Advertisement

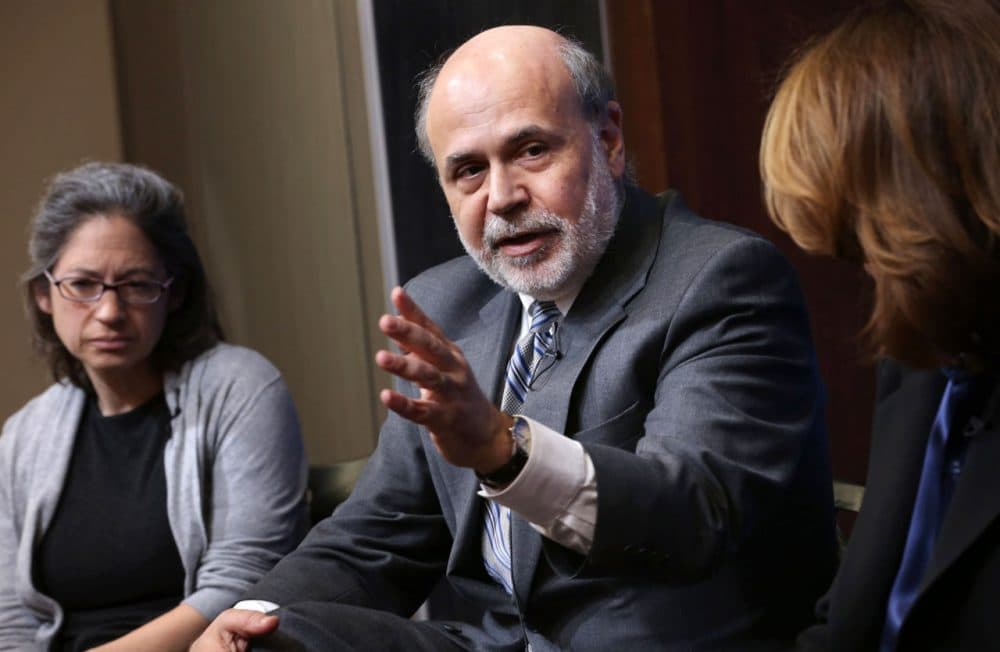

Former Fed Chair Ben Bernanke Measures The Global Economy

One week ago, Federal Reserve chair Janet Yellen announced the long-awaited short-term interest rate hike. It was the first time in seven years that rates were raised above the near-zero benchmark - a benchmark put in place as part of the Fed's plan to counteract the U.S. financial crisis.

Ben Bernanke oversaw the implementation of that plan and other major decisions as chairman of the Federal Reserve from 2006 to 2014. He speaks with Here & Now's Jeremy Hobson about how he sees the current state of the economy, its greatest challenges and what he expects in the year ahead.

Interview Highlights

On his work to stabilize the economy during the 2008 financial crisis

"The financial system is kind of like the nervous system of the economy - if it shuts down, everything shuts down."

"To some extent, the Fed was created to be innovative and to take actions that the Congress politically or for other reasons wouldn't want to take. We were sort of caught between a rock and a hard place because either we did these things that were need to stabilize the system, which were as I said very unpopular, or we let things collapse, in which case obviously the Fed would be blamed for that as well. We decided we were just going to do the right thing. There is a lot of political backlash, still, some of it I think is just ideological, but again the reason you have an independent central bank is so it will take the right actions and leave the politics to later."

On the state of the national economy

"I think the domestic economy is pretty solid. We've got households in good financial shape, jobs are being created, the housing sector is doing pretty well. There's a lot to be happy about in terms of the forward momentum of the U.S. economy. The main risk we face is that we're part of a global economy which is not doing quite so well, and it's a little bit of a race between the strength here at home and the drag from outside the borders."

On the role of the Federal Reserve to help the middle class

"The overall economy has been growing and has been recovering... but it's true that people in the middle are not getting the full benefit of that and that's a long term trend we've seen in this country for quite a while.... [but] it's not something the Fed can fix. The Fed basically can set interest rates, it can try to help the overall economy grow, but it has very little to do about the distribution of income or whether the jobs that are being created are good jobs or bad jobs that's a much longer term issue. There aren't simple solutions - otherwise, we would have fixed it by now but I think a range of things, from investing more in public and private capital to education and training to better immigration policy. A whole variety of things can help our economy grow more quickly and that, in turn, would help people in the middle of the distribution."

Guest

- Ben Bernanke, formal chairman of the Federal Reserve, distinguished fellow at the Brookings Institution, and advisor to investment firms Pimco and Citadel. He tweets @benbernanke.

This segment aired on December 23, 2015.