Advertisement

Thousands of Mass. homeowners face changes in flood insurance rates

Resume

Thousands of Massachusetts homeowners could see major changes to their flood insurance bills starting Friday.

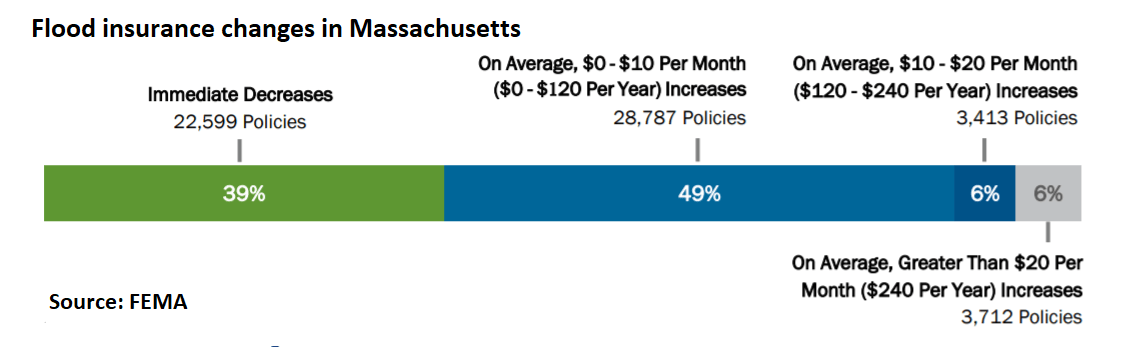

The Federal Emergency Management Agency, which is overhauling premiums for flood insurance nationwide, estimates most of the nearly 60,000 policyholders in Massachusetts will receive rate cuts or modest increases. But the agency estimates 12% will see a rate hike of more than $120 a year, including some who will face much greater increases.

The rate hikes could be particularly challenging for homeowners who are already struggling to pay their taxes and traditional homeowner’s insurance premiums, said Mark Abatuno, a real estate agent in Hull, a South Shore community where many residents have flood insurance.

"The flood insurance premiums, if they go up substantially, can impact the middle and lower class people who may live near the water have been in their homes for many, many years," Abatuno said.

Federal data shows a quarter of residents with flood insurance in Hull will see rate hikes of $120 this year. And that's just for the first year. FEMA can only increase rates up to 18% annually, so the government plans to stretch out the hikes for some homeowners over several years.

The rate adjustments mark some of the biggest changes in decades for the National Flood Insurance Program, which was established in 1968 to help homeowners in places where insurance was either unavailable or too expensive.

The government said it is using a new model, called Risk Rating 2.0, which will be more accurate.

Deanna Moran, of the Conservation Law Foundation, said many of the old rates were based on antiquated flood maps — sometimes 40 or 50 years ago. And climate change has increased the potential threat from flooding in many places.

Moran said the government’s new model will take a more realistic view of the risks to set insurance premiums, adding factors like the resilience of buildings and municipal infrastructure.

"Now they're going to be looking at flood frequency, claim history, whether or not you've experienced multiple types of floods," Moran said.

Some politicians in coastal areas have raised alarm about the potential rate increases. But critics say the rates were too low in many areas — encouraging development in flood-prone neighborhoods that never should have been developed in the first place.

"We've been subsidizing disasters for the past 50 years," Moran said. FEMA estimates it has spent $36 billion more on claims than it collected in premiums for flood insurance over the past five decades.

Joe Rossi, who leads the Massachusetts Coastal Coalition and an insurance wholesale business focused on flood coverage, said some people facing the biggest rate increases probably weren’t paying enough in the past to cover the risk of living near the water’s edge.

"You're actually seeing buildings that may not have been elevated as high as they should have been," Rossi said. "They're seeing some of the increases."

Rossi said the new model is more accurate and nuanced than the old one, and it will reduce premiums for many people who have been overpaying for years.

But, he said, the government’s challenge is to get that message out to policyholders.

This segment aired on October 1, 2021.