Advertisement

Mass. Small Business Owners Dropping Health Coverage That's Become Unaffordable

ResumeRyan Cook wanted to help. The office manager at his small Raynham real estate office needed health insurance; her husband had lost his job and with it, the family's coverage.

So Cook looked into adding the woman and her family to his self-employed plan. "And I was seeing prices at about $1,800 a month. That cost was ridiculous, quite frankly," said Cook, president of FCRG, Inc.

Ridiculous, but not a complete surprise, as Cook's own premiums have increased 50 percent in the last three years.

His office manager tried another option. She applied for subsidized coverage through the state Health Connector and was told she qualified. Her monthly contribution would be $250 a month.

"It just made no sense at that point for me to provide that benefit to my employee," Cook said.

Cook says many small business owners he talks to at Chamber of Commerce luncheons and other meetings are struggling to stay competitive with larger firms when it comes to benefits.

"The one that everyone is choking on is the cost of health care," Cook said. "They’d love to be able to offer it but it just becomes so cost prohibitive to the business that you can’t do it."

Jon Hurst, president of the Retailers Association of Massachusetts, says his members, which have an average of 10 employees, have seen premiums rise in the range of 12 percent every year for the last decade.

"A 12 percent increase in already-high health insurance premiums, coupled with rising rents, rising payrolls and, frankly, sales that are flat or down at the level of inflation, well, that doesn't work economically -- something's going to give," Hurst said.

Small business rates approved for April 1 offer no relief. The base, or starting point for premiums, will rise anywhere from 0.4 percent at Tufts Health Public Plans to 32.3 percent at Harvard Pilgrim Health Care. The average base rate increase is 7 percent -- many times the projected rate of inflation.

"Premiums reflect the cost of medical care," said Eric Linzer, senior vice president at the Massachusetts Association of Health Plans. "What we're seeing is a combination of rising prescription drug costs, care delivered in some of the highest-priced settings, and there are significant costs associated with the Affordable Care Act (ACA) that have increased premiums."

Hurst says many small businesses have tried all the solutions brokers suggest, like offering coverage with high deductibles or increasing employee co-pays. Some of the larger small businesses are moving to self-insured coverage, where a company is responsible for the medical expenses incurred by its employees.

"Or maybe try to get their employees to be insured elsewhere if they are very small," Hurst said.

There are several changes that may have made it easier for workers to move from a company plan to MassHealth (Medicaid) or subsidized coverage through the Health Connector.

For one thing, making that transition is now allowed. Before passage of the ACA, Massachusetts residents who had access to insurance through work could not enroll in subsidized plans. But the ACA lifted that restriction and Massachusetts followed suit in 2014.

Second, many small businesses no longer face a penalty for failing to provide insurance. A state fee of $295 per worker for firms with 11 or more employees ended in 2013. The state employer penalty for small businesses is scheduled to be replaced this year by a federal fine that applies to some companies with more than 50 workers. Cook, the real estate president, says some companies are splitting in two so that they stay under the 50-worker threshold and avoid the fines.

Bill Vernon, Massachusetts director for the National Federation of Independent Business, says members who drop coverage do so because they can no longer afford it. Employees typically switch to a spouse’s health plan, buy coverage on their own or, most commonly, enroll in MassHealth or a subsidized ConnectorCare plan.

"People are insured," Vernon said. "What we see here, I think, is the shift as to who is paying and how it’s being paid."

