Advertisement

Winners And Losers In Patrick's Plan To Eliminate 44 Tax Deductions

Resume

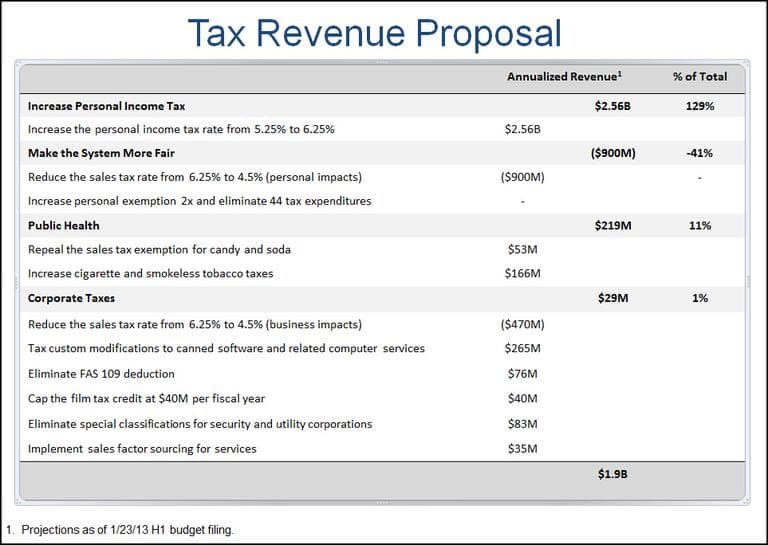

As part of his plan to boost state spending on transportation and education by nearly $2 billion, Gov. Deval Patrick has called for a hike in the income tax and a drop in the sales tax. But that's not all.

He would also eliminate nearly $1 billion worth of income tax deductions now on the books, and he'd use the savings to double the value of personal exemptions taxpayers could claim.

Getting rid of special tax exemptions would simplify the state tax code, but there would be winners and losers.

How Tax Changes Would Affect An Amesbury Pastor

When Pastor Michael John joined the Market Street Baptist Church in Amesbury about 15 years ago, the pay wasn’t exactly sky-high. But there was an important perk: He could live in the church’s parsonage for free.

“I like the setup," he said. "It’s about a quarter-mile from the church, but people don’t know it’s a parsonage. And I can be a regular neighbor in the neighborhood.”

John says the parsonage would rent for about $11,000 a year. And to add to the benefit, he does not have to count that value as part of his salary when paying federal or state income taxes. But under Patrick’s plan, he would have to count it as income, adding approximately $690 to his state tax bill.

John says his budget can handle it. But he worries that the plan could hurt recruitment efforts at other churches.

“They’ve got buildings, but they don’t have much of a budget," John said. "The only reason they can have a pastor is because they have a parsonage, and they can scrape up maybe 20,000 bucks or so and they can have a guy and he can serve them. When you’re paying taxes on that parsonage, that can be a hit when you’re not making a lot of money.”

But Glen Shor, Patrick’s new administration and finance secretary, says the loss of some tax deductions needs to be put in perspective.

"Ever single one of these itemized deductions has a constituency,” Shor said. “It doesn’t surprise us when we hear questions about the governor’s proposal. But we’ve been very encouraged when we’ve explained when people have asked questions — this is not the only aspect of the governor’s proposal.”

For instance, Patrick’s plan would double the personal exemption that John — and every other taxpayer — could deduct from income calculations.

For married filers like John, the effective savings would be approximately $640. That’s not quite enough to counterbalance the added taxes he would pay for counting the parsonage as income, but it’s pretty close.

Every Tax Benefit Has Its Constituency

Some other itemizers would take a more substantial hit. Perhaps the biggest, according to Robert Authier, CEO of the Massachusetts Association of Realtors, would come from the governor’s proposal to impose the state capital gains tax on home sale profits.

“The people that this will hit the most are the people who’ve been living in their homes in Massachusetts the longest,” Authier said.

He added that there are tens of thousands of homeowners who would face new taxes of $4,000 or more if they made a sale under Patrick’s proposed tax regime.

“They pay property taxes every year, spend lots of money locally to keep their property in good shape," Authier said. "But they do that so they can count on using that equity to move to their next home or for retirement. So we think this is a bad idea at any time, but it’s particularly a bad idea at a time when the housing market is beginning to recover. "

As Shor says, every tax benefit has its constituency: deductions for college tuition, for health savings accounts, for child care expenses. In all there are 44 tax benefits Patrick wants to eliminate. (PDF: See all of them.)

There are constituencies that are buying in to the overall plan. They like the way Patrick would shift some of the tax burden from the poor and middle class to higher-income state residents.

Harris Gruman, executive director of the Massachusetts chapter of the Service Employees International Union, says the union will lobby hard for the plan, as well as for a similar plan of its own.

“We have meetings set up with many of the legislators now in the areas where the membership is densest," Gruman said. "And they will be meeting with our members in their districts, with the people that actually vote for them, and talk about why they want to raise taxes in a fair and adequate way.”

Those ground troops will be needed if Patrick’s plan is to survive the Legislature, even in broad outline. Last week, Speaker Robert DeLeo told reporters he was hearing opposition to the tax plan, and he singled out treatment of tax deductions as one big area of complaint.

This program aired on February 14, 2013.