Advertisement

Do electric vehicles mean the end of the U.S. auto industry as we know it?

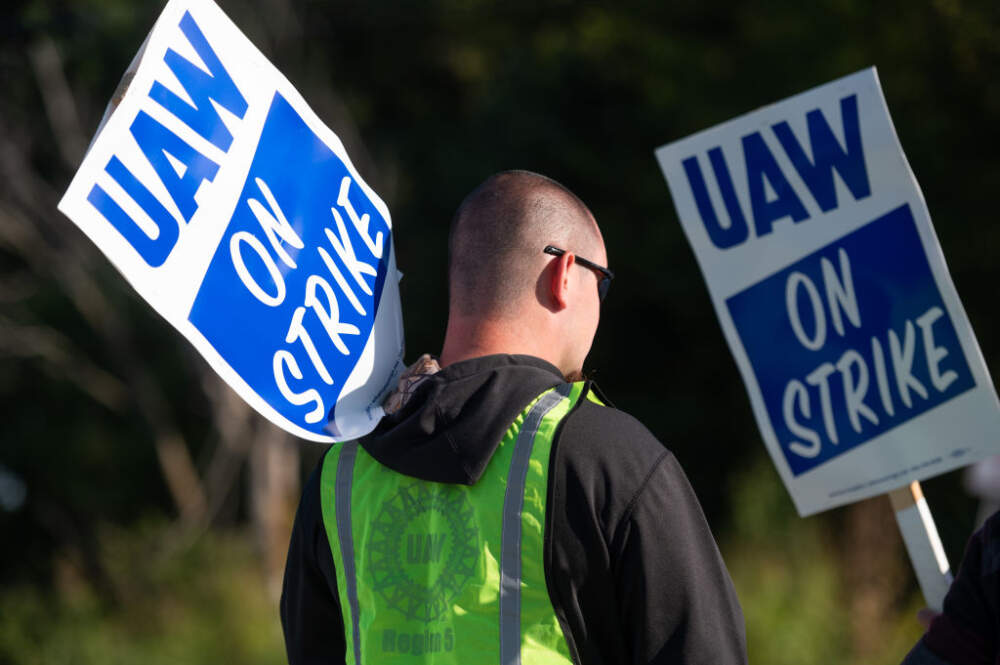

United Auto Workers have walked off the job, in a historic strike against the big three Detroit automakers.

"We are working through the night. We are leaving that building with cuts and bruises," Tiffanie Simmons, striking UAW member and Production Team Leader for Ford Motor Company.

"It’s not that we’re asking for more. It’s we’re asking for what we feel it’s worth."

But the strike is also about something else — the future of unionized workers as the Big Three shift their fleets to electric vehicles.

"Automakers are using this transition as a smokescreen to lower wages and job quality for autoworkers," Jason Walsh, executive director of BlueGreen Alliance, says.

Today, On Point: As auto makers embrace an electric vehicle future, what does that mean for the workers who will make them?

Guests

Jack Ewing, auto industry reporter for the New York Times.

Stephen Silvia, professor in the Department of Politics, Governance, and Economics at American University. Author of "The UAW’s Southern Gamble: Organizing Workers at Foreign-Owned Vehicle Plants."

Jason Walsh, executive director of BlueGreen Alliance, a group uniting organized labor and environmental advocates.

Also Featured

Yen Chen, principal economist at the Center for Automotive Research.

Tiffanie Simmons, striking UAW member and Production Team Leader for Ford Motor Company.

Transcript

Part I

MEGHNA CHAKRABARTI: It's nearing two weeks since members of the United Auto Workers Union went on strike against the big three Detroit automakers, Ford, GM, and Stellantis, the Netherlands based conglomerate that acquired Chrysler in 2021. And yesterday, President Joe Biden showed up in Wayne County, Michigan, the first time a sitting president has ever joined a picket line.

PRES. JOE BIDEN: You guys, UAW, you saved the automobile industry back in 2008 and before. Made a lot of sacrifices. Gave up a lot. And the companies were in trouble. But now they're doing incredibly well. And guess what? You should be doing incredibly well, too. (CHEERS)

CHAKRABARTI: UAW workers say they're on strike because wages have stagnated and benefits like pension funds are shrinking or have been eliminated. They say they're on strike to protect and strengthen what has historically been one of America's most recognizable, solidly middle class jobs. But there's a deeper shift in the auto industry also at play here.

Advertisement

MARY BARRA: We clearly see an all-electric future.

CHAKRABARTI: GM CEO Mary Barra was on MSNBC last month reiterating the carmaker's commitment to eventually transform its entire fleet to electric vehicles. GM has said it will stop making internal combustion vehicles altogether by 2035.

BARRA: And we're putting the technology plans in place.

We just revealed the new Cadillac Escalade IQ. That's part of that journey that I'm really excited about. So we think with the right electric vehicles that we can grow, grow share, and continue to earn customers.

CHAKRABARTI: There's a similar transition underway at Ford, most notably with the introduction of an electric version of its iconic Ford F-150 pickup truck.

Ford CEO Jim Farley recently took a road trip in the Ford F-150 Lightning and took a pit stop in California to talk with CBS News.

JIM FARLEY: As we triple production, quadruple production in the fourth quarter, you're going to see EV adoption increase. To now, we're the best-selling electric pickup in the U.S. We're No. 2 last year to Tesla in EVs, we're also No. 2 in hybrids, so we're really getting into the mass adoption. It's only 8% in the U.S., but as we triple production, quadruple production in the fourth quarter, you're going to see EV adoption increase, and that's why I'm taking this road trip.

CHAKRABARTI: That was in August, and this month, Ford announced that it would double F-150 production in 2024 rather than triple it. That's for the F-150 Lightning, due to slower than expected sales. But the future still looks electric for the big three automakers, and electric vehicles require a different labor structure. One that, right now, pays less. Just last week, in a salaried staff webcast reported by Bloomberg, GM's Mary Barra said that the UAW's recent counteroffer was too expensive.

And in the presentation, she compared GM's labor costs of 67 an hour, including benefits, to the 45 an hour paid by Tesla. It's numbers like that, which seem to be putting the UAW at odds with the growing EV market. It also seems to be putting the Biden administration, with its dual focus on labor and clean transportation, at odds with itself.

Its support for EV doesn't seem to entirely square with the demands of the UAW. Here's what Vice President Kamala Harris said about that yesterday on PBS's NewsHour.

KAMALA HARRIS: I would suggest to you that is, that perspective that some people have, is grounded in a very old false choice. You can do both.

And that is our perspective. We can do both.

CHAKRABARTI: This is On Point. I'm Meghna Chakrabarti, and today we're going to talk about the future of electric vehicles and the autoworkers who will make them. Let's start with Jack Ewing. He's automotive reporter for the New York Times. Jack, welcome to On Point.

JACK EWING: Hi, Meghna. Thanks for having me.

CHAKRABARTI: I actually do want to ask you, given the fact that Biden visited just yesterday, how notable is that he joined the picket line?

EWING: It's unprecedented. I don't think we know of any president that has ever joined a union picket line before and no sitting president, certainly.

And I think it also does put some pressure on the automakers that he's clearly taking the side of the UAW in these negotiations.

CHAKRABARTI: I've noted before, and correct me if I'm wrong, that Biden and GM CEO Mary Barra are actually some, they've been reported as being somewhat close. Does that sort of put some tension in that relationship?

EWING: I'm sure the president talks to all the big auto CEOs. They're very important people, big employers. But I think, in the end, politics rules and Mary Barra's one vote, and all the UAW workers are many more.

CHAKRABARTI: Good point. Okay, so let's get right down to the electric vehicle question. I'd love to get some background from you on the sort of shifts that the big three have made over the past several years, as they all look to an electric future.

EWING: Yeah, they're all in the process of making that shift, they're different stages. First of all, I think it's important to know that I think they underestimated how popular electric vehicles would be. They underestimated Tesla and how fast Tesla sales would grow. And now they're in a position of trying to catch up, and they're having to invest a lot of money, billions and billions, to build new factories.

They're trying to get models out that are competitive. And it's a very difficult time for the auto industry in that respect.

CHAKRABARTI: A difficult time, as in they have to spend a lot of money now in order to catch up with where they think EVs are and should be in the future?

EWING: Tesla is past the point where they're investing in building factories and they're making good money on their electric vehicles. Ford GM, they're still in an investment phase where every electric vehicle they sell is a money loser. So they have to get to that point where they're making enough of them, where they have the economies of scale, where it becomes profitable.

But that takes a couple of years, and it's a very difficult transition, especially since they're still making gasoline cars, and that's still where they're getting most of their money. They're trying to do these two things at once, keep their existing business going and build up a new business, which is a very difficult balancing act.

