Advertisement

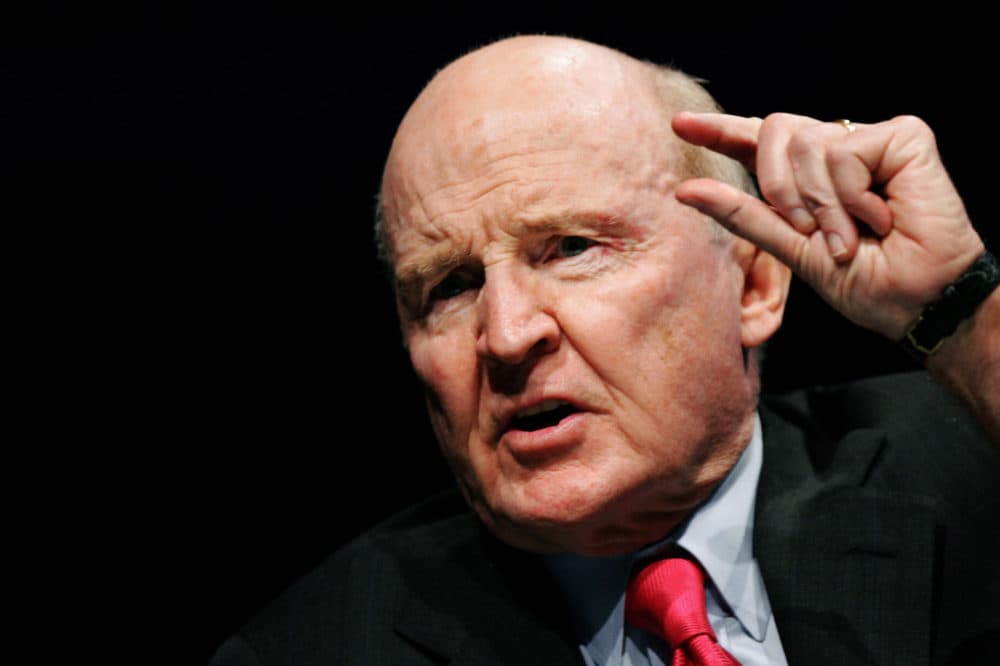

The Life And Legacy Of Jack Welch

He was dubbed “manager of the century" and took GE to historic highs. But did that focus on stock price distort American corporate culture for the worse?

Guests

John Byrne, chairman and editor-in-chief of C-Change Media, Inc. Former executive editor and editor-in-chief of BusinessWeek.com. Co-authored Jack Welch's memoir "Jack: Straight from the Gut." (@JohnAByrne)

Joe Nocera, Bloomberg opinion columnist covering business. (@opinion_joe)

Joe Bower, professor emeritus, Harvard Business School. (@HarvardHBS)

Interview Highlights

When you talk to students about Jack Welch and his impact on American business, how do you describe him?

Joe Bower: “We have been following GE since well before Jack. Which turns out to be an important part of the story, because what he was able to do had a lot to do with what his predecessors had done. What we say is that he really took very seriously the challenge of taking an American icon and helping it survive. People forget that the decade of the ‘80s was the decade in which American companies were falling by the wayside, under attack from Japanese and German competitors. And he turned GE into a formidable competitor. And it was really quite remarkable. I was just thinking, he came to this school often. And in 1985, he addressed the second-year class. And one of the students, during questions, asked him, 'Well, what did you do wrong?' And he said, ‘Well, I didn't move fast enough. I tried too hard to be nice, to take my time, to work with people. And the environment just won't let you do that.' He was famous for saying, ‘You gotta face reality.’”

He said he didn't move fast enough, and he'd been too nice? This from the man who was dubbed 'Neutron Jack' for letting 100,000 GE employees go?

Joe Bower: "Well, if you looked at what he inherited, he inherited a [layered] wedding cake organization. Layer upon layer upon layer. In the old days, the notion was there was a span of control, which was limited. And if you had more people than that, then you had a layer of organization that was simply — they were called 'span breakers.' And GE had layer after layer. And then Reg Jones [chairman and CEO of GE from 1972 to 1981] had introduced a very sophisticated strategic planning system, that was an overlay on top of that. And he didn't fire workers. He fired layer after layer of middle managers. I had some MBA's in class who had worked at GE. And all they could say was they'd died and gone to heaven. Because finally they could work with a business, and work with their leaders and they didn't have layers to go through.”

On Jack Welch and ‘shareholder value’

Joe Nocera: “Before Jack Welch became the CEO, GE used to think of itself as a proxy for the economy. And its mission, its goal, was just to do better than the economy. When Jack took over, he changed the mission to say, ‘The world's most valuable company.’ Well, how do you become the world's most valuable company? You get the stock price up. That's how you do it. And he may not have used the phrase ‘maximizing shareholder value.’ But he exemplified it. And he taught the rest of corporate America executives, to also strive for the same goal. Which, in addition to making the shareholders rich, made the CEOs very rich, because their compensation became completely tied to the price of the stock.”

On the long-term cultural impact of Jack Welch

John Byrne: "Jack was a highly controversial figure on so many dimensions, to be honest. However, if you were to say, 'Who is the single biggest proponent of quality in the years that Jack was in charge of GE, in the corporate world?' Other than the importance of quality, like a Deming [who helped develop sampling techniques used by the Department of the Census and Bureau of Labor Statistics], it would be Jack Welch. Jack Welch made Six Sigma quality metrics a religion within GE. Now, part of Six Sigma was driving out needless costs, not costs that would harm people or result in less safe product or services. But he was focused totally on quality, not necessarily squeezing every nickel and dime out of the business that would endanger people. That's just that's just, you know, a cheap shot, really."

Have the corrections of 2001 and 2008 been wake up calls for corporate leaders?

Joe Nocera: “No, they haven't been wake up calls, but more recently they're talking a better game. The Business Roundtable, you know, rewrote their mission statement to downplay shareholder value a little bit. Larry Fink at BlackRock, as always, writes his annual letter about how business must be more socially conscious and do more to help the world beyond maximizing shareholder value. The problem is, if you're a CEO or a board member, the great thing about shareholder value is it's easy to measure. It's easy to measure a CEO because you say, 'The stock price went up 15%. Or the stock price went down 50%.' If you're not, it's hard to figure out a different measure that works."

From The Reading List

Bloomberg: "Jack Welch Inflicted Great Damage on Corporate America" — "There are well-known people who are vilified during their careers only to seem heroic in retrospect. And then there are others who are lionized in their prime, and only later do we realize how harmful their actions truly were.

"So it is with Jack Welch, who died on Sunday at the age of 84. I know we’re not supposed to speak ill of the dead, but his effect on American capitalism was too profound — and too destructive — to go unmentioned.

"Before the 45-year-old Welch became General Electric Co.’s youngest chief executive officer ever in 1981, the company’s goal was to 'simply grow faster than the economy,' according to Fortune magazine’s Geoffrey Colvin, one of journalism’s leading Welch observers. In the decade before Welch took over, GE’s shares had declined 25% — yet its shareholders, who viewed the company’s dividend as their reward for owning the stock, were sanguine.

"Despite the stock’s poor performance, Reginald Jones, Welch’s predecessor, was still considered the most influential man in business. Even Wall Street didn’t make a fuss about the share price."

The New York Times: "First Chapter: 'Jack: Straight From the Gut'" — "It was the final hockey game of a lousy season. We had won the first three games in my senior year at Salem High School, beating Danvers, Revere, and Marblehead, but had then lost the next half dozen games, five of them by a single goal. So we badly wanted to win this last one at the Lynn Arena against our archrival Beverly High. As co-captain of the team, the Salem Witches, I had scored a couple of goals, and we were feeling pretty good about our chances.

"It was a good game, pushed into overtime at 2-2.

"But very quickly, the other team scored and we lost again, for the seventh time in a row. In a fit of frustration, I flung my hockey stick across the ice of the arena, skated after it, and headed back to the locker room. The team was already there, taking off their skates and uniforms. All of a sudden, the door opened and my Irish mother strode in.

"The place fell silent. Every eye was glued on this middle-aged woman in a floral-patterned dress as she walked across the floor, past the wooden benches where some of the guys were already changing. She went right for me, grabbing the top of my uniform."

The Wall Street Journal: "Jack Welch, Legendary CEO of General Electric, Dies at Age 84" — "Jack Welch led General Electric Co. through two decades of unparalleled growth and transformation, with a brash style that single-handedly remade the conglomerate and changed the landscape of American corporations. He died Sunday at age 84.

"Mr. Welch’s success, driven by a hard-nosed strategy to slash less profitable businesses and unproductive employees, made him an international celebrity in the 1980s and drove GE to become the most valuable U.S. company during the 1990s. He groomed a generation of business leaders who went on to run giants such as Boeing Co. and Home Depot Inc.

"His retirement in 2001 brought bestselling books and more adoration, but GE’s troubles in the decades after his exit—under his handpicked successor, Jeff Immelt—raised questions about Mr. Welch’s management methods and whether he pushed the conglomerate too hard.

“'Today is a sad day for the entire GE family. Jack was larger than life and the heart of GE for half a century. He reshaped the face of our company and the business world,' GE CEO Larry Culp said in a statement. 'We’ll continue to honor his legacy by doing exactly what Jack would want us to do: win.'"

This program aired on March 5, 2020.