Advertisement

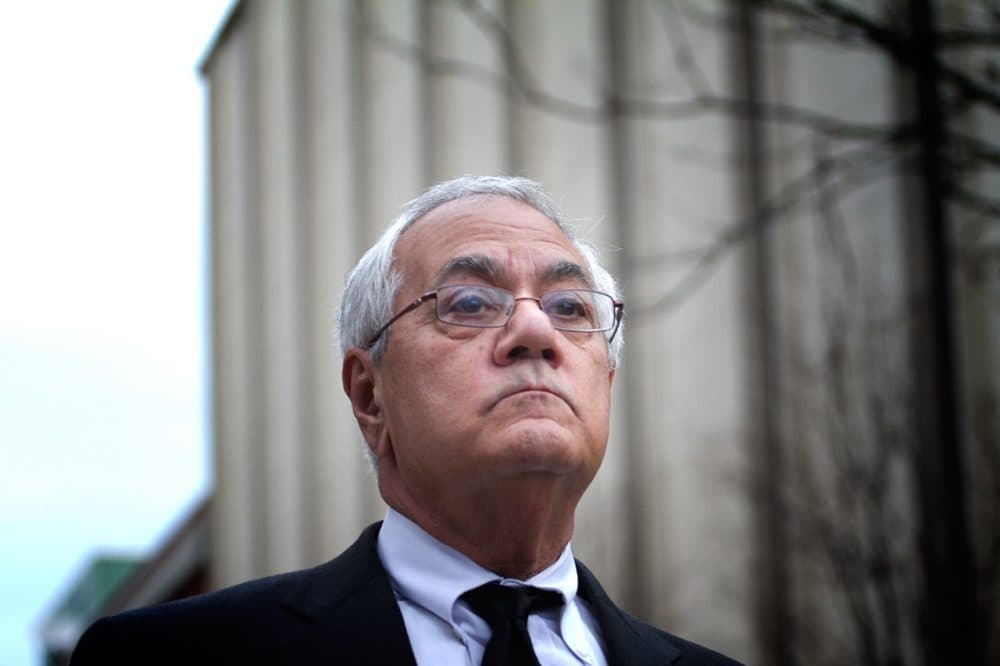

Former U.S. Rep. Barney Frank Responds As Trump Takes Aim At Dodd-Frank

President Trump's plan to rewrite major parts of the Dodd-Frank Act is drawing ire from one of the people who helped create the financial industry regulations: former Massachusetts U.S. Rep. Barney Frank.

Former President Obama signed Dodd-Frank into law as part of his administration's response to the 2008 financial crisis, aiming to increase oversight on banks and set up a Consumer Financial Protection Bureau.

Trump called Dodd-Frank a "disaster," claiming the regulations hurt those in the business community because they "can't borrow money" from the banks.

Frank spoke to WBUR's Morning Edition about the future of his landmark legislation under the Trump administration. Listen to the full interview at the top of this post.

Interview Highlights

On Frank's reading of President Trump's plans

"What he says doesn’t really compute. There’s one provision in the bill that would fix lending. It says no one should lend money to very low-income people with no assets to buy homes which then they would be defaulting on. The only provision we have is to stop these abusive subprime loans."

On his biggest concerns

"In terms of substance, the restrictions on derivatives is the most important, because that’s how we got in trouble. ... Those were the highly leveraged bets. Fortunately, I don’t think there’s anything he can do about that. Those are legislated and those are not going to be repealed, because you’re not going to get 60 votes in the Senate to do it.

"There is one thing that he can do probably with less than 60 votes in the Senate. Under the reconciliation vote, where you only need 51 votes in the Senate, they will probably sadly cut back on the financial autonomy of the Consumer Financial Protection Bureau, which I’m very proud to have helped create. We may lose that one.

"I don’t think he’s going to be able to repeal any of the substantive parts of the law. I don’t think he’s going to get people back in the business of making subprime loans by statute and I don’t think he’s going to be able to deregulate derivatives. But what he will do, and this is what I most fear, he will appoint people who won’t use the powers, who will be too lax in using some of their authority."

Advertisement

Frank's advice for Democrats going forward

"You can’t stop him from appointing people who won’t use their power. What they can do is use the public opinion. I think if people understand what he’s trying to do, they will rebel. They will tell Republican members of Congress 'don’t do that.'

"This notion that we need to be able to let businesses get loans is a sham. It’s a cover for trying to undo consumer protection and allow financial institutions to do irresponsible things. I think as that is understood, the support for Trump on this specific issue will erode."

This segment aired on February 7, 2017.