recent recession).

I called a few people to get their reaction.

"Changes in the marketplace in Massachusetts are far more fundamental and far-reaching than the report suggests," says Michael Widmer, president of the Massachusetts Taxpayers Foundation.

"As costs continue to go up, employers are looking for ways to moderate the premium," says Eric Linzer, senior vice president at the Massachusetts Association of Health Plans. "One of the few levers they have is to look at products that increase cost sharing. This will encourage members to think about the cost of care. If you want real meaningful long term relief you have to do something about underlying health care costs."

The DHCFP report is meant to help frame the health care costs hearings that begin this morning at Bunker Hill Community College. I expect we'll hear a lot more about whether the market is actually working to control health care spending, or whether we are just pushing more payments to consumers.

This program aired on June 4, 2012. The audio for this program is not available.