CHAKRABARTI: I see. And especially startups, right? Unlike Tesla was when it began, really transforming the EV market. So I've been reading that, for example, I think it's for the F-150 Lightning. Talking about the gas-powered cars still subsidizing the EV ones. It's something like 60,000 of the overall cost of the construction of an F-150 Lightning has to be subsidized by the regular Ford F-150?

Does that sound even remotely plausible to you?

EWING: Yeah, no, that sounds right. Ford has said that it lost, I don't have the exact figure in my head, but it lost billions on electric vehicles last year.

CHAKRABARTI: Okay. But they're still committed to it. Do you see that long term commitment to transform their fleets, amongst any of the big three, changing?

EWING: I think it might go faster or slower at certain times.

Ford has made noises like they might slow down a little bit. You mentioned that they're not ramping up F-150 production as much as they thought. But I think the direction is very clear and I don't think that any automaker can survive if they don't go in that direction.

CHAKRABARTI: Okay. So there's a commitment there. That's why we want to talk about this today. Because certainly the UAW is thinking about that, regarding the long term future of their workers. It was very fascinating to me to see this Bloomberg report. Folks talked to them anonymously, that just on Wednesday of last week as I mentioned earlier, Mary Barra gave this presentation, which directly compared wages paid by GM now, versus wages paid by Tesla.

And there was a 20 Delta between the two. So I want to talk to you for a couple minutes, Jack, about why there's that cost differential. And one of those things may be because of just the amount of labor needed for the physical construction of an electric vehicle.

So we spoke with Yen Chen, Principal Economist at the Center for Automotive Research, and he told us that EVs require less labor than internal combustion cars for a simple reason. They've got fewer parts.

YEN CHEN: Traditional internal combustion engines, vehicles. You need two major components. That's engine and transmission.

Of course, along with the engine and transmission, you have a fuel system and exhaust system that go with it. Those are not exist in the EV, EV has none of them. And in terms of the union and employment, making engine and transmission require a significant amount of the labor to put it together.

And versus the electric vehicle, both battery pack and motor are highly automated. It does not need as many workers as they were needed in engine and transmission assembly.

CHAKRABARTI: So Jack Ewing, we've got Tesla here as the comparison. Tell me more about what you think regarding just the sheer kind of labor structure around EVs versus what's currently in place for the big three and their gas-powered cars.

EWING: Yeah, I think there's two elements. One is I think that Tesla pays their workers less on an hourly basis because they're not unionized. That's one thing aside from all the manufacturing. And Tesla, as a company that's totally focused on electric vehicles, has been able to become very efficient in the way that it manufactures and is becoming more efficient all the time. Because as the economist mentioned, you have fewer parts and this whole transition opens up opportunities to rethink the way that you put a car together and to do it in a much more efficient way.

And of course, that's a threat if you're not a worker.

CHAKRABARTI: Yeah. So are we thinking that there could be a potential future as the big three move more towards all electric fleets, that they're just going to need fewer workers?

Advertisement

EWING: That's certainly a threat. I think at the same time, you have to think about that unemployment right now is very low. Actually, a lot of them are having trouble finding people that they need. So that's a positive thing, that there's a labor shortage now. And there may be new jobs created by the electric vehicle industry, for example, manufacturing chargers. that type of thing.

So the jury is still out on what the total effect on employment is going to be. But it's certainly something if you're a worker that you're going to be worried about.

Part II

CHAKRABARTI: Today, we're talking about how electric vehicles are playing into the current massive strike by the United Auto Workers. And I'm joined by Jack Ewing. He's auto industry reporter for the New York Times. We'll hear from a couple of other people as we progress through this hour.

But Jack, so now that we've talked about the some of the structural differences and actually assembling an electric vehicle vs. a traditional gas-powered vehicle. Can you give me your assessment about how much the question of EVs is actually playing into the thinking of UAW strikers and UAW leadership right now?

EWING: I think it's very much an undercurrent in these talks. If you look at the headline demands, they're mostly about wages, working hours, benefits. But I think very much they're informing the whole discussions. I think both sides have that very much in their minds, as they talk. And I think there will be some provisions when we get a final deal that address some of these issues.

CHAKRABARTI: Can you tell me a little bit more about that? The evidence that you see that it's very much the background here.

