Advertisement

WBUR Poll: Ballot Questions On Sales Tax Rollback And 'Millionaire's Tax' Maintain High Support

Resume

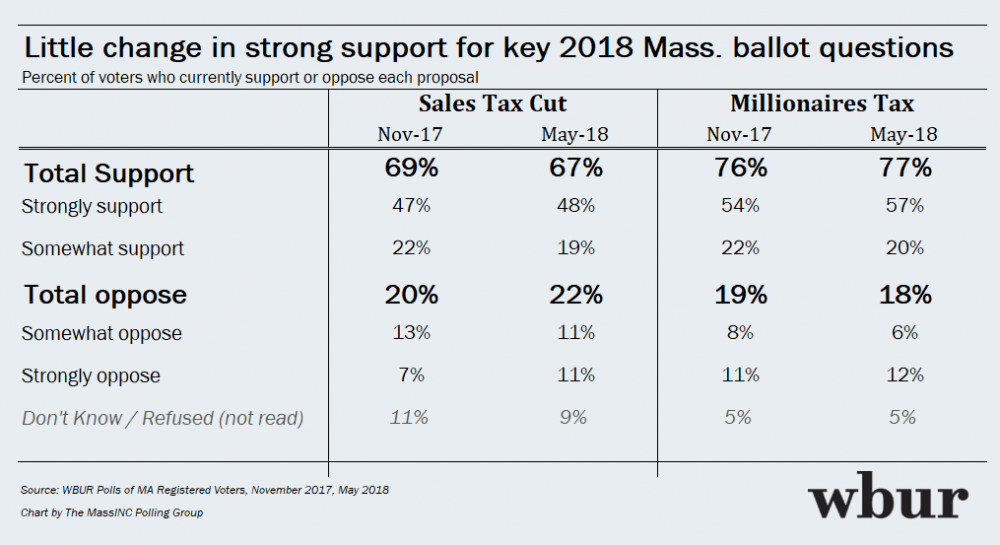

Support remains strong for two ballot questions that could be put to Massachusetts voters this fall, and each of them could drastically change the state's tax structure.

A new WBUR poll (topline, crosstabs) out Thursday finds voters would back the so-called "millionaire's tax," as well as a rollback of the state's sales tax.

The proposed millionaire's tax is a 4 percent surtax on individuals with income that exceeds $1 million. It's estimated to bring in about $2 billion earmarked for education and transportation. Of those surveyed in the latest WBUR poll, 77 percent said they are in favor of imposing that additional tax on such high-earners. Meanwhile, 18 percent of respondents said they oppose the tax.

Those poll numbers are about the same as when WBUR asked the question last fall.

"People recognize that we need investments in transportation and education in this state, and this is a fair and comprehensive way to do that," said Steve Crawford, a spokesman for Raise Up Massachusetts, the group backing the potential ballot referendum.

Another proposed referendum to roll back the state sales tax from 6.25 percent to 5 percent also has broad support. Sixty-seven percent support the cut, while 22 percent oppose it. The reduction could decrease state revenues by $1 billion.

Voters see the two questions as a chance to cut their own taxes, while at the same time letting someone else pay for it, according to MassINC Polling Group President Steve Koczela, who conducted the poll for WBUR.

"Everybody pays the sales tax, so this is a very broad-based tax cut, and therefore, I think has a lot of appeal, whereas the revenue that would cover it, would go in the other direction, would come from a small portion of the population," he said.

That is, revenue to cover a cut in the sales tax could come from the millionaire's tax. If the poll numbers hold up, and both questions pass in November, the budget ramifications may actually be a wash. While education and transportation would get more money via the tax on high-earners, those areas might get less via the sales tax.

Noah Berger, president of the Massachusetts Budget and Policy Center, said the debate on the sales tax right now focuses on tax cuts, and not on the budget implications.

"If you have a tax cut that costs over a billion dollars, that means that there's less money for local aid, for parks, for education, for health care," he said, "and that part of the debate really hasn't come up." Berger wants greater focus to be on how the proposed sales tax reduction may impact "local communities and services that people count on."

When it comes to the millionaire's tax, Eileen McAnneny, president and secretary of the Massachusetts Taxpayers Foundation, said she's concerned about volatility, as well as revenues drying up in economic downturns.

"So you build in a billion dollars more in education, and the money is there one year, and it's not the next," she said. "But the programs and all that are in place, and so it creates more challenges in the budget."

One uncertainty that could change everything is whether these questions are actually on ballot this fall.

Opponents of the millionaire's tax argued before the Supreme Judicial Court earlier this year that the question is unconstitutional, since it earmarks money for education and transportation. They said only the Legislature can determine how tax money is spent.

There are also discussions in the State House to reach a "grand bargain" on the sales tax and other potential ballot issues, including a minimum wage hike and paid family leave. With all that going on, House Ways and Means Chairman Jeff Sanchez said there are too many variables to know right now what it will all mean for the budget.

But, he said, the stakes are high.

"At the end of the day, the impacts are direct, and they are definite," Sanchez said. "So I hope that the work of all the folks that are engaged in the subject area, that are at the table, and the general citizenry, that we really think about this."

Negotiators are running out of time, however, if they want to handle this in the committee room and not the voting booth. The Legislature is currently tied up with finalizing the fiscal year 2019 budget. The lawmakers must finish their session by July 31.

Correction: Due to an editing error, an earlier version of this story said the state sales tax is currently 6.5 percent. It's 6.25 percent. We regret the error.

This article was originally published on May 31, 2018.

This segment aired on May 30, 2018.