Advertisement

What Medicare For All Might Mean For 4 Mass. Households

Resume

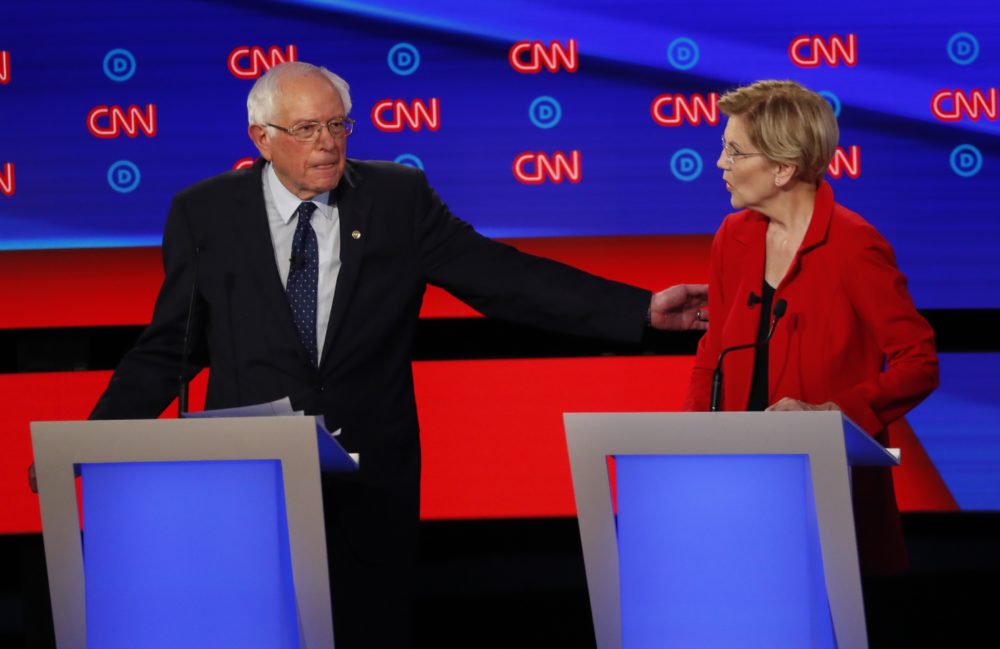

Maybe you've been hearing the Democratic presidential candidates argue about whether the country should drop private health insurance and move to Medicare for All. U.S. Sens. Bernie Sanders and Elizabeth Warren have endorsed that plan.

But there’s little information about what moving to a single-payer health care system might mean for you. Would it cost you more or less? Would you have to wait longer to see a doctor or nurse? Would the medications and treatments you want be covered?

Those questions are difficult to answer without a lot more details. But after consulting with economists and health policy experts, we decided to try answering the question about costs. With their input, we created a basic formula, and four individuals and families in Massachusetts agreed to help test it.

The formula compares each household's total health care spending now to what they might pay in taxes to finance Medicare for All. That's the basic trade-off. Health insurance premiums, co-pays and deductibles go away, as would cash outlays for those who are uninsured. Taxes would rise to fill in the gap.

We looked for individuals and families with widely different incomes to offer a broad range of potential experiences with Medicare for All, and found the four you'll meet below. They tallied a year's worth of health care spending — the total cost of their medical, dental and vision coverage, and everything they paid out of pocket for tests, office or ER visits, hospital stays and prescriptions.

We compared each household's total health spending to the taxes that might be used to fund a single-payer program. We used three possible tax rates, because there is a lot of disagreement about how much Medicare for All might cost. Each rate assumes employers would be charged a new payroll tax in lieu of their current health insurance premium contributions, and that personal income taxes would increase to replace individual or family insurance premiums.

(For more on the methodology, with comments from experts we consulted, go here.)

The results vary a lot based on each household’s income and health needs. But in short: Our two low- to moderate-income earners would save money under all three tax scenarios. Our two higher-income families would only save money at the lowest rate.

If you make your own calculations, think of the numbers solely as guidance, because there are many unknowns that might shift the results, such as:

- What would the tax rates be?

- Would some low- to moderate-income individuals and small employers be tax exempt?

- Would there be additional taxes, like a higher estate tax, that would affect some wealthy households?

- Would employers adjust wages in response to a payroll tax?

Here's one expert's cautionary note: John McDonough, a professor at the Harvard Chan School of Public Health, says our cost comparison can be a useful benchmark for those who want to compare health care expenses under Medicare for All.

"Then [people] can start to make some judgments, understanding that, if it ever were to occur, the end result would likely be strikingly different in one direction or another from what they see in this take," he said.

But rather than waiting until we can answer all of the unknowns, we're starting a discussion about possible Medicare for All financial trade-offs with some individual examples. So here are our four Massachusetts volunteers:

Cheryl Cumings

Cumings is blind and, she said, "thankfully in good health" this year.

But last year, the 52-year-old fractured several ribs. Cumings fell when she stepped into an elevator without realizing it had stopped a few feet below the threshold. She remembers being in a lot of pain, but able to climb out.

Cumings got a ride to the emergency room instead of calling an ambulance. "I had heard it could cost $900," she said. "I probably wasn't thinking clearly. I probably should have called."

Cumings is married but has an individual insurance plan she buys from the state's Health Connector. She makes between $25,000 and $50,000 and qualifies for subsidized coverage. Her plan does not have a deductible. Cumings' health care expenses — including the total cost of her health insurance, co-pays for 11 physician visits and dental coverage — came to $5,625 last year. The government paid $3,708 of that in insurance subsidies.

Cumings' total health expenses would almost certainly drop under Medicare for All. Based on her income, possible tax payments at the three rates -- 11.5%, 15% and 18% — would all be less than $5,625. But it's not clear if Cumings personally would save money because it's not clear if she'd continue to qualify for government assistance.

Cumings runs a small nonprofit after-school program for Boston schoolchildren who are blind or have limited vision. If she herself has to pay both the new payroll and income taxes, she would spend more than she does now. But if small employers are exempt, as Sen. Sanders has said they would be, or if subsidies continue for lower-income Americans, then Cumings might pay less.

"I realize that as a self-employed person, it could be beneficial or not to me personally," she said. "But I think as a society we should go through this process of understanding what it would mean for everyone to have access to medical services."

Bonny And Yuval Gilbert

Bonny and Yuval, both in their early 60s, live in Brookline. Bonny is a reverse mortgage specialist and volunteers her time on health care issues through the Greater Boston Interfaith Organization. Yuval is an IT consultant. Together they make more than $150,000 a year. The Gilberts have medical, dental and vision coverage through Bonny's employer, a family plan that includes the Gilberts' two younger children.

Among our four households, the Gilberts had the highest health care expenses: $33,330. That 2018 tally includes the total cost of their insurance plans and more than $12,000 in out-of-pocket payments.

It might be that one member of the family ends up in the hospital for an overnight stay before the Gilberts have met their $5,400 in-network or out-of-network deductibles. There might be an ER visit or two. The Gilberts pay cash for some mental health appointments because the therapist doesn't take insurance. There are dental bills and prescriptions. It all adds up.

The Gilberts cannot count on cost savings if the United States adopts Medicare for All. They and Bonny's employer would only be better off at the 11.5% combined payroll and income tax rate. The family and possibly Bonny's employer would spend more on health care at both the 15% and 18% rates.

Yuval says he can't imagine serious consideration of the higher tax rates.

"Those numbers are very high," he said, looking at the calculations. "It seems like people would have a hard time with this."

Bonny, who had been more optimistic about Medicare for All than her husband, says the numbers make her nervous.

"But you know what this all says to me? It says how ridiculously expensive our health care is in this country," she concluded. "That is my takeaway."

Liliana Jimenez

Jimenez, of Boston, has one chronic condition, endometriosis, which she treats with medication, but is otherwise healthy.

That's good because the 32-year-old dance studio manager and teacher says she is afraid to go to the doctor; every visit ends with a bill she can't afford. Her health plan, which Jimenez buys on her own, has a $2,500 deductible.

"I'm debating whether to have insurance next year," Jimenez said. "It would be scary to go without, but the money that went to health insurance this year would have covered a lot of other expenses."