EWING: If you look at the public statements of both sides, Shawn Fain, the leader of the UAW, has said that one issue here is a just transition to electric vehicles. On the automaker side, Jim Farley of Ford has said if the union gets everything it wants, they won't be able, Ford will not be able to invest in electric vehicles, we'll have to give up that whole drive.

So I think it's definitely something that they're thinking about.

CHAKRABARTI: Okay. Let's hear a little bit from a UAW worker on where her mind is right now. We just spoke with, we recently spoke with Tiffanie Simmons, a production team leader at the Ford Assembly Plant in Wayne, Michigan. She's a second-generation Ford employee.

TIFFANIE SIMMONS: My father is actually a Ford Motor Company employee since 1987. So I have been a Ford girl before I knew what Ford was. I've been a Ford girl since I was two years old.

CHAKRABARTI: And back then, Tiffanie says the auto industry seemed like a great career path.

SIMMONS: My father was able to maintain an entire household with one paycheck, very comfortably.

So growing up, working in the auto industry was a stable and set kind of career. It was a career when my father started. It is no longer a career right now.

CHAKRABARTI: Tiffanie told us she saw things change soon after she got her start at Ford in 2007. Just as the Great Recession began. Of course, quickly thereafter, the federal government bailed out the auto industry, but so, too, did UAW union members. Because Tiffanie reminds us that they took cuts to their pay and benefits so that the car companies could survive.

SIMMONS: When the auto industry went into the bailout, the UAW helped a lot with alleviating that. We said, "Okay we'll come to an agreement." We'll sustain without these things for a while. We'll get these things up for a while. We didn't give them up with the intention of them being permanently gone. We gave them up with the intention of okay, when everything settles, when the dust settles, and we get back to being the motor city, we would get those things back.

It's like letting someone borrow money and telling them, "Okay when you get on your feet, I need my money back." And then when they get on their feet, they've got a yacht, a mansion, a Lamborghini, and you go to ask for your money back and not only do they say, "No, I'm not giving you your money back." But they call you ungrateful, greedy for wanting what was yours in the first place.

CHAKRABARTI: That's why Tiffanie says earlier this month her UAW co-workers at the Ford Assembly Plant walked off the job.

SIMMONS: Once we heard that we were the strike target, you could hear a battle cry through the entire plant. The adrenaline was high, the anxiety was high, there were nerves, everyone instantly went into fight mode.

Walking with my co-workers out of the building, it was unreal seeing. Walking through that turnstile and seeing everyone was already stationed outside of our plant waiting for us, to receive us. And to go straight into strike mode, it was unbelievable.

CHAKRABARTI: Tiffanie says she's striking to ensure that working in the auto industry can once again mean supporting a family, because right now:

SIMMONS: It's not enough. I have a high schooler, and now I have to think about college. I have to think about the things that high schoolers typically do, prom, sports, extracurricular activities. Life is very expensive right now. All we're asking for is to make this job back into a career, and it's about being compensated for the sacrifices that we make as auto workers every day.

We leave that building with cuts and bruises. We are working through the night. It's not that we're asking for more. We're asking for what we feel it's worth.

CHAKRABARTI: That's Tiffanie Simmons, production team leader at the Ford Assembly Plant in Wayne, Michigan. I want to bring Stephen Silvia, excuse me, I should say, into the conversation right now.

He's professor in the Department of Politics, Governance, and Economics at American University and author of "The UAW’s Southern Gamble: Organizing Workers at Foreign-Owned Vehicle Plants." Professor Silvia, welcome to you.

STEPHEN SILVIA: It's great to be here.

CHAKRABARTI: We're going to, I want to get your perspective about the UAW's future as we move towards electric vehicles.

But in order to do that, let's actually look at the past for a moment. How large is the UAW's current membership, in comparison to its peak? And when was that peak?

SILVIA: So the peak was in the early '70s. And at that point, the UAW had over a million members. At this point in auto production, they have about 150,000 members.

So they've really lost a lot of members since, in that time period.

CHAKRABARTI: So it sounds like you're saying they lost 85% of their members. I did that quickly.

SILVIA: Yeah. In auto production. Yes.

CHAKRABARTI: Okay. And so what has driven that?

SILVIA: It's interesting that the thing that makes this strike very different is for about 50 years, the UAW has been making concessions with the objective of trying to save jobs.

But at this point, it's become crystal clear that it hasn't been effective in doing that. And the membership decline illustrates that. And I thought Tiffanie Simmons contribution was fantastic because it really captures the essence of the strike. That it's been 16 years since the UAW agreed to that two-tiered wage structure.

