Advertisement

Pension costs could make the MBTA ‘insolvent’ by 2038, document shows

Officials at the Massachusetts Bay Transportation Authority have long wanted to raise the retirement age for workers from 55 to 65, to shore up the transit system's ailing pension fund. But they recently decided not to do that — both because the union fought the measure and because the T is in recruiting mode, desperate to hire 2,800 workers to meet current staffing needs.

It’s a decision that came at a price. In an arbitration document obtained by WBUR, the T's financial chief, Mary Ann O'Hara, said that on the current trajectory, expenses for the $1.6 billion pension fund could “cause the MBTA to be insolvent” by 2038.

The document details an arbitrator's findings last year on the T's pension agreement. In it, the fund's actuary projected that pension costs would likely exceed $220 million annually by 2038, eating up 32% of the T’s operating revenue. That compares with 14% of operating revenue in 2018.

The Boston Carmen's Union, which represents more than 6,000 T employees, appears to be counting on new workers to help stabilize the pension fund with their contributions.

"We are glad to see that the new administration and new general manager want to accelerate the hiring of frontline workers, and we are confident that the related impact on the retirement plans will be a positive one," said James Evers, Carmen's Local 589 president, in a written statement.

As of last August, there were 5,301 active union members contributing to the pension fund. But there were 6,553 retired members and beneficiaries drawing benefits. That means far more money flowing out of the fund than streaming in. Meeting minutes of the pension board show the fund pays out $5 million to $6 million more per month than it takes in.

The arbitration document revealed that the T’s pension fund went from being 94% funded in 2006 to 53.6% in 2021. The report noted that was much worse than funding levels for pension plans at other major transit authorities that same year: The Washington Metropolitan Area Transit Authority was funded at nearly 82%. The New York City transit plan was at about 74%. And the smaller MBTA Police pension plan is funded at nearly 85%.

The T contributes tens of millions of dollars each year to the pension fund, and employees are required to contribute 9.3% of their pay. Over time, the T's contribution has surged, but so has the number of retirees drawing pensions. And the fund has not been growing fast enough to accommodate its growing obligations.

Advertisement

T employees are able to draw retirement checks for far longer than they work. Those hired before December 2012 can retire at any age after working 23 years. Employees hired after 2012 can collect full retirement beginning at age 55, after working 25 years.

Boston University finance professor Mark Williams said having the T pension plan funded at a little over 50% is “not sustainable.” He said union members and the T contributing less than what's needed to support benefits is only part of the problem.

The fund's investment returns also have not kept up enough to cover the growing liability, Williams said. “So what you're seeing is this large pension gap right now,” or an unfunded liability of about $1.4 billion.

This looming cost burden only adds to the overall concerns about the T's long-term financial viability. Ridership across the system is at about 61% of pre-pandemic levels and the authority has been relying on federal relief funds to fill the gap. Once those funds are depleted, depending on the arcs of revenues and costs, the authority has said it could face a budget gap of between $321 million and $501 million by fiscal year 2027.

