Advertisement

As Health Insurance Premiums Rise Slowly, Patients Urged To Shop Around

ResumeEmployers across the state sit down this month for an annual meeting that many dread. It’s a briefing on how much their health insurance premiums will increase come January. WBUR's Bob Oakes spoke with reporter Martha Bebinger about what employers can expect.

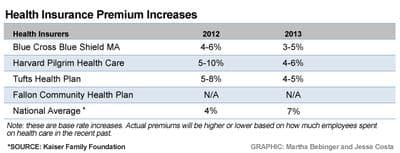

Bob Oakes: The bad news is that premiums, on average, are still rising. But the good news is that many businesses will see about the same increase or slightly lower increases than last year. What’s the range?

Martha Bebinger: Last year, premiums rose 4-10 percent. This year, the increase is expected to be slightly lower, 3-6 percent. Keep in mind that these are so-called base rates. The actual rate for your company could be higher or lower, depending on the age of the employees, how much care they use and a few other factors.

But what about this new state law that says health care costs aren’t supposed to rise any faster than growth in the state’s economy overall? With these premium increases, health care is still growing faster than most other costs. What happens?

Nothing right away. The state will eventually require hospitals, physician groups, insurers and others who deliver health care to submit plans for bringing their costs down if they exceed the state health care spending targets. But that won’t start until 2015 or 2016.

So premiums for most of us are expected to rise 3-6 percent, more or less depending on our health and the health of our colleagues. Why will we see slightly lower increases? Is Mass. figuring out how to get a handle on health care costs?

It's not clear, Bob. There are a number of things happening to slow the rise in health care premiums. Hospitals and doctors are agreeing to lower increases in the contracts they sign with insurers. And patients are seeking less care. This could be the ongoing effects of the recession, and patients putting off elective knee surgery, for example. It could also be that more and more of us have health insurance that doesn’t cover all the costs of a test or treatment. Some patients with a high deductible or higher co-pays are putting off or just not going to the doctor or hospital to avoid those costs.

More employers are buying coverage with high deductibles or other types of insurance to save money. What kind of changes should patients be ready for?

High-deductible plans are a common way that employers save money. These plans are cheaper because they shift some of the cost to the patient. Employers can save even more money by cutting expensive hospitals out of their coverage. This is what's known as a limited network plan. And the fastest-selling product for a few insurers is what's known as tiered coverage. With tiered health plans, patients can go wherever they want, but they might pay $2,000 or more to deliver a baby at Brigham and Women’s Hospital, for instance, and nothing at, say, Melrose Hospital.

Brian Pagliaro, senior vice president for sales at Tufts Health Plan, said "our objective is to steer patients to the highest quality, most cost efficient providers in the network."

So insurers want patients to think more like consumers or shoppers when they need health care. This is a big and complicated change that most of us hear about from our employers. Are employers keeping up with all these changes?

They're trying. I sat in on a forum earlier this summer run by Associated Industries of Massachusetts (AIM), the state’s largest employer group. There were three employers on a panel and they had all switched to these tiered plans. Bill Grant is the CFO at Cummings Properties, a major commercial real estate firm in Woburn. Grant likes tiered plans because employees can still go wherever they want, but they have to think about the cost of that choice.

With Cummings' plan, "the Boston teaching hospitals tend to be tier three, and you will pay for the first $2,000," Grant explained. "Conversely, if you seek a tier one hospital, you will have no deductible. The person has the ability to decide what they want and hopefully be a little more educated."

Cummings has had a wellness program for years that encourages employees to have a yearly checkup and other tests. But the program was not doing much to help Cummings save money. The company shaved 3 percent off its premium increase by switching to tiered coverage.

Not all Boston teaching hospitals are in the most expensive tier one category and not all hospitals outside Boston are tier three. And, a hospital might be tier one under one insurance plan and tier three under another; there's no standard rating. So patients really have to do their homework with these insurance plans, and that's part of the goal, says Sandy Reynolds with AIM.

"We do like the tiered concept because, as Bill just described, employees still have complete freedom of choice as to where they go, but there are consequences," Reynolds said. "It starts to have the purchase of health care work the same way it works when we purchase other things, almost everything else in our lives."

Which has not been the case for health care. If you have insurance, for the most part, you go where you want, and you don't have to pay attention to the price of your care. So are employees ready to shop for care? In a word, no.

Howard Grant, the CEO at Lahey Health System in Burlington, says he had many disgruntled employees during the company's first year with tiered coverage. Grant says he reminded employees who complained about tiered coverage that Lahey wasn’t cutting their choices, just asking them to pay more to use a more expensive hospital.

"But we also reminded our employees that we were spending $66 million a year on health insurance, increasing at 10-15 percent clips every a year," Grant said. "Our ability to sustain fair compensation for our workforce, and our ability to continue to support a very generous pension plan and all the other benefits were in large part dependent on our ability to control what was the only component of our cost structure that we hadn’t been able to manage, historically, very well."

"Sound familiar?" Sandy Reynolds asked as she looked across the audience. Many employers nod. Reynolds cautions employers that they will need to spend a lot of time explaining to their employees how these plans work. Cummings started explaining the change a year before switching to tiered coverage.

Tiered plans are triggering some big changes in companies that have made the switch. Eleven percent of Cummings workers moved to a new primary care doctor to avoid a higher co-pay. At Lahey, well over half of the employees switched doctors, in many cases to a doctor at Lahey, which happens to be in the low-cost, high quality tier one category. Not surprisingly, Howard Grant is pleased.

"We’ve only got six months of data so far, but we’ve seen big reductions in expense," Grant said. "Because [employees] flipped to providers that had the best qualitative track record and the best cost track record. So we're seeing the value already in a short period of time."

Lahey expects a 4 percent premium increase next year by continuing the tiered coverage. That’s much better than past years, but not good enough for many employers, including Peter Sullivan. Sullivan, who runs a small real estate firm, says his annual health insurance increases have become unbearable.

"I need the cost of insurance to go down by 20 percent," Sullivan told the panel at this AIM forum. "I wonder if you could focus some of the discussion on how to cut the cost of insurance."

"What can someone really do, Jim?" Sandy Reynolds asked Tufts Health Plan CEO Jim Roosevelt.

Roosevelt says one way employers and employees can really reduce costs is by agreeing to limit their care to community hospitals — as with a plan that Tufts administers for Steward Health Care.

"But, to my mind, that’s a radical choice," Roosevelt said. "If you want a dramatic change, like 20 percent in your premium, you have to make a dramatic change in your health plan."

Which we’ll likely see more employers doing as the state and the nation try to bring health care spending down to a manageable level.

Are you trying to figure out how a tiered or limited network plan works? Tell us your story here. We'll air some of your comments during All Things Considered on Wednesday.

This program aired on September 12, 2012.