In total, Jimenez spent $5,742 on health care in 2018. That includes her health plan, medications, office appointments and one visit to the dentist. She would almost certainly save money under a Medicare for All system with similar tax rates.

Jimenez makes between $25,000 and $50,000. At the lowest tax rate we used, 11.5%, her costs would be just over half of last year's total. At the high rate, 18%, they are still under the 2018 total.

Jimenez said she supported the idea of Medicare for All before she looked at what she might have to pay. Now, she's all for it.

"Just looking at those numbers, sure, why not?" she said. "I'm already spending that much out of my pocket and I don't get that much coverage."

Kate And Carlos Rodriquez

Kate and Carlos are both 28 and live in Boston. Kate is a biostatistician, and their family coverage through her employer has a $250 deductible. The husband and wife are active and healthy with no chronic medical conditions. They see a doctor for routine annual visits and when being "active" leads to injuries. Carlos, a mechanical engineer, flipped off his mountain bike in 2016 and broke his collarbone.

The Rodriguezes expect their health care expenses this year, assuming no accidents, will total $22,875. That includes their share of the insurance premium as well as Kate's employer's share, their dental and vision coverage, and $225 they've spent for office visits and prescriptions. (We are using the Rodriguezes' 2019 spending estimate, rather than last year's total, because they were in transition for several months before beginning work in Boston in October 2018.)

Under Medicare for All, the Rodriguezes would likely spend more on health care than they do now. Together, they earn more than $150,000 a year, and they would only be within range of their current total health care expenses under the lowest combined tax rate, 11.5%. At the highest rate, 18%, their total health care costs would amount to $13,000 more a year.

The Rodriquezes' reaction, in summary: fine.

"That to me is not a particularly scary number, especially coming from a public health background, knowing that when everyone is healthier it makes you individually healthier," Kate said. "And both of us are strong proponents of health care as a right."

And the way Carlos sees it, the 11.5% rate represents the couple's baseline health care expenses. This year, so far, has been a good year, with no serious events. He says the increase to our middle tax rate, 15%, is about the cost of one serious mountain bike accident, and 18% could represent a bad year of health.

"We've been very fortunate but there's nothing to say that our tide won't change in the future," he said. "Medicare for All is a way for us not to have to worry about the future."

Now Hold On: Some Limitations

These four examples are just a snapshot. Predictions about whether Americans would be better or worse off financially under Medicare for All vary dramatically.

UMass Amherst economics professor Gerald Friedman, whose work was cited by Sanders in 2016, estimates "that over 90% of people would be saving money [with Medicare for All]. But at the very upper end, people would be paying more."

Friedman assumes Medicare for All would reduce health care spending.

Jodi Liu, a Rand Corporation policy researcher, co-authored a report that estimates health care spending would rise with adoption of a national single-payer plan.

That would probably mean higher taxes to fund the plan, but Liu hasn't looked at the individual impact of higher health spending under Medicare for All. She says a lot depends on whether the wealthy pay a greater share of new taxes, for example, or whether tax increases are spread evenly across all incomes.

Americans who already have health insurance might see a less dramatic transition than those who are currently uninsured. But then, many Americans who have insurance don't realize how much their employers contribute to employee plans.

"When we're talking about the impact on households, it's important to recognize that people are starting at different places," Liu said.

This cost comparison doesn't touch questions that are more pressing for some, like:

- What prescriptions and treatments would be covered?

- Would wait times for appointments, tests or surgeries increase?

- Would some patients need supplemental insurance to get the best care?

Analyzing individual spending also doesn't take into account all of the Americans who work for health insurers and might lose their jobs if Medicare for All is adopted. And it doesn't acknowledge major payment cuts that more expensive hospitals -- like several in Boston -- would likely face.

MIT economics professor Jonathan Gruber says the details about Medicare for All raise questions about trade-offs and priorities. He argues that the U.S. could cover the uninsured, lower costs, and fix other flaws, all within the existing health system.

"So I think it's very important when we talk about single payer to break out, what it is that people want that single payer is going to deliver them," Gruber said.

Have a story idea, question or feedback? Email the politics team: politics@wbur.org.

This segment aired on October 17, 2019.