Advertisement

The Truth Behind The Ryan Budget

As we head into the final weeks of the presidential election, the Romney campaign’s hopes remain fixed on the economy. Specifically, Romney is trusting that enough of the two-thirds of Americans who tell pollsters we're heading in the “wrong direction” can be persuaded to vote against Barack Obama and overturn the president's current lead in the polls.

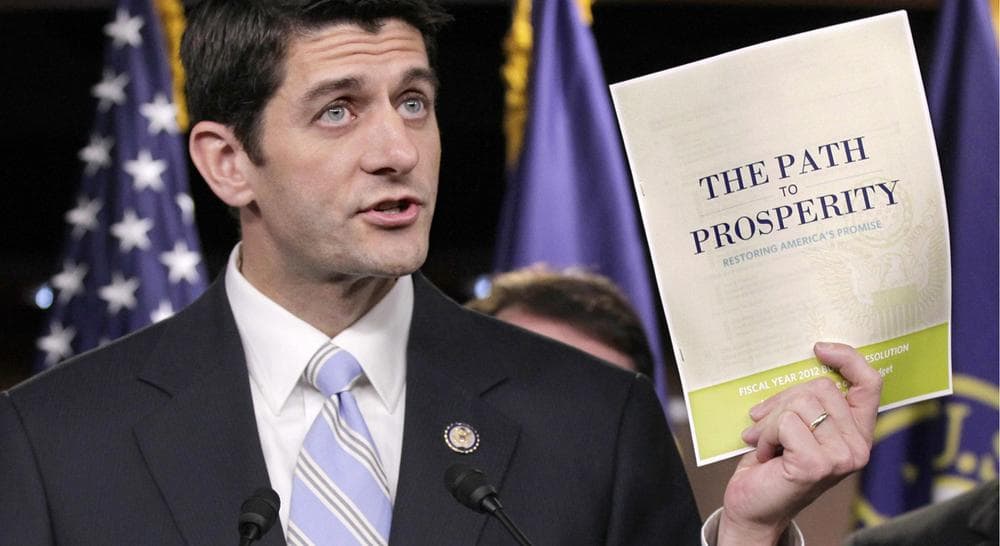

The concept of "wrong-track" is vague, of course. Does it mean unemployment? Deficits? Taxes? Whatever it is, Romney’s running mate, Paul Ryan, was selected largely because of his reputation as the man with a clear, radical solution to fix this wrong-trackness. Congressman Ryan's "Path to Prosperity" budget, combined with his homespun Midwestern manner, are designed to appeal to Americans who have recession-proofed their own finances through a mix of belt-tightening, paying down debt and generally sacrificing what they simply want in favor of what they need. The implication is that the Ryan budget can solve the country’s budget problems and put us back on track by taking a similar approach.

The trouble is that when you look at the specifics of the Ryan budget it does not do any of these things.

To begin with, the plan is based on a flawed assumption: that our national budget crisis arises from too much spending. This idea resonates with many in the Republican base. But debt is actually the result of interplay between revenues coming in, spending going out and the interest paid on past borrowings. The U.S. national debt has grown to $16 trillion because of a steep reduction in tax revenues: the 2008 recession, coming on top of President George W. Bush’s unfunded tax cuts, combined with spending on unfunded wars in Iraq and Afghanistan and the unfunded Medicare Part D prescription drug benefit. Moreover, spending is not just about federal outlays for defense, entitlements and other programs. It also includes “tax expenditures” – deductions for mortgage interest, college savings plans, charitable giving and thousands more – which effectively reduce the amount of revenues collected by the Treasury. Congress’s susceptibility to well-oiled lobbying campaigns has resulted in an incredibly complex tax code that benefits only a handful of special interest groups and wealthy taxpayers, but which shrinks the amount of revenues flowing into the U.S. Treasury.

Despite its radicalism and structural flaws, the Ryan plan enjoys considerable support.

The Ryan budget would start by reducing revenues even further. His budget proposes even more tax cuts, including a big reduction in the top rate of the federal income tax rate - from 35 to 25 percent. It then tries to plug the even-bigger fiscal hole by reducing tax expenditures and cutting a series of federal programs. The promised reductions in tax expenditures – amounting to $1 trillion – are deliberately hazy. But such a big number would require major tax reforms - such as eliminating the mortgage interest deduction or the employer health care tax deduction.

The plan calls for other draconian changes, including gradually turning Medicare into a private voucher system; handing Medicaid over to the states as block grants (despite the fact that states are grappling with the deepest budget shortfalls since World War II) and cutting in half the funding for everything the government does apart from military spending. The result would be deep cuts for U.S. diplomacy, national parks, air traffic control, food inspections, border controls and so on. Ryan would enforce fiscal discipline by arbitrarily capping government spending as a percentage of GDP.

While the ultimate impact of his plan is unclear, several non-partisan think tanks that have examined the Ryan budget plan concluded that it would make the tax system less progressive, reduce Medicaid spending by about one-third and cause the middle class elderly to scramble to find health care – all while protecting boondoggle contractors at the Pentagon.

Despite its radicalism and structural flaws, the Ryan plan enjoys considerable support. It passed the House of Representatives last March and narrowly lost the Senate in May. The reason is the growing bipartisan consensus that the U.S. financial situation is dire.

This week, I attended a confab at the Center for Strategic and International Studies in Washington, D.C. Luminaries including former defense Secretary Robert Gates, Admiral Mike Mullen, former Senator Alan Simpson and Erskine Bowles (co-authors of the Simpson-Bowles deficit-reduction plan) and numerous other experts again called for setting the nation on a more sustainable financial footing. Charts were trotted out showing how U.S. deficits will balloon once interest rates return to normal levels. Speaker after speaker decried the stupidity of the threatened “sequester” – the law which now threatens to cut all programs (including defense) across-the-board unless Congress overturns it. This approach, argued Secretary Gates, represents the ultimate “managerial cowardice” – Congress failing to distinguish between the important and the unimportant and refusing to make difficult strategic choices.

This brings us back to the Ryan budget. If Paul Ryan becomes vice-president, he will be the intellectual thought leader of the party. Paul Ryan, so the argument goes, has at least put forward a plan.

Unfortunately, it is an awful plan.

Ryan is not proposing to take advantage of historically low interest rates to rebuild American infrastructure. Nor is he proposing a balanced diet of revenue increases, spending cuts and slight modifications to entitlements as the Simpson-Bowles plan did.

What Ryan wants to do is radically alter our priorities in terms of taxes and spending. His plan would further reduce taxes on the wealthiest and cut many government services. It would transfer much of the health care burden to state taxpayers. It would lead to more complexity and confusion for seniors. It would not stop the federal debt increasing. And it would not lower the deficit.

How someone could claim this recipe could take us back in the right direction is a mystery.

This program aired on September 19, 2012. The audio for this program is not available.