Advertisement

The Problem With U.S. Tax Policies

ResumeTax expert David Cay Johnston says it's easy to fool the IRS, but there's one catch: "you have to be rich."

Johnston says Congress keeps passing laws that make the tax code increasingly complex, while at the same time it's cut funding for the IRS, making it very hard for the agency to inspect returns properly.

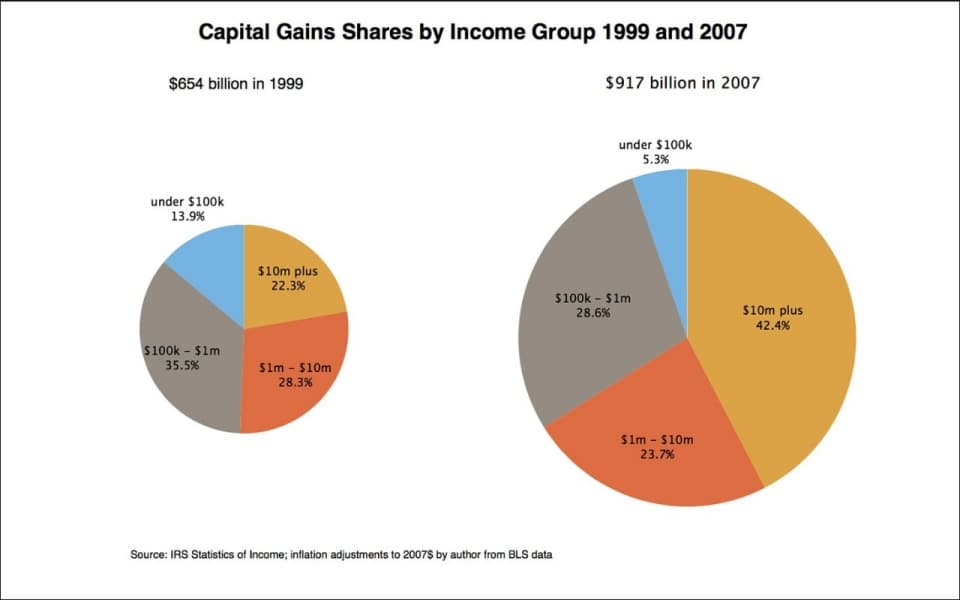

Still, says Johnston, it's almost impossible to cheat on your taxes if you earn your living in wages, because most taxes are deducted from your check before you are paid. On the other hand, people who own business and those who make most of their money from investment "self-report" their income, which creates many opportunities for mistakes and for cheating.

Johnson says there is a fundamental problem with our tax code — it's not structured for growth and job creation; it's structured to reward speculation and cash hoarding.

"What we have is a tax system designed for the industrial economy of the 20th century, and we need one for the 21st century, but no one in Washington is serious about that kind of major reform," he tells Here & Now.

Guest

- David Cay Johnston, investigative reporter who won a Pulitzer Prize while at The New York Times. He teaches business, tax and property law of the ancient world at the Syracuse University College of Law. He is the best-selling author of "Perfectly Legal", "Free Lunch" and "The Fine Print" and editor of the new anthology "Divided: The Perils of Our Growing Inequality." He tweets @DavidCayJ.

This segment aired on April 15, 2014.