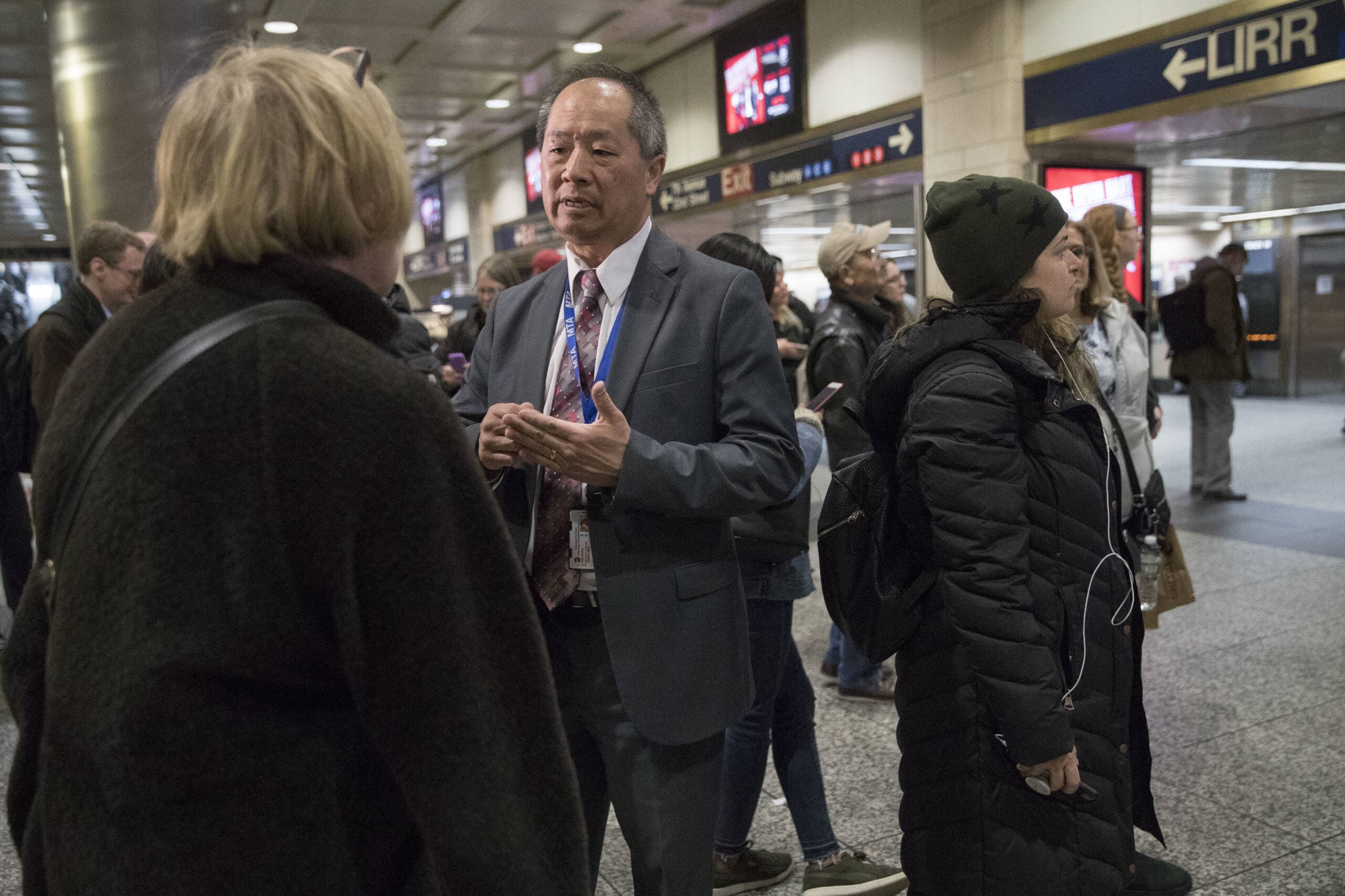

The T’s new general manager, Phillip Eng, is charged with getting the system's lingering repairs completed and improving service. He has said hiring is one of his top priorities. On his first day on the job, Eng told reporters he encourages people to apply to the T: “We want people to know it's a fantastic career,” he said.

The T is offering signing bonuses of up to $7,500 for new hires. It’s looking for bus and subway operators, rail repairers and track laborers, among other positions, as the transit system works to boost ridership and revenue. It also began a mobile hiring fair campaign this month, taking a branded bus with human resources personnel to different communities to encourage people to apply.

Williams, the professor, doubts that hiring more people will solve the pension’s dire financial problems. He said the way to close the gap is “by reducing the amount of excessive benefits and then increasing how much people pay to support the benefits.”

Adding workers will increase contributions, but it also will increase the pension fund’s long-term liabilities. According to the arbitrator's report, T management said the fund’s assumed rate of return on investments was too high at 7.5%. The retirement board lowered that projection to 7.25% by the end of 2021, but it has historically been higher than other public pensions. The much-larger Massachusetts state pension fund uses a 7% benchmark.

In the view of T management, overly optimistic assumptions about the fund's investment returns mean "the cost to be borne by the MBTA and its employees are likely to get even worse than what is projected,” the document said.

And taxpayers and T riders will likely have to make up for any shortfall.

In the arbitration, the union countered that future pension funding will depend on several factors, including ridership, service and staffing levels, government subsidies and investment returns. According to the union position stated in the document: “There is no purpose served by speculating on these developments over the next 20 years.”