When they voted on it, the only people who voted were people who were going to keep the higher wages. Because it was only new hires that were going to get the lower wages. 16 years later, a big share of the UAW membership is getting paid. About one third less than those legacy employees that were around in 2007.

So they have been agitating, understandably, to try to undo that because they're really suffering as a result.

CHAKRABARTI: I see. So that's a major part of the picture here, but I want to also still understand further about the decline in membership. Because correct me if I'm wrong, but over that same period of a couple of decades, actually about roughly 50 years that you're talking about, we have seen automakers set up very large plants far outside of Detroit, to put it bluntly, right?

That's what your whole book is about, like just the rise of new plants over the past decades, in places like Tennessee, for example. Can you just briefly tell us that story about how much that, how that shift has happened?

SILVIA: The Detroit big three, they have plants across the country, including in the South, but they have arrangements with the UAW that make it relatively easy to unionize those plants.

So the Southern plants of GM, Ford and Stellantis are unionized. It's the growth of the foreign owned plants that has really made a big difference, that they started investing in the 1980s, and increasingly they started investing in the South, as Southern states started paying bigger and bigger subsidies to the foreign companies to invest there.

And it's those plants that are not union.

CHAKRABARTI: Okay so then help me understand something. If the Southern plants for the big three out of Detroit are unionized, can you help me understand further the UAW's concern as the same big three, some of them are opening up giant plants right now that are at least largely dedicated to electric vehicle battery and actually car production.

Can't those also be unionized?

If the internal combustion engine factories have been successfully done so?

SILVIA: In the '80s, there were also some joint ventures between Detroit companies and foreign companies, and those plants ended up being unionized, but most of them, they ended up being closed down in the '90s.

Now what's happening now is some of the car companies are planning to set up battery plants. And those, they're doing joint venture plants with Korean firms. Ford just stopped, pulled out of doing a joint venture with a Chinese firm. And that's the battle that is going to be at the bargaining table, because the question is, with these joint ventures, are they going to get the full UAW contract? Or are they going to get some sort of lower pay scale? And so that's a big issue.

It's almost like the two-tier discussion back in 2007, that if it gets set in place, that these battery plants are going to get a lower rate, that'll be locked in for some time. And that won't, and that will lead to the same sort of divisions that we see with two tiers in the existing plants.

CHAKRABARTI: Okay, I see.

Jack Ewing from the New York Times. Did you want to add to that?

EWING: Yeah, I think that's an excellent point. That the manufacturer is going to shift from engines and transmissions to batteries. And as a professor pointed out, these battery factories that are going up at a very fast rate, mostly in the South, are not unionized and it's not clear.

It appears that most of them will pay less than what the auto workers are making. And I think that's very much a concern for the UAW.

CHAKRABARTI: I want to give a concrete example of what we're talking about right now. There's a town in the South. Let me see if I got it right. It's in Tennessee.

And it's expected to employ about 6,000 workers. Now, the town that this new factory is going to be in is Stanton, Tennessee. We actually reached out to the mayor of Stanton to see if he could join us, and he's on vacation, deserved vacation this week, so he couldn't join us. But Stanton is a 400-person town. 400.

And it used to rely a lot on cotton and other industries that have really fallen away from the town. Once operational, this Ford EV and battery plant is expected, again, as I said, to employ 6,000 workers. Obviously, not just from Stanton but the region around there.

It's going to be a complete renaissance for those workers and other businesses in the Stanton region, in Tennessee. It's like one of, it is one of those, forgotten places in America that has been suffering economically for quite some time. So as we're focusing on the UAW, Professor Silvia, shouldn't we also acknowledge that this move towards electric vehicles and battery production by the big three is actually quite a boon for regions and states and communities in the South?

That are desperate for economic development.

SILVIA: This is pretty typical for the expansion of the foreign producers in the South, that they generally go to small towns, and that it really does lead to a boom. But it's also part of something that in my book, "The UAW Southern Gamble," that I call the union avoidance playbook. That the companies purposely go to these small towns, because it's really hard to organize a plant there, that the workers will be driving in from 100-mile radius from around that town.

And then when they're done, they drive out. If you're trying to talk to workers, you've got a 200-mile circle that you have to try to cover to even get to talk to the workers to find out what they're interested in. So it's all part of a structure that makes it extremely hard to organize these kinds of plants.