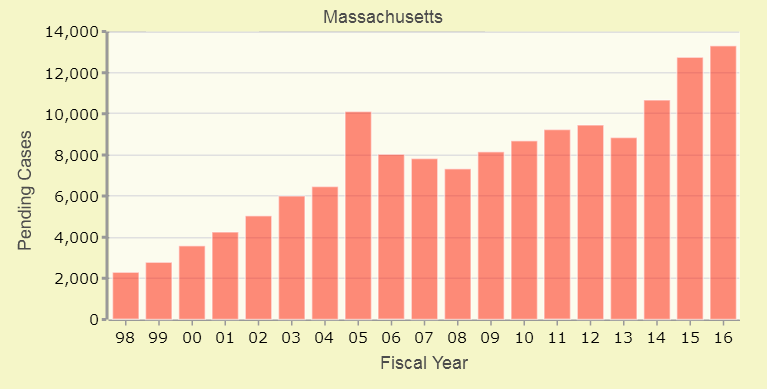

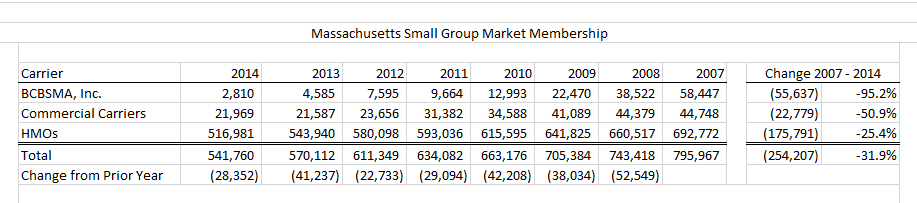

It’s not clear how big of a shift is underway. Raw numbers from the state Division of Insurance (DOI) show at least a 30 percent drop in small business coverage between 2007 and 2014.

Fewer Small Business Employers Offering Coverage:

Fewer Employees Covered By Small Business Plans:

Bob Carey, a health care consultant who was part of the team that launched the Connector, pulled the above DOI numbers after noticing a recent one-year drop in small business coverage rates.

The small business insurance filings for April 2016 show the number of workers covered by an employer plan has dropped another 5 percent.

Changes in state and federal insurance law may explain some of the drop. People who are self-employed used to be counted as small businesses, but are now tallied in the individual market. More DOI data compiled by Carey shows 27,517 people who might be in this category. Then, some small businesses may have grown and moved into the larger employer category. And some firms, as Hurst said, have started self-insuring and would not be captured in the DOI figures.

But still, it looks like something is happening in the small business market.

"I think folks in this market assumed that the small group market, which is 50 or fewer employees, had remained relatively stable," Carey said. "But in fact we see that there's been an annual decline in both the number of people covered and the number of employers who offer coverage."

DOI doesn't see the numbers that way.

“The apparent decline over that timeframe cannot definitively be attributed to small employers not offering employees health insurance plans," said Chris Goetcheus, spokesman for the Office of Consumer Affairs. "These employers may have found alternative means to negotiate coverage in the large employer group, which DOI does not regulate.”

The most recent survey of employer coverage might seem to support that idea. It shows that 76 percent of Massachusetts employers offered health insurance between 2011 and 2014, a rate that's significantly higher than the national average of 55 percent.

But Aron Boros -- who directs the Center for Health Information and Analysis, the agency that produced that survey -- says the overall steady rate masks some subtle changes.

"We do see, over the last year, a trend where fewer members are receiving their coverage in that small group market," Boros said. "We see premiums increasing in that small group market at a more volatile and higher rate than in other sectors."

Boros says he can't tell exactly where employees of small businesses go for insurance if the company ends coverage. Some of the numbers he's looking at don't add up. Private plans say they are covering about the same number of people, the state's uninsured rate was consistent last year at 3.6 percent, and yet enrollment in MassHealth and subsidized ConnectorCare is up.

"There's a little bit of an open mystery in these enrollment figures," Boros said.

There's no question this mystery is putting enormous pressure on the state budget. MassHealth grew to just over 2 million residents 15 months ago. That’s one-third of the state’s population. The Baker administration reviewed eligibility and the number dropped to about 1.8 million — still a quarter of all the men, women and children in Massachusetts. State Health and Human Services Secretary Marylou Sudders says she’s not making a direct link between a decline in employer coverage and an increase in the state rolls yet, but is watching the insurance numbers closely.

"Massachusetts health reform law is based on all of us having shared responsibility," Sudders said. "As we go forward we need to be certain that our employers, our individuals and our insurers are all part of that conversation so that we can continue to have 97, almost 100 percent of folks in Massachusetts have health care coverage."

Many small businesses say they hope to be part of that conversation, but they're struggling. The idea that employers would take their share of responsibility for expanding coverage was premised on the pledge that health insurance would be affordable. For many small businesses it is not.

"The costs are getting crazy for us," said Tom Erb, president of Electric Time Co. in Medfield, where premiums rose 22 percent this year. "For a family plan, my cost per employee is $5 to $6 an hour."

Erb says he doesn't feel like he can drop health insurance and still attract good employees.

Besides, he said, "I don't know what the options are, kick everyone out and throw them to the Connector?" It's not something Erb wants to do.

"This is a harbinger for the rest of the country," consultant Carey said. "We had, and we still have, more small employers offering coverage than almost any place in the country, but we’ve seen a decline, and I think you’ll see that play out in other states as health reform and people realize that there are other coverage options."