Advertisement

Health Plan Charges Up To $1,000 More For 'High-Cost' Hospitals

Many of us go to the state’s most expensive hospitals without realizing it. Maybe it's where you've always gone, maybe it's peace of mind, maybe it's where you feel you'll get the best care. But you may soon — if not already — have to pay for that choice.

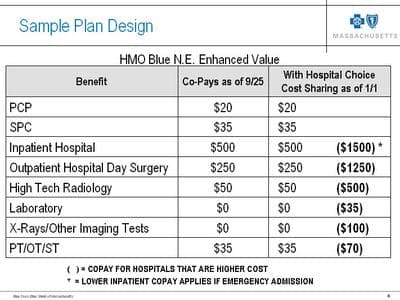

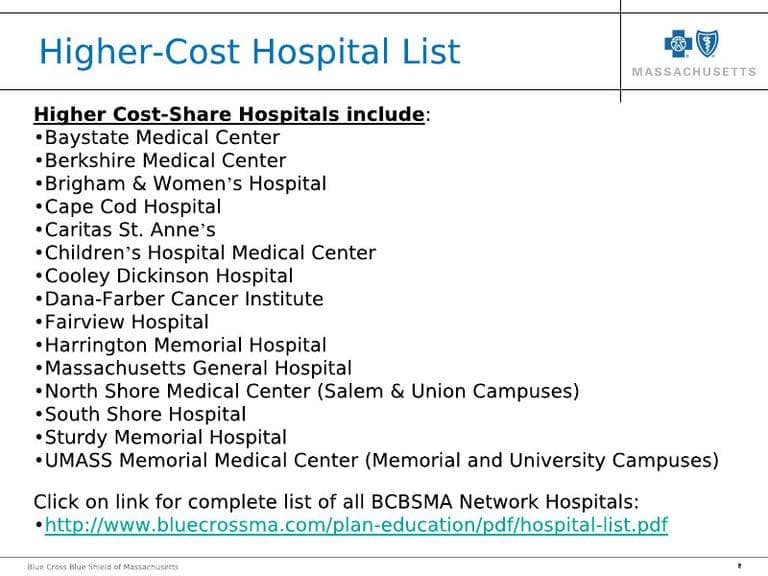

The state’s largest insurer, Blue Cross Blue Shield of Massachusetts, is out with a plan that charges members more — as much as $1,000 more — when they check-in or have tests at one of 15 hospitals Blue Cross calls "high-cost."

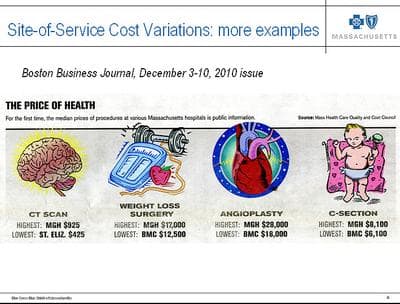

Would you pay $1,000 more to have an expected normal delivery at Brigham and Women's Hospital rather than at a hospital in your community? How about $450 more to have a MRI at one of the state’s most expensive hospitals? (You can answer on Facebook or Twitter, too.) We're asking because that, in a nutshell, is what this story is about. Will much higher co-pays persuade patients to spend less on health care by checking-in to or scheduling tests at cheaper, less-well-known hospitals? Many employers hope the answer is yes.

"The more that we can encourage employees to seek lower-cost alternatives that are equally good in quality, that will help address some of the cost issues that we face," said Rick Lord, president and CEO of the state’s largest employer group, Associated Industries of Massachusetts. He says Blue Cross must make sure patients know that many lower- and higher-cost hospitals have the same quality ratings.

But are business owners ready for angry comments from workers who may be referred to or schedule surgery at Mass General Hospital, for example, without realizing it will cost them $1,000 more?

Lord responds by saying, "Current increases in the cost of health insurance are not sustainable. These products don’t deny people access to those providers. What it does, though, is require them to pay a higher co-pay, so think twice about it before they choose a higher-cost hospital vs. a lower-cost one."

Blue Cross launched this plan, called "Hospital Choice Cost Share," for companies with 50 or fewer workers. The insurer says employers who sign on are saving roughly 5.5 percent. That means employers facing a $1,500 increase on a family plan would instead pay $675 more. A vice president of sales at Blue Cross, Larry Croes, says usually, when Blue Cross offers a new type of health insurance, just 1 to 2 percent of businesses try it the first year. But this high co-pay option plan is taking off.

Advertisement

"We’re seeing in the mid-20s adoption rates, right out of the bat," Croes said. "Yeah, wow, it’s been a very good reception."

Croes acknowledges the plan will not sell well in the Berkshires or on Cape Cod, where the main hospitals are on the high-cost list. In Boston, Blue Cross picked the top four high-cost hospitals: While Beth Israel Deaconess has some high charges for tests and procedures, it is not on the high-cost list. Two Partners hospitals, Mass General and Brigham and Women's are on the list. Partners Network President Tom Lee says this designation is not fair or reasonable.

"If our rates are higher it’s not because our doctors, or are making more money than other people, it’s because we are using those funds to do other things which I think, by and large, society wants us to do," Lee argued.

Lee says when Partners makes money, on high-end tests for instance, it uses the profit to keep services that lose money afloat, such as mental health, pediatrics and a burn unit. So if Partners' business on the moneymaking services drops, what happens to those money-losing services?

"We’re not like trying to hold a gun to the baby’s head, you know we would never do that," Lee said. "But, can you invest in certain programs that aren’t going to make money if your margins in other areas that do make money are being taken away? Of course not, you have to limit those investments."

Blue Cross is not the only insurer putting pressure on Partners and the other high-cost hospitals to cut costs. The state’s Group Insurance Commission offers insurance that also charges higher — although less dramatic — co-pays for admission to higher-cost hospitals.

Of course there are political dimensions here. Blue Cross spokesman Jay McQuaide says this high co-pay insurance plan is proof that insurers are taking steps without government intervention to control health care costs.

"The private market isn’t just sitting around letting increases go up at double-digits year after year," McQuaide said. "With this product and others we’re really offering employers a way to get to a more affordable and sustainable position."

Blue Cross plans to sell this high co-pay product to all employers, not just businesses with 50 or fewer workers, later this year.

This program aired on February 10, 2011.