Advertisement

'Millionaire's Tax' Won't Be On The State Ballot, Mass. SJC Rules

Resume

Voters will not have an opportunity to impose an income surtax on the state’s wealthiest earners this November, after the Supreme Judicial Court issued a long-anticipated ruling Monday that the proposal known as the "millionaire’s tax" cannot appear on the ballot.

The proposal, which supporters dubbed the “Fair Share Amendment,” would have raised an estimated $2 billion via a 4 percent surtax on any income above $1 million. The amendment stipulated that money raised would be earmarked for education and transportation expenditures.

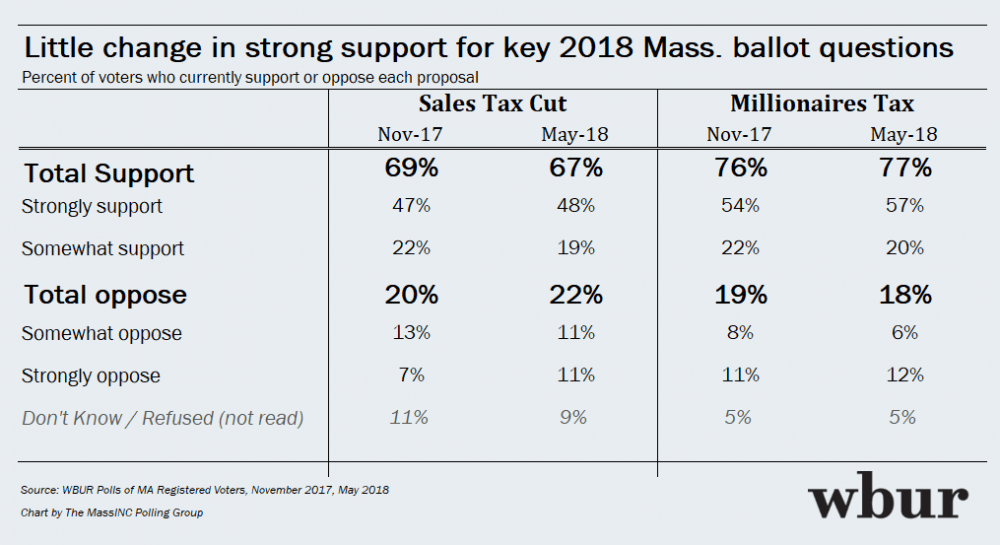

WBUR polling found consistent public support for the measure.

Attorney General Maura Healey ruled last year that the proposed amendment to the Massachusetts Constitution was legal, and qualified for the ballot, but opponents including business groups took Healey to court to challenge the constitutionality of the amendment.

"We conclude that the initiative petition should not have been certified by the Attorney General," the high court's 5 to 2 ruling states.

Healey said in a statement that she's "disappointed that the people of Massachusetts will not have the opportunity to vote on this important question."

Lawyers for the proposal's opponents argued the state constitution prohibits “logrolling,” which is the practice of placing more than one objective in a single constitutional amendment. The opponents said this amendment did that, by imposing the tax and then stipulating how the money could be spent.

The court agreed. The decision, authored by Justice Frank Gaziano, finds that the three parts of the ballot question — the flat tax on income over $1 million, and the future appropriations of that revenue to transportation and education — aren't "mutually dependent," as required by law.

"The two subjects of the earmarked funding themselves are not related beyond the broadest conceptual level of public good," Gaziano wrote. "In addition, they are entirely separate from the subject of a stepped rather than a flat-rate income tax, which, by itself, has been the subject of five prior initiative petitions."

In essence, voters in the booth would be faced with several initiatives, all packaged in the same measure.

"Including it on the ballot would place a reasonable voter in the 'untenable position of casting a single vote on two or more dissimilar subjects,' " the decision says.

Attorneys for the group backing the amendment, Raise Up Massachusetts, had claimed the proposal is constitutional. Attorney Kate Cook told the SJC justices in February that transportation and education are related since “they are keys to social mobility,” adding they are “chronically underfunded government services."

In her dissent, Justice Kimberly Budd — joined by Chief Justice Ralph Gants — disagreed that voters can't "express their opinion on a one section, four-sentence petition because it contains subjects that are not related."

In a statement Monday, Raise Up said it's "incredibly disappointed that a few wealthy corporate executives and their lobbyists brought this lawsuit that blocked the right of Massachusetts voters to amend our state’s constitution."

The group added:

This decision does not change the fact that Massachusetts desperately needs major investments in our schools and colleges, our roads and bridges, and our public transportation systems. It does not change the fact that our wealthiest residents can afford to pay a little more to make those investments.

The Massachusetts Taxpayers Foundation, one of the groups that challenged the amendment, had warned that the proposed surtax may push the wealthy to move out of Massachusetts. (Other analysis has refuted that finding.)

Five plaintiffs, including the foundation's president, Eileen McAnneny, and Massachusetts High Technology Council President Christopher Anderson, released a joint statement Monday, praising the ruling:

This historic decision will prevent special interests from circumventing the Constitution's separation of powers, under which the Legislature must determine specific public expenditures and specific tax rates on specific groups of taxpayers. This case was not about whether a graduated income tax is good public policy or bad public policy, it was about how the proponents tried to achieve it...

In its statement Monday, Raise Up said it "remains strongly committed" to its other two ballot initiatives: one guaranteeing paid family and medical leave for workers, and another raising the hourly minimum wage to $15 an hour.

The SJC ruling could have a bearing on negotiations to reach a compromise to avoid certain questions from going to the ballot.

A separate ballot initiative sponsored by the Massachusetts Retailers Association would roll back the state’s sales tax from 6.25 percent to 5 percent, and make permanent a “sales tax holiday” during a weekend in August.

Many have viewed the two tax related referenda -- the surtax on wealthy earners and the sales tax rollback -- as largely counteracting each other.

A recent WBUR poll showed both initiatives would be expected to pass if put before the voters.

With the surtax ruled unconstitutional, Beacon Hill budget writers are fearful state revenues could take a huge hit if voters roll back the sales tax, with nothing available to replace the lost revenue.

Key state legislators have been working with stakeholders behind the scenes to try to reach some sort of a “grand bargain” on the tax questions, as well as the paid medical leave and minimum wage ballot questions.

The Legislature has until mid-July to come up with their own compromise, which if approved and signed by the governor, could prompt backers of the initiatives to accept a legislative solution in exchange for dropping their ballot questions.

With additional reporting by WBUR's Benjamin Swasey

This article was originally published on June 18, 2018.

This segment aired on June 18, 2018.