Advertisement

Smoke ’Em If You Got ’Em — Cigar Taxes Could Light Up

Resume

Smoke 'em if you got 'em, because before too long you may not be able to afford 'em.

Cigars that is — havanas, coronas, belevederes or, as the late George Burns famously enjoyed (at least 10 times a day), good ol' El Productos.

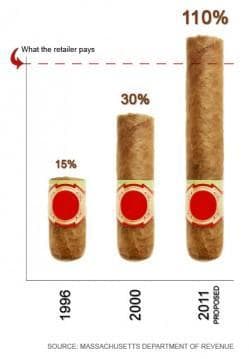

Under Gov. Deval Patrick's proposed 2011 budget, the excise tax on cigars would skyrocket from 30 percent to 110 percent. (A similar increase, from 30 to 120 percent, would affect pipe tobacco; from 90 to 110 percent for chewing tobacco.)

Patrick's $28.2 billion proposed budget is designed to close a budget gap of nearly $3 billion. Cut a few million here, a few million there — nothing major, but every cut affects someone. And this one could snuff out cigar smokers.

An excise tax is paid directly to the government by retailers, and it’s usually based on how much that retailer paid the manufacturer for the product. Under Patrick's new budget, tobacco retailers will be paying the state more in taxes on their inventory than they paid for the inventory itself.

Retailers say they will have no choice but to at least double their prices.

Stealing From Her Customers

Jetmira Kaziu is the COO of Cigar Masters, a cigar bar and lounge in the Back Bay. As a smoking bar, by law, at least 60 percent of its revenues must come from tobacco sales. Kaziu is worried that if the excise tax increase passes, she will feel like she's stealing from her customers because they could easily get their favorite cigars cheaper elsewhere. Maintaining that 60-percent requirement would be difficult.

"We are in between two states, New Hampshire, which doesn’t have any tax, and Rhode Island, which has just a 50-cents tax," Kaziu said.

"So that means that all my customers, they’ll buy their regular cigars from the states next to us or probably go online and buy them, and as such we might even go out of business … and obviously the employees thrown out on the street in this economy is not such a viable thing to do.”

Joe Corrado, a 24-year old bartender, is a regular at Cigar Masters. He's there a couple times a week, spending $30-50 a week, and he says if the excise tax hike passes, he would still most likely be a fixture in the bar, but his habits would change.

"Where I’m smoking $10 to $12 cigars now, I might bump down to the lower grades," he said. "Or alternatively, I have aunts and uncles and friends that make frequent trips to New Hampshire, 40 minutes away or less, they make a day of it and stock up for the month.”

Christian, a 27-year old sales manager who did not give his last name, will be making some changes, as well. “I’d say I’m here three or four times a week, and I smoke two to three cigars at a time, and I probably spend couple hundred bucks here a week, so there’s no way that I’d be able to sustain that if that tax increase was to go into effect.

"It’s not going to stop me from smoking cigars, because I’d just buy them elsewhere, out of state, and bring them back. It'd be disappointing, because it would drive a lot of small businesses under, like this place, and Stanza in the North End, or a couple other cigar stores in the city. It’s really gonna hurt them as well.”

'It Would Put Us Out Of Business'

L.J. Peretti’s is a 140-year old Boston institution, just off the Boston Common, that specializes in premium cigars and hand-blended pipe tobacco. Its faithful customers over the years have included the likes of British Prime Minister Ramsay MacDonald, Mickey Rooney, Jack Lemmon and Walther Matthau (frequenting Peretti's as a pair) and the iconic pipe-smoking detective himself, actor Basil Rathbone, who played Sherlock Holmes.

The place is right out of a time capsule. Amid the swirl and sweet aroma of smoke coming from a customer's stogie, the front of the shop is a dizzying display of hundreds and hundreds of cigars and pipes. The counters and walls are decorated with antique tobacco-related tools, machinery and artwork.

Back in the "blending room", a couple tons of loose tobacco, in bags, are stuffed in cubbies, waiting to be blended on a heavily worn and deeply stained wooden counter.

Stephen Willet is the president of Peretti’s. Leaning against the blending counter, as he packs and repacks the tobacco in the pipe between his teeth, Willet expresses little ambiguity about how the proposed excise tax hike would affect his business.

“It would put us out of business," he says flatly. "And I’m not being overly dramatic saying that because no one is going to pay that kind of tax. All they have to do is go on the Internet.

"They can already go to New Hampshire and get it for considerably less. You don’t want to drive business out of the state, it seems to me. You want to make some revenue on products that are in the state. It just seems logical to me, maybe I’m missing something, but that’s how I feel about it.”

Unintended Consequences Of A Tax Hike

Driving business out of state may or may not be the intent of the tax proposal, but according to the state Department of Revenue, it's expected. While total excise tax revenues for these tobacco products totaled almost $17 million for fiscal 2009, the state estimates the proposed hike would add only $15 million to that total, to be funneled back into the state health care system.

Bob Bliss, a spokesman for the state's Department of Revenue, said he assumes the hike in taxes would drive down demand. When asked if he thought the tax would drive businesses to close, he had no comment.

Stephen Willet, of L.J. Peretti's, says now is not the time to raise taxes on anything, whether it's on a candy bar, soda or a cigar. "If you're a small business owner like I am, you feel as if the unemployment rate is more like 20 percent, rather than 10 percent."

Willet also sees too much government intervention into people's personal lives. "This is the archetypal nanny state here," he says. "But the fact of the matter is, federally, tobacco is a legal product. So like liquor or anything else, either make it illegal or get off our backs."

JFK's Last Request

Willet recounts the 1962 story of how President John F. Kennedy asked his press secretary Pierre Salinger to round up a thousand of Kennedy's favorite cigars, H. Upmann Petit Coronas — Cubans. Willet says store records show Salinger ordered 22 boxes of them from Perretti's. As Salinger himself remembers the story, he reported back to Kennedy the next day that he managed to buy 1,200 cigars. Just then Kennedy reached into his desk drawer, pulled out a piece of paper and signed it. It was the decree banning all Cuban products from the United States.

"Not to make a judgment, but that tells you something about politics, doesn't it?" Willet says.

In the end, politics may be the saving grace for places like Peretti's and Cigar Masters. House Speaker Robert DeLeo is already on record opposing any new taxes in next year's state budget, and his office confirms that includes this tax on tobacco products.

This program aired on February 23, 2010.