Advertisement

Commentary

How cutting up your credit cards could help the climate

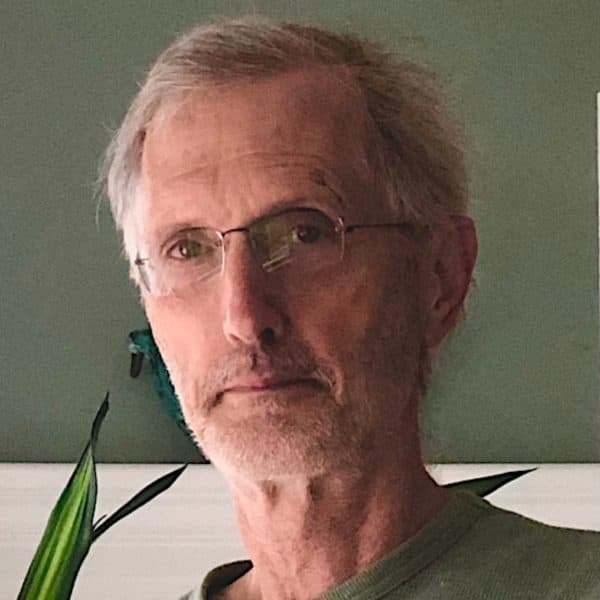

Earlier this month, four men chained themselves to the front doors of an office tower in downtown Los Angeles in an act of civil disobedience. As participants in a global protest led by the scientific community, NASA climate scientist Peter Kalmus and three of his colleagues were taking on a corporation deeply implicated in the climate crisis.

It wasn’t a government building where the demonstration occurred, and it wasn’t a power plant or the headquarters of a major oil and gas producer. It was the Chase Bank building. JPMorgan Chase is one of the world’s largest investment banks.

Climate activists have strategically targeted the big banks for the past several years, although financial backing for fossil fuels has not substantially abated over that period. Yet some right-wing groups and oil-producing states, alarmed by what gains activists have made, are aggressively striking back by sanctioning financial firms that shun fossil energy.

The theory behind focusing climate activism on big banks hinges on the fossil fuel industry’s formidable appetite for capital. If pressure on the banks can make financing oil and gas production less profitable — or, better, socially unacceptable — it could slow the expansion of fossil energy and tip the balance in favor of investments in renewable energy and electrification.

If that seems like a circuitous route to phasing out fossil fuels, keep in mind that, for most of these big banks, oil and gas funding constitutes only a small fraction of their loan portfolio. Getting totally out of fossil fuels would not require a wholesale rethinking of their business model as it would for an oil giant like ExxonMobil or Shell.

To date, protests against financial institutions have had limited success. The big banks have made public statements about their ambition to become “net-zero,” and they have made substantial commitments to funding renewable energy. JPMorgan Chase just announced that its new headquarters in Manhattan will be an all-electric, zero-emission building.

Getting totally out of fossil fuels would not require a wholesale rethinking of their business model as it would for an oil giant like ExxonMobil or Shell.

But despite all the green positioning, the banks continue to grow their fossil energy business. A new report from Rainforest Action Network shows that the banking industry pumped $742 billion into fossil fuels in 2021 alone, roughly the same amount as in 2020. Since the Paris Agreement of 2015, financing for oil, gas, and coal has exceeded $4 trillion.

Prominent climate activist Bill McKibben recently conceived a new grassroots organization, ThirdAct.org, whose first campaign is directed at four banks — Citi, Wells-Fargo, Bank of America, and JPMorgan Chase — which provide the bulk of the financing for the fossil fuel industry.

ThirdAct.org is specifically for people over 60, the demographic with the greatest financial assets and consequently the most leverage in the financial world. The hope is that an orchestrated customer exodus from the four banks by a large number of relatively well-off boomers will strike a nerve in corporate boardrooms.

The movement to wean the financial industry off fossil fuel funding has already struck a nerve in some state legislatures. NPR reported on a recent Texas law — passed at the behest of oil and gas interests — prohibiting financial firms that restrict investment in fossil fuels from doing any business with the state. (Sen. Ted Cruz is a big fan of the new legislation.)

According to the Center for Media and Democracy, the Texas law originated from a model bill developed by the Texas Public Policy Foundation and the Koch-connected American Legislative Exchange Council. The New Republic reports that the adoption of a similar law proposed in West Virginia would prop up dying coal companies and burden pension funds with risky investments.

The Texas law validates the premise of McKibben’s strategy with ThirdAct.org by illuminating Big Oil’s sensitivity to anything that would hinder its access to loans or bond underwriting. Other pressure groups (BankFWD and Stop the Money Pipeline, for example) are also working to starve the fossil fuel industry of capital.

At the Chase Bank building in Los Angeles, the protesters who chained themselves to the front doors were removed and arrested by a phalanx of cops in riot gear, but the video of an impassioned speech that scientist Peter Kalmus made at the scene went viral.

Big banks have become an important front in the climate movement. Taking scissors to some of the credit cards in your wallet may well turn out to be a meaningful act of resistance.