Advertisement

Report: Boston faces more than $1 billion tax shortfall due to empty offices

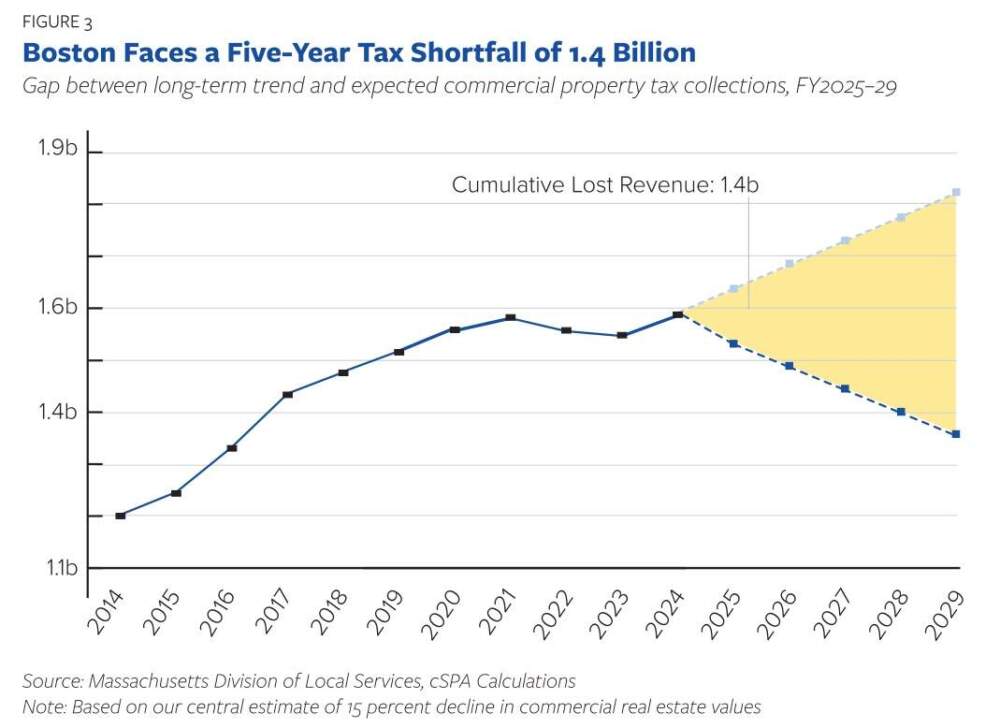

Boston will likely lose $1.4 billion in tax revenue over the next five years due to empty office spaces, according to a new report released Wednesday by the Boston Policy Institute.

The city also could face an ongoing shortfall of about $500 million a year after that initial five years, the report found.

The analysis was done in partnership with the Center for State Policy Analysis at Tufts University, and examines the financial impact of the city's empty office spaces.

High interest rates and the post-pandemic move to remote or hybrid work have made commercial real estate less valuable, according to Evan Horowitz of Tuft's Center for State Policy Analysis.

"The shift to remote work means fewer people are traveling to offices and there's no reason to expect that office work is going to come back, so this shortfall will continue," Horowitz said.

Cities across the country are experiencing this trend, but Boston has an especially heavy reliance on commercial property tax revenue, Horowitz said. More than one-third of Boston's tax revenue comes from commercial property taxes — the highest proportion among major US cities, the report noted.

Boston is "uniquely dependent on this revenue source and therefore uniquely vulnerable to the price declines in the commercial sector," Horowitz said. These taxes help pay for vital city services.

As the value of commercial real estate dips, so does potential tax revenue because property taxes are based on the assessed value of buildings. In a worst case scenario, this could potentially lead to a downward spiral, according to the report.

Horowitz said political leaders are not to blame for the situation but will need to work to address the projected shortfalls.

"This is an economic act of God," Horowitz said. "This is something that happened to us and that we have to respond to, not a failing by decision makers."

The report highlighted a few potential solutions. One option is for the state to provide direct aid to the city. Another is for the Legislature to give Boston the option to impose a local sales tax or congestion charge for driving downtown. Other cities are less reliant on property taxes because they can levy local sales and income taxes, the report noted.

Other potential solutions include raising taxes on commercial and residential properties. But Horowitz said that likely would make commercial properties "less desirable" and would be a hard hit for residents.

The report comes as Boston has been trying to transform downtown by helping new businesses fill vacant storefronts, along with broader efforts to attract more people to the area for reasons beyond going to work.