Advertisement

Cash-Only Mass. Home Sales Are Booming

Home loans are the cheapest they’ve been in generations. Freddie Mac says the average interest rate on a 30-year fixed mortgage fell to 4.01 percent last week. That’s the lowest since 1951.

Which makes it all the more surprising that a fast-growing number of Massachusetts homebuyers are not getting home loans at all. Instead, these buyers are plunking down all cash.

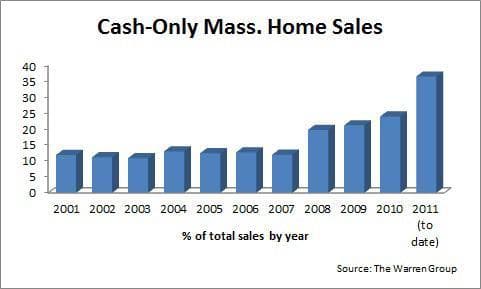

To a lot of us, the idea of ever having hundreds of thousands of dollars in cash to pay for a house outright seems pretty foreign. But typically, one in every 10 Massachusetts homes is paid with cash only.

"Probably one of the areas where we see it most commonly is the ‘kiddie condo’ in Boston," said Laurie Cadigan, who heads the Massachusetts Association of Realtors.

That’s where parents of college-bound kids buy a place with plans to sell it after graduation. Or, Cadigan says, it’s baby boomers downsizing or maybe buying a second home.

"The other areas where we typically see cash purchases are in high-end communities, where people have the liquidity to sort of purchase something outright," Cadigan said.

But those scenarios don’t explain why cash-only home sales are skyrocketing nowadays. So far this year, almost four out of every 10 homes sold in Massachusetts were bought with cash.

And sales of distressed homes, such as through foreclosure auctions, seem to be a big reason. Cory Hopkins, with the real estate tracking firm The Warren Group, says speculators and investors are fueling the growing number of cash-only home sales.

"Bought for a song, a little bit is being invested in them, and then they’re being flipped, turned into apartments," Hopkins said.

Advertisement

Cash sales are not exactly what you think of when you picture a healthy housing market.

The Warren Group’s records show that the number of cash sales started climbing three years ago. That’s when the recession scared away many typical homebuyers who usually get a home loan first. Banks have also been nervous about financing sales of foreclosed homes that haven’t been maintained. So Hopkins says investors looking to make a buck are filling the void — paying cash, cleaning up the property, and putting it on the market a few months later.

"You would think that putting especially properties in blighted, more urban neighborhoods back into productive reuse — you would think that that’s a good thing," Hopkins said.

And Hopkins says it probably is good that speculators and investors are bridging the gap. But the cash sales are not exactly what you think of when you picture a healthy housing market.

"In a perfect market in a perfect world, people are going to the bank first and using the bank’s money to buy these homes," Hopkins said.

In some recent cases, buyers who were having a hard time getting a bank loan just got fed up and spent their own cash savings. But what kind of a housing market is it when you may have to have stacks of greenbacks to buy the white picket fence? Hopkins says the trend is perplexing.

"One way or another, it may not prove health or non-health," he said. "It certainly proves how strange 2011’s housing market is."

One example of just how strange it is: In some Massachusetts communities, more than half of home sales this year are have been paid with cold hard cash. Those communities include Provincetown, New Bedford and Cambridge.

This program aired on October 3, 2011.