Advertisement

What Boston Needs To Know About The Child Tax Credit Payments

Resume

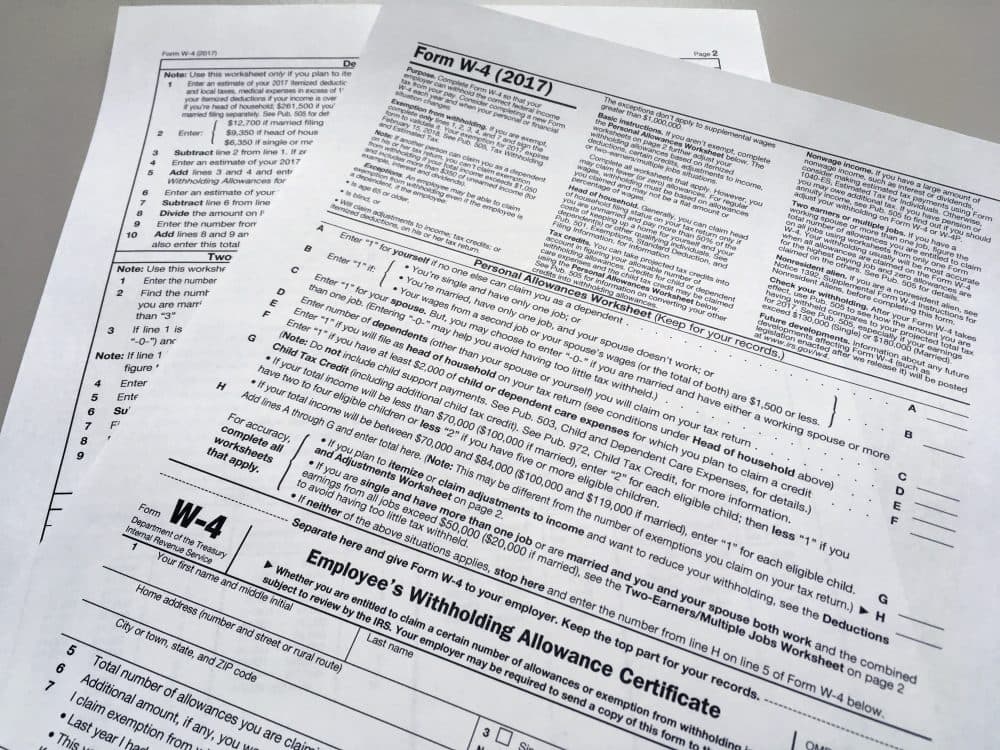

The first monthly child tax credit payments are going out today, and the IRS estimates that roughly 39 million households, which covers around 88% of children in the country, will receive the credit. But what about the families who won't receive a check?

We talk with Dr. Megan Sandel, a pediatrician and co-director of the Grow Clinic at Boston Medical Center and Principal Investigator at Children's Healthwatch, and Victoria Negus, Policy Advocate at the Massachusetts Law Reform Institute, about the impact of the checks — or lack thereof — on families in the Commonwealth.

This segment aired on July 15, 2021.