Advertisement

Anemic Jobs Numbers And Recession Fears

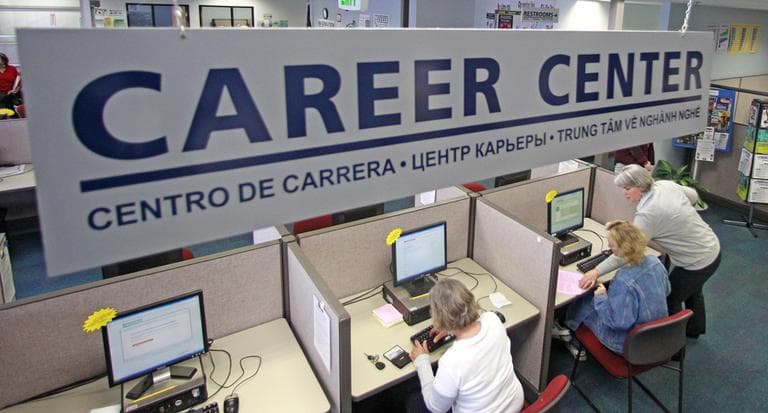

ResumeSome really disappointing jobs numbers came out on Friday. And now, many economists fear the recovery may be on shakier ground than they thought. Do the new numbers point only to a temporary setback, or do they point to a double–dip recession? And what should we do?

Double-dip recession isn’t just a cute turn of phrase. It is not two scoops of ice cream for the country’s economy. If it happens, it will mean more pain for more time, after a long run of blows already.

Last week, double-dip fever was all over. Bad housing numbers. Bad manufacturing numbers.

And, at week’s end, the big bad: bad jobs numbers. Only 54,000 created in May. Not nearly enough. The markets were selling off. The recovery looked wilted. And politicians’ prescriptions for what to do were flying in opposite directions.

This hour On Point: staring down the double dip.

- Tom Ashbrook

Guests:

Greg Ip, U.S. economics editor for The Economist.

Corinne Krupp, professor of public policy, at the Center for International Development at Duke University’s Sanford School of Public Policy. She was one of more than 150 economists who signed a letter (PDF) released this week by House Speaker John Boehner calling for government spending cuts that exceed the debt ceiling hike.

Chad Stone, chief economist at the Center on Budget and Policy Priorities, a Washington think tank; acting executive director of the Joint Economic Committee of the Congress in 2007; chief economist for the Democratic staff of the committee from 2002 to 2006; chief economist for the Senate Budget Committee in 2001-02; senior economist and then chief economist at the President’s Council of Economic Advisers from 1996 to 2001.

This program aired on June 6, 2011.