CHAKRABARTI: Huh. I hope I understood you correctly because I'm hearing that, yeah, it's hard to talk to workers because they have to drive 100 miles in and out of their job. I presume also the implications, that's tough on the workers, right? Because they have to have such a long travel time.

But again, I'm also just trying to see, it's that or nothing. Because, until the EV based plants are built there, we're talking about regions that don't have anything on those sites and workers who are probably, I'm guessing, very happy for the jobs. So is it, did I hear you correctly in describing that you're seeing this as a move by the automakers to undermine the power of organized labor?

Is it really that simple?

SILVIA: It's one of the things, but the thing is when it's a boom, the people who it's a boom for are the landowners in those towns. Like way back in the 80s when the Nissan plant was put into Smyrna, the mayor of Smyrna, which was also a very small town, his reaction was, "We're going to be rich."

However, for the autoworkers, they'll get jobs. When you look at the Smyrna plant, they're getting paid in the mid-twenties, mid-20 per hour, which is one of the best jobs in the area, but it's really isn't nearly as good as the UAW contract.

CHAKRABARTI: Okay. So Jack Ewing, let me just briefly turn back to you here.

I hear all the critiques that Professor Silvia has about paying lower wages, non-unionized work at the plants that are opening up in the South, but specifically about EVs, one of the problems that the big three have right now that you mentioned at the top is that they're still really expensive to make and they're not making money on them.

In order to do that, they have to drive down costs somehow to help, the EV expansion that everyone's talking about. How else could they do it if not through labor costs?

EWING: First of all, the unions say that labor costs are really a very small part of the cost of an EV, something like 5%.

So a big pay raise is not necessarily going to undermine the auto companies. Although, of course, the managers tell you exactly the opposite story. But certainly costs are a big part of it. But I think the big challenge for the automakers is more of a management challenge. How do they transform these big, very traditional organizations into something that can compete with Tesla?

Part III

CHAKRABARTI: Today we're talking about the slow but ongoing shift to an all-electric vehicle future that's being undertaken by the big three automakers in the United States and how that is factoring into the current massive strike underway from the United States auto workers. I'm joined by Jack Ewing. He's the auto industry reporter for the New York Times. And just a little bit ago in the program we mentioned how some of the southern states and southern communities, where new plants are going up, new EV and battery production plants workers there are really benefiting from the investment in their communities.

And some of these are communities that have long been under invested in, if you go to the places where the plants are opening, the excitement is palpable. Because they say residents there say nonunion jobs are still good jobs. So we spoke to William Rawls, Jr. He's the mayor of Brownsville, Tennessee.

It's a town of about 10,000 in the western part of Tennessee. And he told us traditional industry there, such as agriculture, has supported fewer and fewer jobs as farming has become more automated. And that's why he's thrilled that Ford is opening an electric vehicle plant nearby. It's the one I mentioned just a couple of minutes ago, that will create 6,000 jobs.

And even if they're nonunion, Rawls says it'll be transformative for Brownsville. He says his talks with officials at Ford have left him confident that those jobs will pay well, as the automakers are jockeying for labor.

WILLIAM RAWLS, JR.: Competition would take care of that. So if you show up to work, and you do your job, and you have the right attitude, I feel you should be compensated.

And I think the people at Ford that I've talked to believe in that.

CHAKRABARTI: So that's William Rawls Jr., Mayor of Brownsville, Tennessee. Let's go back to how the UAW might be seeing this moment, or at least how external analysts are seeing the moment and the sort of game or risk that the UAW is taking. We heard a little earlier from Yen Chen, principal economist at the Center for Automotive Research, and he sees that the UAW potentially risks overplaying its hand in the current negotiations.

If they ask too much now, Chen says, that could mean fewer quality union jobs are available in the longer term.

YEN CHEN: For the union, I think they really need to see through what the current sticking point in the wages is, and all the current economics terms that directly benefit the current members. One thing I think they know, but they're afraid of talking to it, is their actual competitors is a non-union automakers.

Those are the major competitor to the company. If a company continue to shrink, more wage increase mean nothing to them because they'll continue to lose their jobs.

CHAKRABARTI: I want to bring Jason Walsh into the conversation now. He's executive director of BlueGreen Alliance, a group uniting organized labor and environmental Advocates.

Jason, welcome to the show.

JASON WALSH: Thanks, Meghna. It's a pleasure to be here.

CHAKRABARTI: So do you see the Biden administration's dual fealties to an electric vehicle future and its very strong support for unionized labor potentially at odds with each other right now?

WALSH: I don't, and here I will echo the vice president who we heard a recording of earlier.

We think it's a false choice when companies claim they can't pay workers, family sustaining wages, and at the same time produce electric vehicles at a scale and pace to meet investor and consumer demand and in the climate moment.

CHAKRABARTI: Yes. And, as you said, the vice president and the president are asserting that, too.

Just yesterday, right, when Biden was on the picket line in Wayne County, he repeated that campaign promise of having a just transition from the fossil fuel era to the clean energy era. Jason, what does that just transition, what could it look like?

WALSH: What it can look like, I think, is what the UAW is articulating repeatedly that they have said over and over again that their members are ready to build the electric vehicles of the future, because they know the survival of the U.S. auto industry depends on its ability to keep pace with the rising demand for electric vehicles. But for that transition to be just, incumbent auto workers who currently make the power trains for gas vehicles should be able to shift to EV production under a same or similar contract.

And new workers making EV should be paid family supporting wages and have a free and fair chance to join the union.

CHAKRABARTI: So let's put some numbers on this because the Biden administration in its true push to for a clean energy future has set some goals, right? In 2021, President Biden said he wants electric vehicles to make up 50% of U.S. vehicle sales by 2023. So seven years from now, 50% of U. S. vehicle sales should be EV. That's the goal that the president set. I keep thinking about what Jack, who's still with us, what Jack Ewing said earlier. That if they're going to be U.S. automakers that are a big chunk of that 50% EV market, they still have to make a very large transition in a short period of time.

So can that be done with the strictures of the kinds of contracts that the UAW is seeking, Jason?

WALSH: We think it can. And let's point out that the Biden administration and Congress passed historic legislation in the previous Congress, which will provide tens of billion dollars, tens of billions of dollars to auto companies to help them afford to make this transition.

These companies have an unprecedented amount of taxpayer funded resources. Potentially they're at their disposal, as they're making the kind of capital investment that Jack Ewing pointed out earlier. They're frankly playing a little catch up to make. I think it's important to once again, emphasize that it's not just UAW saying that labor costs are 5% of car production. It's actually the center for automotive research. You had the principal economist quoted earlier. that was 10 years ago, that 5% estimate for midsize sedan, it is almost certainly lower now. And it is significantly lower for the battery production that is at the core of this negotiation right now.

In fact, I would bet that if you calculated the cost of paying nonunion battery production workers a UAW scale wage on the overall sticker price of an EV, it would be in the low three figures, which by the way, is less than the dealer fee I paid when I bought my Chevy Volt.

CHAKRABARTI: Jack Ewing, jump in here. What do you think about what Jason Walsh is saying?

EWING: Yeah that's true. I think, the bigger issue here is just because of the strike, all the focus is on labor and kind of putting the blame on labor for what, some mistakes were really made by the auto industry management taking too long to recognize the threat from Tesla.

The other point I wanted to make, about the federal funds. That's very true that the carmakers are getting billions from the federal government and they're investing it in the south, often in states where the representatives and senators voted against the legislation. So there's a bit of an irony there in that a lot of this money is flowing to places where it's very difficult to form a union.

CHAKRABARTI: Okay. Now I have to say there's so much news every day that sometimes my memory does not serve. But Jason Walsh, when you said the billions of dollars, you were referring to the infrastructure in the act, right?

WALSH: It's actually, most of the money authorized is from the Inflation Reduction Act.

CHAKRABARTI: The Inflation Reduction Act. Sorry, I'm getting my I's confused.

WALSH: No, it's fine.

CHAKRABARTI: Thank you. Thank you so very much there. But wasn't sort of part of the Inflation Reduction Act that had to do with electric vehicles or the electric vehicle market somewhat thwarted by Senator Joe Manchin?

WALSH: In the House version of what became the Inflation Reduction Act, there was a bonus tax credit for both on the consumer side and on the manufacturer side, for cars produced in facilities under collective bargaining agreements. That did not make it into the final Senate version.

But I think it's important to emphasize that federal agencies have the authority to attach standards to granted loan programs that incentivize companies applying for these funds to support high quality jobs and respect workers' rights as a condition for receiving taxpayer dollars.

So an example of this is the $15.5 billion package of grants and loans recently announced by the department of energy to award funding from programs primarily authorized by the Inflation Reduction Act, including the Manufacturing Conversion Grant Program and the Advanced Technology Vehicles Manufacturing Loan Program.

Both of which will provide funding to companies to convert production lines that are building internal combustion engine vehicles.

And their parts into production lines, building electric vehicles. And in the funding opportunity announcements for these programs, DOA makes crystal clear that they will give preference to projects that commit to pay high wages for production workers that retain high quality jobs in communities that currently host manufacturing facilities and that maintain collective marketing agreements.

CHAKRABARTI: Okay. Thank you for that clarification. And just because I hate getting my facts mixed up, I want to correct myself here about Joe Manchin. Jason, you were exactly right that Senator Manchin had a hand in crafting the EVA tax credit, sorry, the electric vehicle tax credit that was in the Inflation Reduction Act.

But I think earlier this year, in fact, he introduced a new bill that would halt that tax credit until some battery requirements, strict battery requirements were put into place. So that will, I'm sure that will go on and on. But I want to go back to you, Jack, and just ask you, because I haven't, didn't ask you directly.

How do you see the Biden administration, trying to balance these interests between labor and a clean energy future, and supporting U. S. based car makers?

EWING: It's not easy. And the Inflation Reduction Act has some built in contradictions. Because on the one hand, it's trying to promote electric vehicle ownership.

Giving people pretty generous tax credits if they buy an EV. On the other hand, there are a whole lot of restrictions that are designed to build up a domestic supply chain for EVs and prevent China from dominating the whole supply chain. And that makes the job of the automakers more difficult.

They have to find sources of lithium and so on that qualify. On the one hand, they're saying we want more EVs. On the other hand, they're saying you have to fulfill all these different requirements in order to get the benefits.

CHAKRABARTI: Okay. So yeah, that brings back to mind that obviously it's not just the U.S. automakers that are rapidly moving and investing in electric vehicles. We're going to come back to that as a final bit of analysis in a second but let's hear from another big three CEO. This is Ford's Jim Farley. We heard a bit of tape from him earlier from CBS News. And in that same interview, he was asked about how electric vehicles are playing into current contract talks.

FARLEY: So this is very important for Ford and for our country. I think the UAW and Ford have the same intent, which is to improve the middle class and make this transition to electric vehicles. And I don't want to portray the negotiations right now because we're in the middle of it. All I'd say is they have great ambition and so do we.

CHAKRABARTI: UAW President Shawn Fain has a different perspective on it. He says more needs to happen to help workers as carmakers transition to all electric fleet. Here's what he told PBS NewsHour just last night.

FAIN: We support a green economy. We have to have an earth that we can live on that's sustainable for life.

And but it has to be a just transition. And that's what this fight, part of this fight is about. Our tax dollars are helping finance this transition and these companies are taking the billions of dollars in our tax dollars. But they're trying to drive a race to the bottom by paying substandard wages and benefits.

And we don't stand for that. So we're pushing very hard for these jobs to have our standards in them. So people can live off of it.

CHAKRABARTI: So Jason Walsh a little earlier in the show Stephen Silvia was talking about how when foreign automakers built plants in the South, those were the ones that were non-unionized in comparison to U.S. based automakers when they built facilities in the South.

Regarding electric vehicles, isn't that same trend likely to continue so that no matter what the UAW negotiates for its workers now or even in the near future, could we just potentially be seeing more and more auto workers being non-unionized because they're working for foreign automakers?

WALSH: We are certainly seeing that trend continue as my colleagues on this show have commented on.

Look, the most important response to this trend is for unions to organize these new facilities, wherever in the country they're located. That is an existential challenge facing the labor movement right now. Policy makers can make that more achievable, by passing legislation that puts sharper teeth in our labor laws like the PRO act.

But even without new law, every worker in this country has the right to organize into unions, to collectively bargain with their employers for better wages and benefits and working conditions. And if anyone is under the illusion that unions can't organize in the South, they should look to the workers at Bluebird in Georgia, making electric buses, who voted to join the United Steelworkers earlier this year.

I don't want to underestimate the challenge here. But workers are going to organize in the face of lower wages, and we need to be able to support them in doing that.

CHAKRABARTI: Jack, we've just got about 30 seconds left here. What are you going to be keeping your eye on over the coming days and weeks that might signal some sort of change or breakthrough with the current strike?

EWING: That's a tough one because it's very hard for an outsider to know what's going on in the negotiations. There's certainly, there's been some indications that things are going faster with Ford, but I think we're going to know there's a deal when there is a deal.

This program aired on September 27, 2023.