Advertisement

Student Loans Aren't The Only Way To Pay For College

There are 10.4 million low-income working families in the U.S. That’s about 50 million people. And, despite the continuing escalation of college tuition costs, many of these families still aspire to send their children to college. But how can they possibly afford the cost? Can saving for college make a difference? And do they have the budgetary flexibility or means to do so?

These are important questions to ask as we watch the college financial aid system unravel. The system is in trouble in large part because many parents and students no longer want to take out loans. They know that those who do borrow are often buried in long-term debt, and many, unable to repay their loans, are forced into default. In early June, the president announced student loans with built-in forgiveness. It is a sure-fire way to bankrupt the loan program.

Saving is the logical alternative, and low-income families can do that.

To ignite savings, we need to innovate.

Many low-income families are well-versed at saving, having saved for things like remittances to families overseas. Plus, they save for many of the same reasons that families at higher income brackets save. If they don’t currently put money away for their children’s college educations, it is likely because many of them have no college experience and just don’t know what it takes to convert the desire to send their children to college into a reality.

When parents join FUEL Education, a program that teaches families in under-served communities how to prepare for their children’s higher education, most of them have no plan for paying for college. Many parents assume that student loans are the only way. After families educate themselves, however, they learn the importance of setting aside money for college and all the associated costs. FUEL Education also gets families to begin thinking about things like the FAFSA, scholarships, standardized testing and their children’s GPAs.

To clear up any illusions, savings will never catch up to tuition under the present system. As long as colleges can rely on government money in the form of student loan proceeds, they will keep hiking up the cost.

So why save? Because many colleges, especially public ones, have tuitions that savers can truly afford. In fact, Sallie Mae reports that many low-income families are making wiser choices about colleges, ruling out those schools that are beyond their means. With increased affordability, savings can account for a larger piece of the pie.

Advertisement

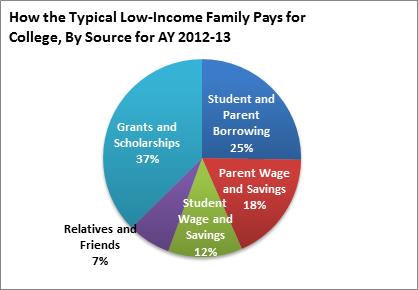

For the typical low-income family, savings comes in third as a means of college payment. Indeed, among low income families, students’ contributions — savings and wages — pay a bigger chunk of the tuition pie than in middle or upper-income families.

And, saving for college does a lot more than just pay some of the bills. Savings engenders a deeper level of engagement and investment in planning and preparing for college. The commitment to saving for college opens up families to seek out scholarships, grants and other ways to pay for college.

What, then, is the best way to help low-income families save?

One way for families to focus on savings is to utilize the national college savings account. Although not very customer friendly, the 529 Plan has attracted billions of dollars in contributions by offering tax-free savings. While 529 Plans are embraced by the middle class, lower income families have shied away. Only 12 percent of low-income families are using 529 accounts.

If the government wants to pivot from student loans to family savings, it is going to have to meet savers where they are and help them see not only the benefit of a college education, but also a path to making that a reality.

To bridge this gap, some states are offering college savings programs aimed specifically at low-income families. Other cities and states, from San Francisco to Maine, are experimenting by opening a savings account in every child’s name. Child savings accounts (CSAs), which parents can open when their child is born or as their child enters kindergarten, often come with incentives and awards such as seed money and matches.

To ignite savings, we need to innovate. Could financial aid spur savings by converting need-based grants into need-based matches? The savings of low-income families would be rewarded with government dollars in that scenario. Could we create communities of savers where low-income families would receive information about college and peer encouragement to save?

If the government wants to pivot from student loans to family savings, it is going to have to meet savers where they are and help them see not only the benefit of a college education, but also a path to making that a reality. Support for savings is a stepping stone on that path.

Related: