Advertisement

Mass. Becomes First State To Require Price Tags For Health Care

Massachusetts has launched a new era of shopping. It began last week. Did you notice?

Right this minute, if you have private health insurance, you can go to your health insurer's website and find the price of everything from an office visit to an MRI to a Cesarean section. For the first time, health care prices are public.

It's a seismic event. Ten years ago, I filed Freedom of Information Act requests to get cost information — nothing. Occasionally over the years, I'd receive manila envelopes with no return address, or secure .zip files with pricing spreadsheets from one hospital or another.

Then two years ago Massachusetts passed a law that pushed health insurers and hospitals to start making this once-vigorously guarded information more public. Now as of Oct. 1, Massachusetts is the first state to require that insurers offer real-time prices.

"This is a very big deal," said Undersecretary for Consumer Affairs and Business Regulation Barbara Anthony. "Let the light shine in on health care prices."

There are caveats.

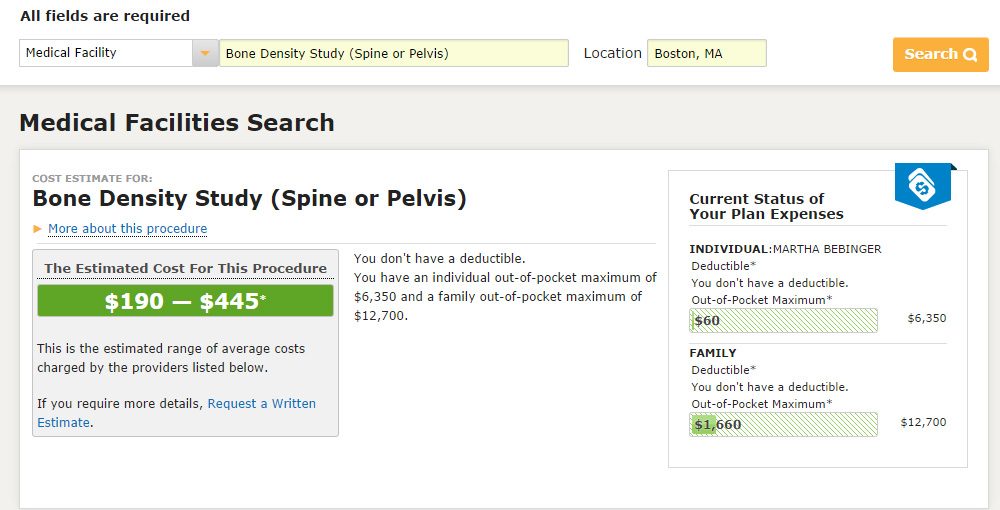

1.) Prices are not standard, they vary from one insurer to the next. I shopped for a bone density test. The low price was $16 at Tufts Health Plan, $87 on the Harvard-Pilgrim Health Care site and $190 at Blue Cross Blue Shield of Massachusetts. Why? Insurers negotiate their own rates with physicians and hospitals. And some of the prices include all charges related to your test, others don't (see No. 2).

2.) Posted prices may or may not include all charges, for example the cost of reading a test or a facility fee. Each insurer is defining "price" as they see fit. Read the fine print.

3.) Prices seem to change frequently. The first time I shopped for a bone density test at Blue Cross, the low price was $120. Five days later it had gone up to $190.

4.) There is no standard list of priced tests and procedures. I found the price of an MRI for the upper back through Harvard Pilgrim's Now iKnow tool. That test is "not found" through the Blue Cross "Find a Doc" tool.

Advertisement

5.) The quality information is weak. Most of what you'll see are patient satisfaction scores. There is little hard data about where you'll get better care. This is not necessarily the insurer's fault, for many tests the data doesn't exist.

6.) There are very few prices for inpatient care, for surgery or an illness that would keep you in the hospital overnight. Most of the prices you'll find are for outpatient care.

These tools are not perfect, but Tufts Health Plan Director of Commercial Product Strategy Athelstan Bellerand said "they are a major step in the right direction." Bellerand added: "They will help patients become more informed consumers of health care."

Patients do finally have a sense of how much a test or procedure will cost in advance. They can see that some doctors and hospitals are a lot more expensive than others. For me, a bone density test would cost $190 at Harvard Vanguard and $445 at Brigham and Women's Hospital.

The most frequent early users are probably providers. Anthony says some of the more expensive physicians and hospitals react with, "I don’t want to be the highest priced provider on your website. I thought I was lower than my competitors."

Anthony is hoping that response to this will generate more competition and drive down prices.

"I’m just talking about sensible rational pricing, which health prices are anything but," she added.

Take, for example, the cost of an upper back MRI.

"The range here is $614 to $1,800, so three times," said Sue Amsel, searching "Now I Know," the tool she manages at Harvard Pilgrim. "That to me is a very big range," Amsel said.

In this case, the most expensive MRI is at Boston Children’s Hospital and the lowest cost option is at New England Baptist, with no apparent difference in quality.

"It’s not just for choosing. It’s primarily for getting you the information, about whatever you’re having done, so you can plan for it," she said.

Most of us don’t have to plan for anything except our co-pay. But about 15 percent of commercial insurance plans have high deductible plans, where patients pay the full cost of an office visit or test up to the amount of their deductible, and that number is growing.

"As more and more members are faced with greater and greater cost share, this sort of information is really important," said Bill Gerlach, director of member decision support at Blue Cross.

To use these tools, you’ll log in on your insurer’s website. If you have a high deductible, the online calculator shows how much you’ve spent so far this year toward your deductible. If your coverage does not include a deductible, the tool will calculate the balance towards your out of pocket maximum.

All these numbers are confusing. Most of us haven't thought about shopping for health care or paid attention to how much we spend. The state and most of the insurers are rolling out education campaigns to help us wrestle with the previously hidden world of health care prices.

One last tip: Look for the Blue Cross cost calculator under "Find a Doctor." It's not as easy to find as Tufts' "Empower Me" page or Harvard Pilgrim's "Now iKnow."

Both Tufts and Harvard Pilgrim used Castlight Health to build and now run their shopping tools while Blue Cross contracted with Vitals.

Aetna was the first insurer in Massachusetts to offer cost and quality comparisons through its Member Payment Estimator. It's not clear if all insurers doing business in the Bay State met the Oct. 1 deadline, but all of the major players did. There is no penalty for those who failed to do so.

We have a challenge for anyone who is ready to shop. Find the biggest gap between the high and low price for a test, treatment of procedure. You can measure the percentage gap or the total difference in price. Happy shopping!