Advertisement

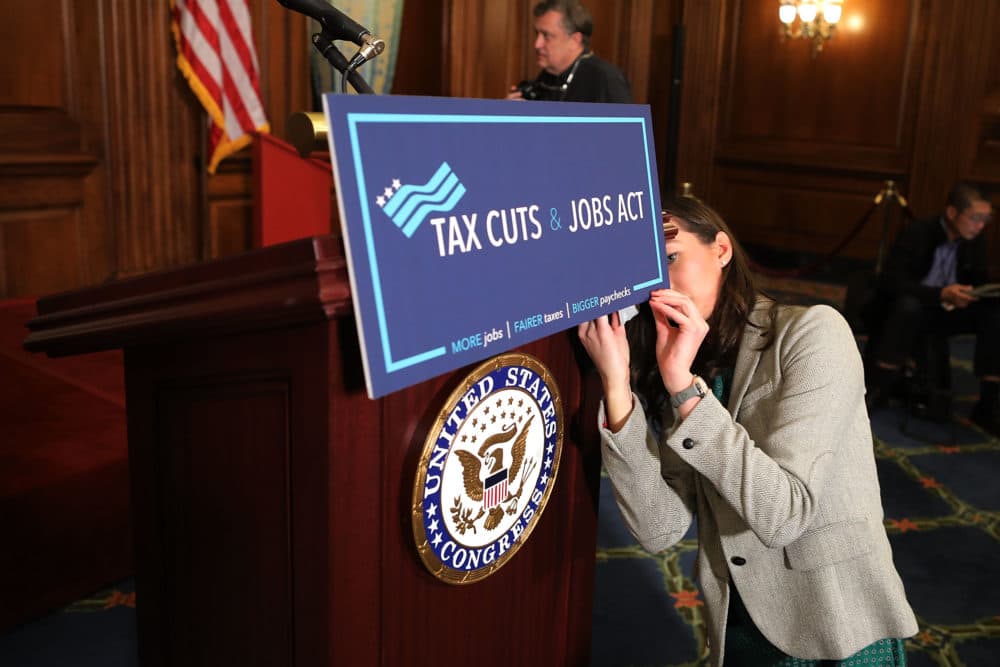

Could The GOP Tax Law Mean Less Charitable Giving?

Resume

The holidays are a big time for giving, but charities are concerned they will see less money in donations this year, because of changes from last year's tax law. That law increased the standard deduction, and researchers at Indiana University say that could cause people to donate less.

“The Tax Cuts and Jobs Act was passed at the end of December, 2017, and it brought some changes to American households and especially taxpayers who are now facing some new financial decisions,” says Una Osili, associate dean at the university's Lilly Family School of Philanthropy.

Now, under the new law, it is more advantageous for households to take the standard deduction instead of itemizing their donations and getting the associated tax benefits, according to Osili.

“In the past, about a third of Americans itemized their deductions, which meant that a third could take advantage of the charitable deduction,” Osili tells Here & Now’s Jeremy Hobson. “Today ... probably less than 10 percent of Americans will itemize.

“That's a pretty big drop off.”

Interview Highlights

On whether she has seen evidence of people giving less to charity because of the new tax law

“I think it's too early to say very definitively exactly what impact tax reform will have on giving. What we have started to see so far is that some households are beginning to adopt a particular strategy around their giving. For example, they may choose to make a big charitable gift in one year rather than spreading it across several years. We're also seeing some households expressing interest in particular vehicles around charitable giving and the form of the charitable giving that they may make, whether that's a cash donation or appreciated stock or other forms of giving. And especially for households who are working with a financial adviser or who may have other assets other than cash to give, it does make some sense to have more strategy.

“Many households are still figuring this out, because this is fairly recent from a policy standpoint and a data standpoint, so it's going to take a few years before we have the exact answer to the question, how does tax reform actually affect American households?”

"That decision to give or not to give is motivated by a host of other variables, some of them economic -- whether you have ... the means to give -- but also your connection to a cause, your social networks, whether you're asked to give or not."

Una Osili

On how nonprofit organizations may be affected by changes in donations

“Nonprofits of different sizes ... are going to feel these impacts differently. Nonprofits that depend primarily on wealthy households may not be as impacted by these changes. However, nonprofits that benefit from donations across the income spectrum — and certainly everyday Americans and their giving — have actually started to talk to donors about this, emphasizing that their gifts are still eligible for the charitable deduction, but it really does depend on their tax situation. Nonprofits that are in different parts of the country may also be messaging differently to their donors, because nonprofits in high-tax states may actually have a different set of recommendations for donors.”

On how corporations have adapted to the new tax law

“Certainly, there is some change in the tax code for corporations, where the taxes that corporations are assessed was reduced, so in principle, corporations may have more after-tax profits to donate or to invest back into the company, and so some companies we've seen become more attuned to ways that they can support charitable giving either at the community level or through supporting where their employees are giving.”

"The biggest driver of overall charitable giving that we've seen over time is the overall state of the economy."

Una Osili

On how much tax incentives play a factor in a person’s decision to give to a charity

“We know that tax incentives are not the only reason that many Americans give. But research does show that tax incentives affect the amount that households give, the timing of their gifts and often the vehicles that they use to make those charitable contributions. ...

“That decision to give or not to give is motivated by a host of other variables, some of them economic — whether you have the income, the wealth, the means to give — but also your connection to a cause, your social networks, whether you're asked to give or not.

“Where we see tax incentives really affecting how households behave and their decision-making is in the amount that they give — so whether they give a large amount or small amount — similarly, the timing of their gift. So this idea of bunching your gift, making a large gift in one year so that you can maximize your tax benefit, is an adaptation or could be a response to tax reform. And then, the vehicle that you choose: Certainly, tax incentives can affect whether you give appreciated stock versus a cash donation versus some other type of asset.

“While the decision to give or not give is motivated by a host of factors, the timing and the amount and the weight, manner and vehicle that donors use is certainly sensitive to tax incentives.”

On the economy’s effect on the amount someone gives to a charity

“The biggest driver of overall charitable giving that we've seen over time is the overall state of the economy. That includes growth in the economy, both in the real sector — so what's happening with household incomes, with employment, with consumption — but also what's happening in financial markets, because we know that wealth affects giving. In other words: People give when they feel financially and economically secure. And so really, when we look ahead to what will in fact affect giving in 2018 and beyond, the overall strength of the economy has a lot to do with this, and when there is uncertainty in terms of whether there will be some economic slowdown ahead, that does have the potential to also influence how households make their giving decisions.”

On the motivations people have for giving to charity

“By far, one of the drivers of giving is being asked and an awareness of a cause. So knowing where to give, knowing about an issue and also having that opportunity to give is really one of the biggest factors, but people's social networks affect their giving, and today we know that that can be direct, in-person interactions, but also social media interactions and online messages that might raise awareness and motivate a donor to give.

"In addition, awareness has all kinds of forms and someone learning about an issue — whether that's a local issue, a national issue or even an international issue such as the global refugee crisis — can motivate a donor to give, and increasingly I think there are many ways that donors can learn about causes, and that can actually lead a donor to make a gift, and once they make that gift, the nonprofit then has the opportunity to engage that donor and hopefully build a long-term relationship with that donor so that they continue to support that organization or that cause over time.”

Jill Ryan produced this interview, and Todd Mundt edited it for broadcast. Jackson Cote adapted it for the web.

This segment aired on December 27, 2018.