Advertisement

Health Care Spending Is Down, Why Aren't Our Premiums?

Happy New Year and welcome, most of you, to another year of sometimes-painful health insurance premium increases.

Does this have to happen again?

I ask because health care spending is down — or is at least not rising as fast as our premiums. We have proof for 2012 in two recent reports.

In 2012, total medical expenses increased just 2 percent in Massachusetts, according to the state Center for Health Information and Analysis (CHIA).

That same year, the average premium increase for large employers who don't self-insure was between 4 and 10 percent.

So should health insurers have compensated us last year, in 2013, or in our 2014 rates?

Ninety percent of premiums are based on medical expenses, CHIA Director Aron Boros says, "so if plans are seeing that their medical expenditures are growing at about 2 percent, you’d expect that to be roughly reflected in the premiums." If, he continues, "premiums are growing faster than that, then there are things at work that the plans should be able to explain."

Tufts Health Plan says premiums are set well in advance of when they actually take effect, are based on historical data, and anticipate costs but are still a challenge to predict.

Tufts collected too much money in 2012 and reimbursed members $33.4 million. Harvard Pilgrim sent back $13.5 million. Blue Cross Blue Shield did not issue a rebate for the second year in a row. Insurers are allowed to keep 10 percent of premiums. They only have to reimburse members if they have money left over after subtracting that 10 percent.

OK, reimbursements to members begin to explain the gap between what we spent and what we paid in 2012, but doesn't account for all of it.

And what if the gap is bigger than it looks?

Nancy Turnbull, an associate dean at the Harvard School of Public Health, says "we should be seeing health insurance premiums rise by less than total medical expenses". That's the 2 percent mentioned above.

Why? Because most employers are saving money by buying plans with higher co-pays and deductibles and the like. As we patients take on a bigger share of total medical expenses, then the share paid by premiums should shrink, right?

The gap between actual spending and premiums wasn't so great for all employers, says Eric Linzer, senior vice president for the Massachusetts Association of Health Plans.

He points out that the starting point for small businesses was between 2 and 4 percent in 2012, depending on the firm's renewal date. Fine, but few, if any, employers pay the starting or "base" rate. Many small businesses reported increases well above 10 percent in 2012. And keep in mind that small employers are a modest segment of the total insurance market.

Nationally, it looks like health care spending has hit a plateau and is not rising as fast as overall economic growth. I know insurers base premiums on multi-year cycles, looking at trends. So is four years of largely flat growth enough of a trend? Are patients starting to spend more money now on care? If insurers are seeing this, no one mentioned it.

Rick Lord, the CEO at Associated Industries of Massachusetts, says he's optimistic about the CHIA report "and would hope that in the next year or two that would be reflected in the premiums."

Lord says a practice hospitals have of inflating what they charge private insurers to make up for low government insurance reimbursement rates may be one reason that private insurance continues to go up more than actual expenses.

And Phil Edmundson, who runs the brokerage firm William Gallagher Associates, says "insurers will seek larger price increases when the economy is better, when they feel that corporations are less price sensitive." So that might also explain the gap in 2012.

Then finally, suggest employers, it may be that CHIA's numbers aren't completely accurate; this is a preliminary report.

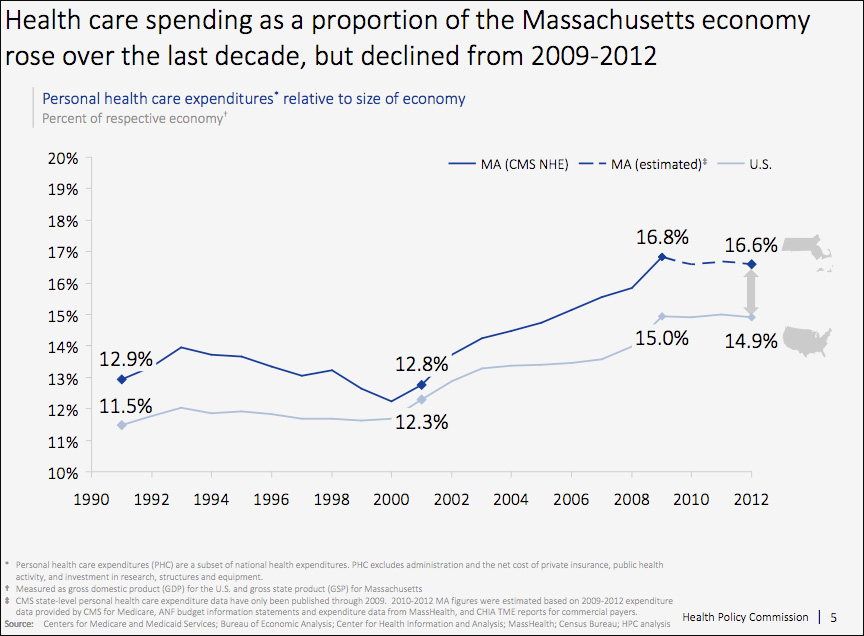

But there are other signs that the pace of health care spending is down. Take a look at this slide from the state's Health Policy Commission. It shows that personal health care expenditures grew slower than the state economy as a whole. These numbers would not translate directly to lower premiums because they include health spending outside of our medical expenses. Still, it makes me wonder, do we have health care spending under control and we just don't know it?

The state's health care cost control law requires all kinds of new reporting and reviews and analysis of how we spend money on medicine in Massachusetts. But its success will be measured in our premiums. Is the law going to save money for you, me, employers, towns and the state?

We have to make sure that all the claims of savings and efficiencies translate into lower cost but still good-quality health insurance.