Advertisement

Low Interest Rates Abound, But Few Refinance

The average fixed interest rate for a 30-year mortgage has fallen below 4 percent for the first time ever.

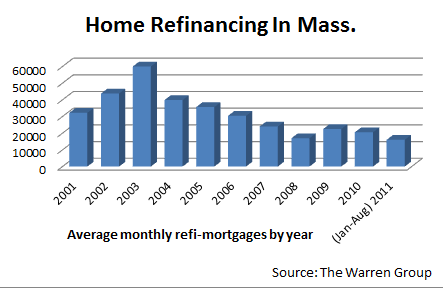

Even so, the historic rock-bottom rate is not translating into high numbers of home loans. In fact, the number of refinanced mortgages in Massachusetts is on pace for its lowest level in at least 10 years.

Steve Kelly lives in a three-bedroom, two-bathroom split-level house in Billerica, with his wife and two daughters.

Kelly says that like many people, his household finances have gotten tighter over the last few years. So his family has been looking over their budget for places to cut back.

Where they were able to cut was their mortgage payment. Last month, they refinanced to a variable-rate loan starting out at just over 3 percent and saved more than $150 a month. The refinance is helping them meet those monthly day care bills.

With such low rates, and with such tight budgets nowadays, you’d think there’d be a run on refinances. But the real estate tracking firm The Warren Group says refinanced mortgages are on track to be at their lowest number in more than a decade. Loan broker Amy Slotnick with Fairway Independent Mortgage in Needham says there are several reasons why she’s not saying yes to more refinancing.

"You have to say no to people if they have credit scores below, generally, 640," Slotnick says. "You have to say no to people if they don’t have sufficient income."

Unfortunately, that often means the 7 percent unemployed in Massachusetts, Slotnick says.

Many homes that were bought during the housing boom are now underwater, or have very little equity. That’s the case with Elana Houde. She’d like to refinance her house in Saugus.

Advertisement

"I try not to think about it too much, because we’re just not eligible," Houde says.

Houde lives with her husband, two cats, and Mackie, a greyhound they adopted after the racetracks closed. The interest rate on their home is 5.25 percent. Still, they’d be able to save a few hundred dollars a month if they could refinance to today’s rates. But Houde and her husband don’t have much equity. That means banks are unwilling to take on the risk of refinancing.

"We get by now. And we’re both working," Houde says. "I’d just love to be able to save more."

The painful reality is that the very people who could use the savings the most — people out of work, people whose homes are underwater — are the very people for whom today’s record-low interest rates may out of reach.

Cory Hopkins from The Warren Group says there’s another reason refinancing activity is down. Interest rates have been relatively low for the last three years. Hopkins says many of those who can refinance already have.

"Unless rates can fall even further, people aren’t going to go through the hassle, the closing costs, that sort of thing, to refinance again if they already did that six months ago," Hopkins says.

Mortgage broker Amy Slotnick concedes that the paperwork is thicker and refinancing more difficult now. Even so, she says:

"There are a lot of people who are eligible. I think that people are afraid that they’re not. And so they’re not picking up that phone to make that phone call."

Slotnick wishes more people would look into it to find out if they can benefit from today’s record low interest rates.

This program aired on October 11, 2011.